NNPC, RMFAC, Arewa Think Thank, others support Tax Reform Bills

4 total views today

By Naomi Sharang

A cross section of stakeholders, on Monday, at a Public Hearing on the four Tax Reform Bills expressed their support for the bills.

The public hearing was organised by the Senate Committee on Finance chaired by Sen. Sani Musa.

The News Agency of Nigeria (NAN) reports that the four bills include “The Nigeria Tax Bill (NTB) 2024; The Nigeria Tax Administration Bill (NTAB) 2024; The Nigeria Revenue Service (Establishment) Bill (NRSEB) 2024 and the Joint Revenue Board (Establishment) Bill (JRBEB) 2024.

The agencies that made their submissions include the Nigerian National Petroleum Company Limited (NNPCL), Revenue Mobilisation and Fiscal Allocation Commission (RMFAC) among others.

In his submission, Group Chief Executive Officer of NNPCL, Mele Kyari, said that the entire oil and gas industry was happy with the bills.

“We are the happiest people to see this tax law coming into place, bringing every education in one basket.

“And bringing in a significant number of reforms that will bring simplicity to the tax system and the tax laws in our county.

“And I want to tell you, you know, making our business more profitable, we have a plan to keep our industry as strong as possible, multiple tax systems, multiple tax rules.”

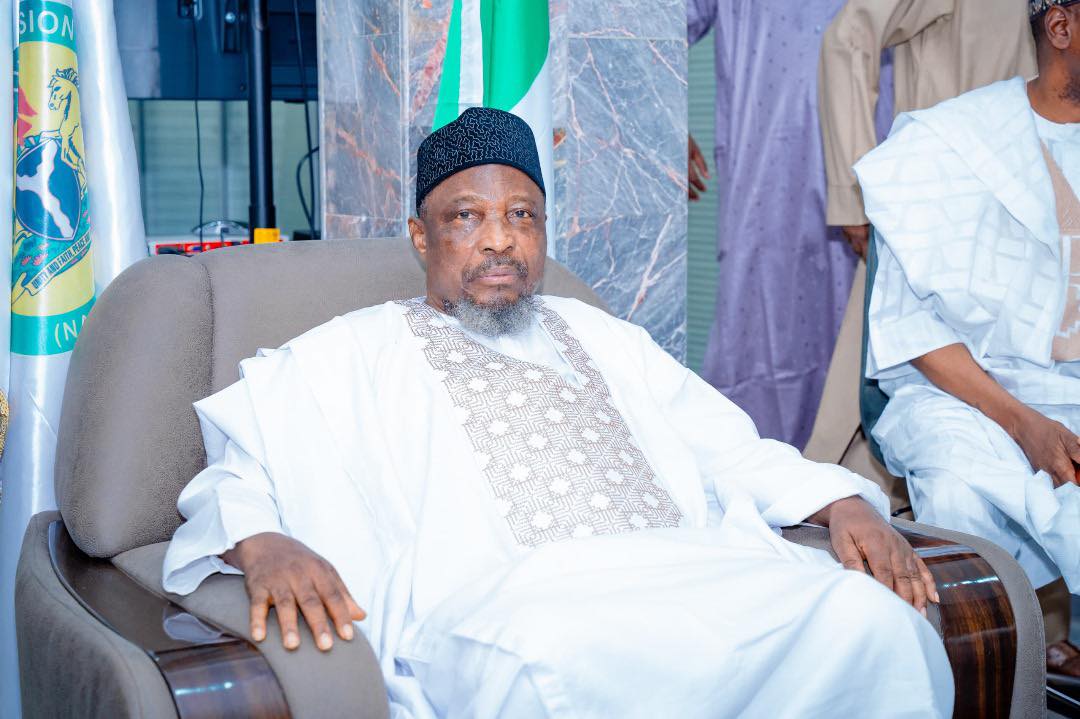

Also speaking, the Chairman of Revenue Mobilisation and Fiscal Allocation Commission (RMFAC), Dr Mohammed Shehu, said that the commission was in support of the bills 100 per cent, adding that the bills would enhance stability in the economy.

He urged the Senate Committee on Finance to address the area of bad distribution to sub-nationals.

“I hope that this bill will address the issue of endless reconciliation with NNPC”.

On his part, the Convener, Arewa Think Thank, Muhammad Yakubu, said that the group was one of the groups that saw the benefits of the bills.

“We analysed the benefits of the bills and made our position known and we have submitted same.

“The perception that the North is against the bill is not true. And please, some of these views that are very very important to the country should not be put aside,” he said.

The representative of the Supreme Council for Sharia in Nigeria, Ahmad Dogarawa, said that it was the view of the Supreme Council for Sharia in Nigeria that the Nigerian tax system was indeed in need of reform.

“We, therefore, commend the government for its genuine efforts to reform our tax system.

“However, the Council wishes to bring the attention of the National Assembly to the following concerns of the specific sections of particularly the Nigeria Tax Bill and the Nigeria Tax Administration Bill.

“We have suggested that the Value Added Tax (VAT) be reviewed to five per cent or to maintain the present 7.5 per cent.”

In his remarks, Chairman of the Senate Committee on Finance, Sen. Sani Musa, said that Nigeria was becoming more united with the tax reform bills.

He said: “Where there are some differences or disagreements, we will agree and come to where we can all agree.

“We are going to give Nigeria the desired law, legislation that will guide our tax collection, distribution and enhance prosperity in line with the new rule of the President.

“The President has a very good intention. I was with him two weeks ago and he said, Chairman, go and do the needful for me.

“Give me a law that is working. We will want to present a legislation that tomorrow, there will be not a lot of lawsuits.” (NAN) (www.nannews.ng)

Edited by Sadiya Hamza

Published By

Has also recently published

Economy/BusinessFebruary 24, 2025NNPC, RMFAC, Arewa Think Thank, others support Tax Reform Bills

Economy/BusinessFebruary 24, 2025NNPC, RMFAC, Arewa Think Thank, others support Tax Reform Bills HealthFebruary 24, 2025NAPTIP secures 600 convictions, rescues 20,000 victims since 2003

HealthFebruary 24, 2025NAPTIP secures 600 convictions, rescues 20,000 victims since 2003 PoliticsFebruary 24, 2025Stakeholders canvass rotational presidency as panacea to ethnic agitations

PoliticsFebruary 24, 2025Stakeholders canvass rotational presidency as panacea to ethnic agitations HealthFebruary 24, 2025ABUTH Heroes: Doctors, staff donate blood to save accident victims

HealthFebruary 24, 2025ABUTH Heroes: Doctors, staff donate blood to save accident victims

2 hours ago

20

2 hours ago

20

English (US) ·

English (US) ·