It’s been rumored for the past several months that Apple plans on releasing an iPad sporting an OLED screen. The tech giant has its work cut...

Why not settle into the weekend with a nice, simple Quordle puzzle to solve. Or rather, four of them – because the challenge here is to...

It’s Friday, it’s the final Strands puzzle of the working week (for some) and it’s a rather easy one. That’s my experience at least – but you...

In a significant development for military training and security in the Niger Delta region, Rivers State governor, Siminalayi Fubara, has inaugurated the new Navy Training Command...

Operatives of the Economic and Financial Crimes Commission (EFCC) attached to the Taskforce on Currency Mutilation, Dollarisation of the Economy and Forex Malpractice, have arrested 34...

Nigerian chess champion, Tunde Onakoya has revealed that someone bought a house for his parents. While thanking the person who bought the house, Onakoya disclosed...

When Asheem Chandna drove up to Rubrik’s office in Palo Alto on a Friday night in early 2015, he was looking forward to learning what the...

Minister of Arts, Culture and the Creative Economy, Hannatu Musawa, has said that the creative industry is Nigeria’s ‘new oil’ as the nation seeks to diversify...

The Saudi Ministry of Hajj and Umrah has cautioned intending pilgrims planning to perform Hajj against falling victims to fake travel companies in this this year’s...

Employees of Tantita Services Limited from Itsekiri ethnic group have debunked a viral video of some persons protesting against High Chief Government Ekpemupolo, alias Tompolo, and...

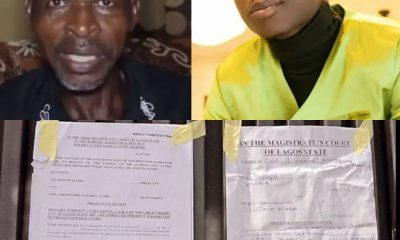

Joseph Aloba, the father of late singer, Ilerioluwa Oladimeji Aloba, better known as Mohbad, has served his late son’s wife, Wunmi, a notice of the pending...

Recent reports from Alex Crook for talkSPORT reveal that Newcastle United are pulling out all the stops to retain the services of their star striker, Alexander...

A young lady broke down in tears after finding out that her boyfriend of five years was getting married to another lady. The heartbroken lady identified...

The British monarch, King Charles III, will resume his public duties next week following a three-month break to focus on his treatment and recuperation. A few...

The Delta State Ministry of Health has given reasons why it refunded unauthorised fees to students in the state-owned colleges of nursing. The money running into...

Kelechi Iheanacho and Wilfred Ndidi, stars of the Super Eagles, have played a pivotal role in securing Leicester City‘s return to the Premier League after a...

Liverpool’s emerging talent, Kieran Morrison, has taken a significant step in his footballing journey by signing his first professional contract with the club at the age...

Leicester City’s journey back to the Premier League has been nothing short of dramatic. After a season filled with ups and downs, the Foxes have finally...

Resident doctors at the Delta State University Teaching Hospital, DELSUTH, have commenced a one-week warning strike over the alleged Delta State Government’s insensitivity to issues affecting...

A High Court sitting in Lokoja has issued a summons for the Chairman of the Economic and Financial Crimes Commission (EFCC), Ola Olukoyede, to appear in...