Business

What you need to know to apply for the N200 billion Intervention Fund as Manufacturers, MSMEs in Nigeria

The federal government announced the launch of a N200 billion Presidential Intervention Funds (PIF) for Micro, Small and Medium Enterprises (MSMEs) and manufacturers in the country.

The Minister of Industry, Trade and Investment, Doris Uzoka-Anite, made this announcement on Monday, 22 of April 2024, in Abuja.

According to the Minister, N75 billion will be allocated to MSMEs while N75 billion will be allocated to manufacturers under the Presidential Intervention Fund Programme.

Below is everything you need to know to apply for the Intervention Fund Programme:

1. To apply, applicants should visit the official application portal at www.fedgrantandloan.gov.ng

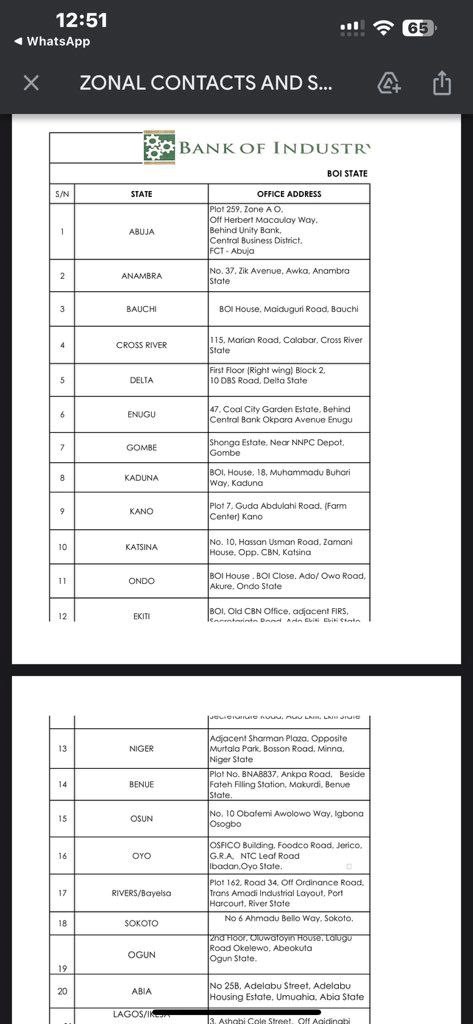

- Additionally, applicants seeking more detailed information should visit the local state Bank of Industry branch.

2. Eligibility Criteria:

- Applicants must be in an existing business in operation for at least one year, or a registered start-up.

- Applicants must provide CAC business registration documents.

- Applicants must present a Company’s Bank Statement for existing businesses or Chief Promoter’s Bank Statement for start-ups.

- Applicants must fulfil the required monthly turnover and comply with other requirements as specified by the bank.

3. Security:

- Applicants must provide a Personal Guarantee from the promoter.

- Applicants must agree to BVN Covenant.

- Applicants must adhere to Global Standing Instruction (GSI) and other securities as required by the bank.

4. Repayment Frequency:

- Monthly equal instalments with no moratorium, spanning a 3-year term.

5. For Manufacturers (For Loans up to N1 Billion):

- Applicants must choose between Working Capital or Asset Financing.

- Applicants must maintain at least a 6-month business/corporate banking relationship.

- Applicants must Provide additional documentation as required by the bank.

- Asset Financing comes with a 5-year repayment period, and Working Capital Financing includes a 6-month moratorium on principal and interest, followed by a 12-month equal instalment repayment plan.

Local Banks of Industry in States (Images Below):