Zenith Bank Plc, Nigeria’s second-largest lender by market value, plans to expand in Africa, starting with the Ivory Coast, after raising fresh capital to meet new regulatory requirements.

According to Bloomberg, Olukayode Akinbinu, the bank’s head of strategy, said the lender is considering setting up operations or buying existing ones in the West African Economic and Monetary Union and the Central African bloc. “Ivory Coast is likely to open this year, then Cameroon as soon as possible,” he said.

Read Also: MTN is investing N1trn in 2025 to boost network quality – Karl Toriola

The bank will invest 40% of the ₦350.5 billion ($231 million) it raised this year into overseas expansion. The funds were part of its effort to comply with new Central Bank of Nigeria rules that increased minimum capital requirements tenfold, with a March 2026 deadline.

Ivory Coast has averaged 6.7% annual growth over the past five years, making it one of the fastest-growing economies in the world and a key destination for regional investors.

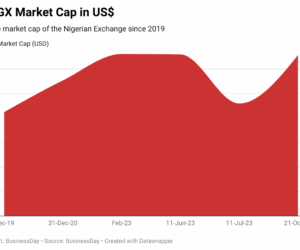

Zenith already operates in Ghana, Sierra Leone, and The Gambia, with additional offices in South Africa, the UK, France, China, and Dubai. Its shares have gained 43% this year, compared with a 35% increase in the Nigerian Exchange All Share Index.