Currencies

Leading Nigerian companies incur a staggering N1.8 trillion in FX losses in 2023

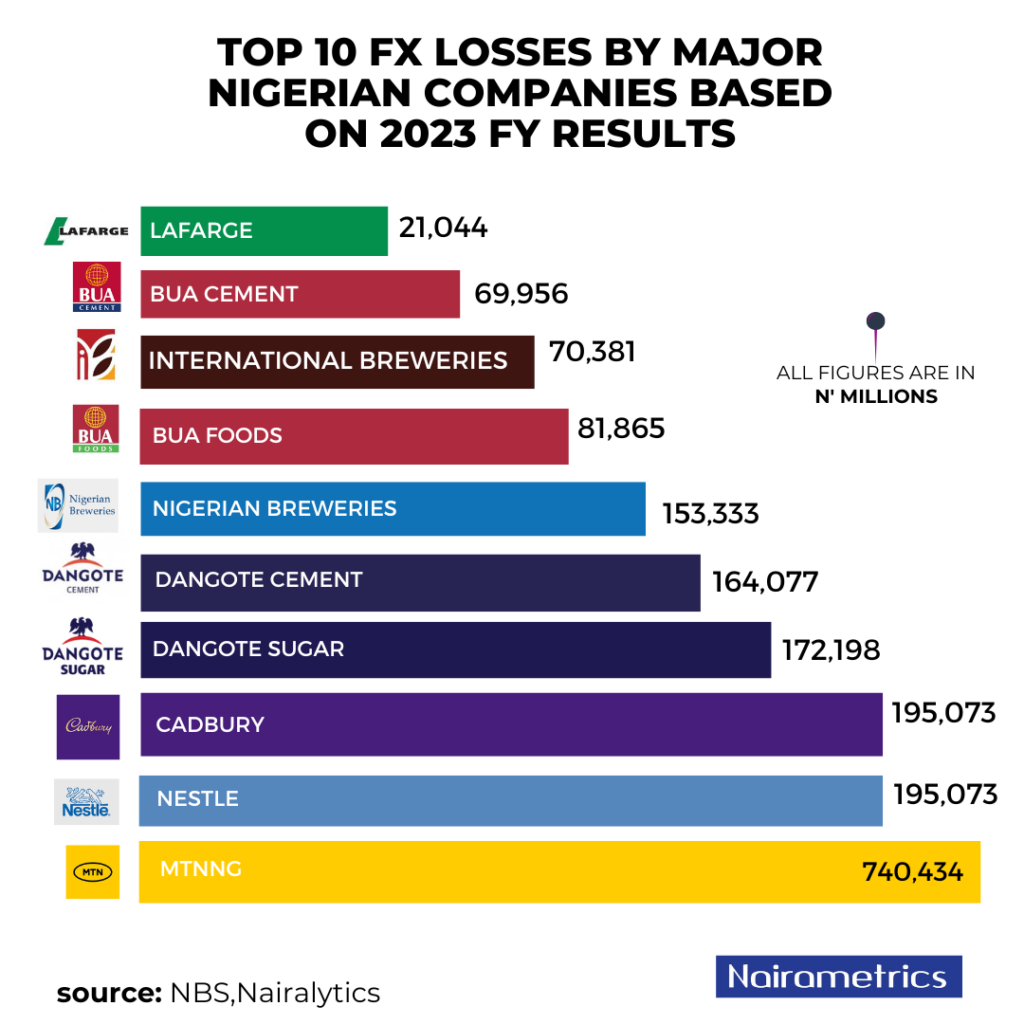

Some of Nigeria’s leading companies incurred a combined forex loss of N1.8 trillion in the financial year 2023.

This is according to information contained in the financial statements of these companies and collated by Nairametrics.

The size and magnitude of the loss were so significant that it effectively wiped out the shareholder funds of some companies, forcing mega restructuring for others.

The staggering losses were triggered by the devaluation of the naira following the Tinubu administration’s forex unification policy launched in June 2023.

Following a series of devaluation the naira closed the year at an official exchange rate of N907.11/$1 compared to N461.5/$1 at the start of the year.

This led to massive foreign currency losses incurred by most Nigerian businesses with dollar denominated obligations when translated in local currency.

Forex losses wiped out trillions in shareholder funds.

According to the data seen by Nairametrics, the losses cut across several sectors such as consumer goods, telecommunications, and cement production.

- Companies affected included heavyweights such as MTN (Nigeria’s largest telecommunications firm), Dangote Cement (Nigeria’s largest cement manufacturer), Nigerian Breweries (Nigeria’s largest brewer), and BUA Foods (Nigeria’s largest indigenous food manufacturing company).

- Foreign-owned conglomerates such as Nestlé, Cadbury, International Breweries, and Lafarge Africa were also badly affected by the forex losses.

- In total, Nairametrics collated losses from about 10 of the largest companies, with the forex losses decimating their operating profits.

MTN Nigeria topped the list with a combined forex loss of about N740.7 billion, representing 39.7% of the total forex losses incurred by the companies under review.

- Dangote Group’s cement and sugar divisions incurred a combined N336.2 billion, the largest of any conglomerate.

- BUA Group, which owns BUA Cement and BUA Foods, incurred a combined loss of N151.8 billion, reducing the group’s overall profitability.

- Nigerian Breweries and Nestlé also join the list of heavily impacted companies, with N153.3 billion and N195 billion, respectively.

Why did they incur the losses?

A cursory review of the financial statements of the companies under review suggests the losses stemmed from the forex loans carried by the companies over the years.

- For some, the losses emanate from forex obligations in the ordinary course of their business operations.

- We also observed that some of the companies incurred the losses from intercompany loans denominated in dollars that were obtained at the start of the forex crisis in 2021.

- Some of the companies resorted to their parent companies for related-party loans to help fund raw material inputs as the Emefiele-led central bank enforced capital controls.

- Seen as a lifeline, the intercompany loans turned out to be a financial weapon of forex losses as the unification of the naira devalued it by over 50% against the US dollar.

- For example, Nigerian Breweries reported that it obtained a forex loan in the naira equivalent of N63 billion, out of which the forex impact was N21.89 billion.

- Nestlé had a balance of $443.5 million in intercompany loans which, when translated at a 2023 closing exchange rate of N907/$1, left the food manufacturer with an exchange rate loss of over N173 billion.

Some of the losses were unrealized

Some of the losses were also not “realized,” according to explanatory notes from some of the companies in question.

- Unrealized forex (foreign exchange) losses refer to the decrease in value, expressed in the home currency, of foreign currency-denominated assets or transactions due to a change in exchange rates.

- These losses are called “unrealized” because they occur on paper only; the actual loss is not realized until the asset is sold or the transaction is settled.

- For example, Nestlé claims about 90% of its losses are not realized. MTN also claims 83% of its forex losses are unrealized.

- Nearly all the companies report some unrealized losses, suggesting that the losses have yet to fully crystallize in real terms. However, accounting provisions require that they be captured on paper.

- Whether this will provide shareholders of these companies with some succor remains to be determined.

What analysts are saying

Nairametrics spoke to Olumuyiwa Adebayo, the Chairman, Committee of Finance Expert (CoFE), Nigeria Employers’ Consultative Association (NECA), who opined that addressing these issues requires “coordinated policy responses aimed at stabilizing the currency, enhancing the business environment and supporting economic sectors most at risk” from currency fluctuations.

According to Mr. Muyiwa Adebayo, companies with significant foreign currency debt exposure face heightened risks when the naira depreciates.

- “With the naira’s depreciation, the cost of servicing foreign currency debt escalates, consuming a larger portion of their revenue,” he explained. This increase in debt servicing costs can lead to tighter financial conditions and reduced profitability, potentially increasing default risks. Such financial instability can affect the banking sector and overall financial stability.

Mr. Adebayo also noted the impact of currency instability on investment. Uncertainty regarding the financial health of major companies and currency stability might deter investment, causing both domestic and foreign investors to adopt a ‘wait and see’ approach.

This hesitation can delay or reduce the capital inflows that are essential for economic growth. Moreover, companies burdened by FX losses might freeze hiring or reduce their workforce to cut costs, which could adversely affect employment levels.

According to Samuel Oyekanmi, a Research and Insight Associate at integrated financial services fiem, Norrenberger Financial Group, Nigerian businesses have faced considerable challenges due to substantial foreign exchange (FX) losses, mainly due to the depreciation of the naira against major currencies.

- He explained, “This forex challenge has resulted in a series of net losses for numerous enterprises, undermining shareholders’ equity in some instances.” T

- hese significant losses have serious implications, especially concerning the companies’ strategic growth initiatives, as they potentially impede expansionary endeavors and strategic investments.

Oyekanmi also highlighted the broader impact on shareholders, who have traditionally relied on dividend payouts from these businesses.

- “The inability to offset losses has hindered dividend distributions, impacting shareholders’ returns and expectations,” he noted.

This financial strain has contributed, at least in part, to the recent downturn observed in the Nigerian equities market.

Further discussing the ramifications, Oyekanmi mentioned that these losses might deeply affect the operational frameworks of businesses, potentially leading to economic contractions.

- He pointed out, “It’s essential to acknowledge that a portion of these losses remains unrealized, serving primarily as accounting constructs.”

This distinction implies that the losses are not yet tangible and could potentially be recouped in subsequent periods.

- However, he cautioned, “The uncertain nature of future currency fluctuations and market conditions underscores the complexities surrounding the recovery of these losses.”