👨🏿🚀TechCabal Daily – The ABCs of Alphabet’s first-ever dividends

Good morning ☀️

We’re trying something new in TC Daily.

We’re introducing a new column called Techxperts Talk where bi-weekly—every other Monday—we’ll share insights from stakeholders across the ecosystem on trending issues. You can look forward to fresh insights in these editions.

If there’s a critical question you’d like the leaders of Africa’s tech ecosystem to answer—or you want to share feedback about this edition—shoot me an email at [email protected] and I’ll hunt down some answers for you.

How to solve fraud on the continent

In the very first edition of this column, the CEOs of Kenya’s Peleza, Marita Mutemi, and Nigeria’s Prembly, Lanre Ogungbe, share their thoughts on how startups and companies can tackle rising fraud on the continent.

In the past two weeks, two major banks across Nigeria and Kenya have revealed how they lost funds to fraud. Kenya’s Equity Bank lost $2.1 million to a debit card fraud, while Nigeria’s Wema Bank lost $600,000 to fraud and forgery. Here’s what these CEOs think.

TC: What do you think about the current state of fraud detection and prevention in the financial sector?

Marita: The surge in fraud incidents in Kenya highlights critical vulnerabilities in the current state of fraud detection and prevention within our financial sector. While traditional methods have had their place in safeguarding against fraudulent activities, they now face the challenge of keeping up with the evolving tactics employed by sophisticated fraudsters. We have to appreciate that the advancements in technology and rise in online transactions have significantly changed the nature of fraud we face now. In Hong Kong, for example, fraudsters used deepfake technology to convincingly impersonate a company’s CFO during a video conference call, resulting in a $25 million loss. In light of these developments, there is an urgent and compelling need for the financial sector to transition towards more advanced, adaptive, and real-time fraud detection systems.

Lanre: We need synergy to curtail fraud in the sector. We need advancing local technologies, and direct investment in education to have the right talents and knowledge banks. I must also state there needs to be clear and rapid consequences for companies that do not have minimum fraud large-scale prevention requirements and greater consequences for perpetrators. Let me state that fraud cannot be eliminated completely in the financial space. It will always happen as we will continue having bad actors always trying to circumvent the financial companies, but we can make it harder and tougher for it to happen.

TC: Are there any emerging technologies or trends that hold promise for enhancing fraud detection capabilities?

Marita: Unfortunately, many consumers do not recognise fraudulent activity until it’s too late. Increasing financial literacy would go a long way to help consumers identify and report potential fraud. Financial institutions play an important role by implementing comprehensive consumer education programmes and campaigns. These initiatives should prioritise educating consumers on how to spot common and emerging fraud patterns, understand their responsibilities, and emphasise adoption of strong security practices. This can be delivered as online content such as webinars, press releases, social media posts, blogs and articles tailored to different demographics. These educational materials can include topics such as recognising phishing emails, insecure websites & WiFi networks, protecting personal and financial information, use of strong passwords and two-factor authentication, and understanding the importance of regularly monitoring account activity.

Lanre: The best I have seen around is “profiling technologies”. It’s difficult to create technologies around prevention when financial businesses aren’t always willing to expose incidences, and data OR replace existing technologies. There is a school of thought around creating islands/silos of infrastructure within the sector as it claims that if no eternal peripheral is interfacing with those silos, it reduces the chances of fraud. over time, we see that this theory is outdated as financial players play in a field that requires continuous technology upgrades as they determine a lot of technology advancements for the country.

TC: In your opinion, what role should startups play in innovating new solutions to combat fraud, and how can they collaborate effectively with traditional financial institutions?

Marita: Startups have the agility, creativity and often a good understanding of emerging technologies, so they are well-positioned to experiment and develop innovative solutions to address the evolving challenges of fraud. Their nimbleness allows them to experiment quickly and iterate, keeping them ahead of emerging threats. Startups can partner with traditional financial institutions and promote collaboration. Startups will have access to the vast resources and industry expertise of established financial institutions, while these institutions will be able to take advantage of fresh perspectives and innovative solutions offered by startups.

TC: From a regulatory perspective, what measures do you believe are necessary to strengthen fraud prevention frameworks?

Lanre: From a regulatory perspective, strengthening fraud prevention frameworks requires a multi-faceted approach. This starts with imposing stringent requirements for financial institutions to implement robust anti-fraud policies and procedures, including regular risk assessments, employee training, and the use of advanced technologies for fraud detection. There should be increased collaboration among industries to share information and best practices, helping to identify emerging fraud trends and curb them at their inception to mitigate risks. Regulations should be updated to keep pace with evolving fraud tactics and technologies. This includes implementing measures such as biometric KYC checks, transaction monitoring, and data encryption to ensure the integrity of the financial system.

Peleza is a pioneering East African company dedicated to providing comprehensive background checks, extensive KYC, KYB, and AML checks, and powering businesses of all sizes.

Prembly is one of the most comprehensive digital security providers on the continent. It is an AI-powered compliance infrastructure company, driving digital integration on the continent by enabling businesses across 40 African countries to transact with trust.

Read Moniepoint’s case study on family-owned businesses

Family-owned businesses are everywhere, shaping our world in ways you might not expect. We’ve found some insights into how they work, and we’d love to share them with you. Dive in right away here.

Nigeria freezes 1,146 bank accounts linked to illegal FX trading

Last week, the Nigerian Federal High Court granted the country’s financial crimes watchdog, the Economic and Financial Crimes Commission (EFCC), the authority to freeze over 1,146 bank accounts.

Why? These accounts are linked to an ongoing investigation into illegal foreign exchange dealings, money laundering, and terrorism financing. This move by the EFCC is the latest in a series of actions taken by Nigerian authorities to crack down on financial crimes and currency speculation.

Nigeria fights illegal forex trading: With an unstable currency that has gone from $1/₦460 to $1/₦1460 in one year, Nigeria is searching all corners of its economy for a solution. In a series of moves, the country is going after currency speculators who destabilise fixed exchange rates.

Last Monday, the agency blocked 300 illegal forex accounts ollowing a court order. These accounts were allegedly involved in illegal peer-to-peer foreign exchange transactions. The head of the anti-corruption agency said the agency froze the bank accounts after discovering over ₦19.5 million ($15 billion) moving through one of the forex platforms in the last year, outside the financial regulations. He warned that this activity could have weakened the Nigerian currency (Naira) if it was left unchecked.

Per TechCabal’s report, “It has been confirmed that you trade cryptocurrency. We humbly request that you provide us with a valid court order for the release of your funds,” read an email from a financial institution to a customer whose funds were frozen.

Olukoyede noted that another worse scheme other than the cryptocurrency trading platform Binance and its system. The scheme popularly called the “P to P” peer-to-peer financial trading scheme has operated outside the official banking and financial corridors and there was a looming disaster that could further crash the Naira value that has continued to gain.

A rise in P2P raises eyebrows: A report in March to Nigeria’s Central Bank raised concerns about peer-to-peer (P2P) currency trading. The report found suspicious activity where some traders placed large orders for a digital currency (USDT) but never completed the purchase. This, according to analysts, might be a way to manipulate foreign exchange (FX) prices and weaken the Naira.

EFCC confirmed to have uncovered users who have been using the platform for price discovery, confirmation, and market manipulation, which has caused tremendous distortions in the market “resulting in the Naira losing its value against other currencies,” Hakeem Bello, an EFCC operative, said in a March affidavit.

Enjoy hassle-free transactions with Fincra

Collect payments without stress from your customers via bank transfer, cards, virtual accounts & mobile money. What’s more? You get to save money on fees when you use Fincra. Start now.

Alphabet to pay its first dividend

Last week was payday, but if you own a stock in Google’s parent company, Alphabet, you may be getting a second salary.

How? This quarter, Google’s parent company, Alphabet hit a whopping $23.7 billion in net income, and to celebrate, it’s issuing its first-ever dividend.

A first dividend: Alphabet issuing its first cash dividend of $0.20 per share comes on the back of incredible revenue growth in the company. The group reported revenue of $80.5 billion in Q1 2024, a 15% bump from the $69.8 billion recorded the previous year. While this is a first, the company has promised to keep the party going by paying subsequent quarterly dividends. If you plan to join the party, Alphabet’s share price shot up by 15% after-hours trading.

The ABCs of a first dividend: While it might surprise many that the 8-year-old company is just issuing its first dividend, several factors might influence a company’s decision to delay dividend sharing with its shareholders. Typically, the decision to issue dividends in the US rests with the company’s board of directors and the company might decide to share dividends based on growth priorities and financial stability. Companies need a strong financial foundation before paying dividends. Once a company like Alphabet reaches a certain level of maturity and profitability, it may have excess cash flow that can be shared with investors through dividends.

While companies typically do not announce a total dividend payout, Alphabet currently has approximately 12.488 billion outstanding shares, with each share costing about $173.69.

The share split: Google search made the bulk of Alphabet’s revenue, contributing more than half—$46.2 billion—of the company’s revenue. Alphabet generated $8.09 billion on YouTube, a 21% increase from the $6.7 billion generated in the same quarter last year. Google Cloud contributed $9.6 billion to the group’s revenue, a 28% increase—$7.5 billion—from the previous year.

Across regions, the United States led the way, contributing $38.7 billion to Alphabet’s revenue. EMEA (Europe, Middle East, and Africa) contributed $23.8 billion, while Asia-Pacific added $13.3 billion to the group’s revenue.

Alphabet’s dividend shares come after Meta’s board authorised its first-ever dividend in February. The group’s board also authorised the repurchase of up to $70 billion in stock.

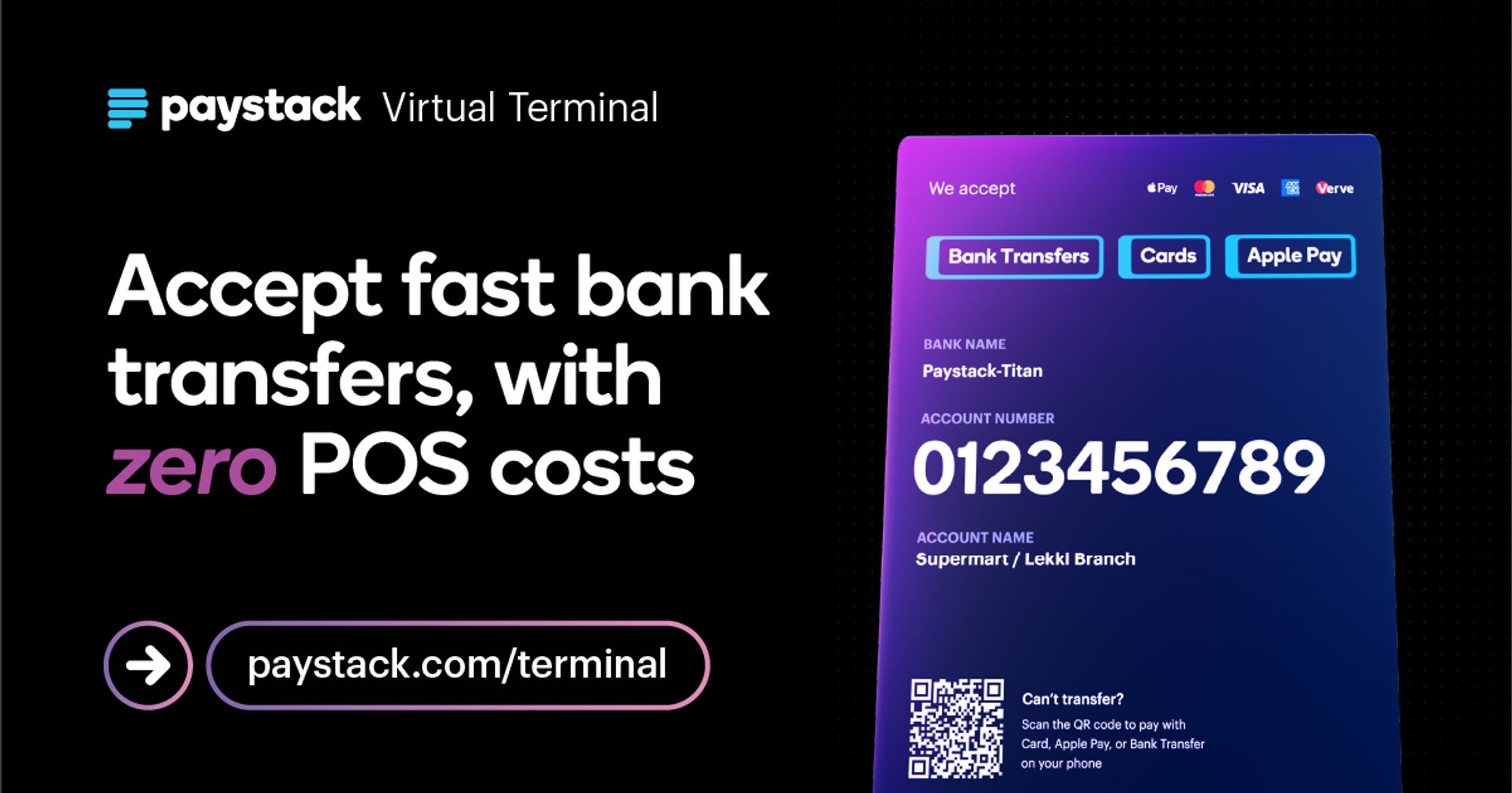

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

South Africa releases new crypto guardrails

Two weeks ago, South Africa’s financial conduct regulator approved 59 crypto licenses in its first batch of crypto licenses. While global crypto giant, Binance, missed out on the preliminary list, crypto firms Luno and VALR were the poster children among the first licensees.

The move signified South Africa’s warm embrace of crypto in the country with an estimated 5.8 million crypto users. However, in a bid to mitigate money laundering and terrorist financing risks associated with crypto transactions, the Financial Intelligence Centre (FIC)—South Africa’s national centre for gathering, analysing, and disseminating financial intelligence—has set new guardrails for such transactions.

What guardrails? Last week, the FIC issued a directive asking crypto platforms to specify parties involved in a crypto transaction. 😲

Crypto platforms will be expected to provide the sender’s full name, ID or passport number, residential address, date and place of birth, and wallet address. For cross-border trades, senders must provide addresses of both the sending and receiving crypto wallets and the crypto recipient’s full name.

Why? The FIC says it is complying with the ‘travel rule’ set by the Financial Action Task Force (FATF) which grey-listed the country in 2023 for lax anti-money laundering rules.The FATF developed the travel rule to help mitigate money laundering and terrorist financing. The rule requires financial institutions—virtual assets providers inclusive—to provide transaction information of the sender and recipient.

The latest rule excludes transactions less than R5,000 ($264.68) unless there is suspicion of money laundering or terrorist financing. Crypto providers have until May 31, 2024, to make comments on the proposal or forever hold their peace.

Ghana to license Starlink

Ghana has changed its course on SpaceX’s Starlink satellite internet service. Last Friday, the National Communications Authority (NCA) finally granted Starlink the approval to operate in the country.

Starlink illegality in Ghana: This comes just four months after Ghanaian authorities declared Starlink illegal, stating that any entity selling Starlink equipment or providing Starlink services in Ghana directly violated the Electronic Communications Act 2008.

On December 7, 2023, the NCA, Ghana’s telecoms regulator, cautioned the general public against using services purported to be from Starlink following reports of equipment being sold and operated in the country. “We wish to inform the general public that, the NCA has neither licensed the operations of Starlink in Ghana nor type-approved any of their equipment,” the NCA said in a press release.

The turnaround follows the approval of Ghana’s Satellite Licensing Framework by the ministry of communications and digitalisation. Last week, Ursula Owusu-Ekuful, Ghana’s minister for communications and digitalisation, disclosed that Starlink, the satellite internet service provider, is expected to receive a license to serve the Ghanaian populace soon.

Will other countries follow suit? With the decision Ghana becomes the eighth African nation to embrace Starlink, joining Nigeria, Mozambique, Eswatini, Zambia, Malawi, Kenya, and Rwanda. However, several other African countries, including Botswana, Zimbabwe, and South Africa, have banned Starlink due to concerns about regulations, competition, and potential security risks. A regulatory approval in South Africa, however, is highly unlikely as South Africa’s laws require all foreign companies to relinquish 30% of their equity to South Africans in order to operate in the country.

This decision could significantly improve internet access in Ghana, which recently reported a 70% internet penetration rate, up from 68% in early 2023. With nearly 24 million internet users nationwide, Starlink’s arrival could further expand connectivity options for Ghanaians.

Attend GITEX Africa

GITEX Africa returns a second time on May 29–31, 2024, to Marrakech, Morocco, discussing ways to accelerate the continent’s digital health revolution. GITEX is the continent’s largest all-inclusive tech event renowned for uniting the brightest minds in the technology industry.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $63,650 |

+ 0.62% |

– 10.13% |

|

| $3,302 |

+ 1.86% |

– 5.32% |

|

|

$0.79 |

+ 2.13% |

– 9.96% |

|

| $141.32 |

+ 0.72% |

– 25.29% |

* Data as of 22:55 PM WAT, April 28, 2024.

Here’s what you should be looking at

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.