Nigeria’s cement industry is set to have a new force with the announcement of a $600 million plant in Kebbi State by business tycoon Muazzam Mairawani, chairman of MSM Group, a move that’s considered to challenge market leaders such as Dangote and BUA Cement.

Born in Kano, Mairawani’s conglomerate spans oil and gas, agriculture, cement, logistics, shipping and fintech in what is now going public in the United States through an Initial Public Offering (IPO) estimated at $225 million.

Despite being born into one of Africa’s wealthiest families and having a natural business instinct, Mairawani has a stellar education record. A bachelor’s degree in Business Information Systems at Middlesex University in the United Kingdom and an advanced diploma in Computing from Informatics Academy, Singapore, further honed his skills in business management and technology development, two of which have helped his conglomerate expand into a multi-billion dollar giant.

As a young entrepreneur, his foray into core business ventures in Nigeria following the franchise of Tangaza mobile pay during the country’s shift towards a cashless policy demonstrates his foresight in financial inclusion in a country where many are still excluded.

From oil and gas to $600m cement factory

The billionaire who has overseen MSM Group’s expansion into different sectors for about 14 years is doubling down and moving into a new territory, with bold $600 million plans that’d rival leading industrialists’ cement companies — Dangote and BUA.

The new factory that’d be situated in North Western Kebbi will have a production capacity of 12 million tons. That’s about 41 percent less than BUA’s 17 million tons, and both are a little above half of Dangote’s capacity of 52 million tons.

Read also: Cement makers’ FX gains hit six-year high on naira rally

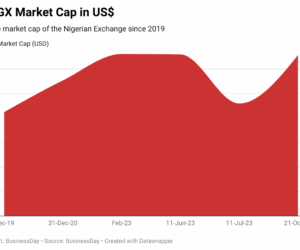

But beyond production volumes, Mairawani’s cement plant, if listed, will have to contend with BUA’s over N5 trillion market capitalisation and Dangote’s more than N7 trillion, a rare feat that would take years to achieve.

The Kebbi project will be built in clusters, each valued at around $600 million, according to Mairawani. He explained that the investment is part of MSM’s long-term push into manufacturing, which he believes will boost local production, create jobs, and support the federal government’s drive for industrialisation.

$225m U.S IPO to pave way for $2.7bn annual investment

Barely few days before the announcement of the $600 million cement plans, Mairawani unveiled plans for a $225 million initial public offering (IPO) in the United States in a bold attempt to expand its operations across the shore of Africa. That move is expected to lure in $2.7 billion worth of investments into the country, the oil mogul said.

MSM Group intends to list 22.5 million units at $10 each on Nasdaq through its New York-based acquisition arm, MSM Frontier Capital. The move follows the discovery of oil reserves worth about $15 billion in one of the group’s assets.

According to Mairawani, the IPO will support investments across oil and gas, cement, shipping, and power. “We are targeting $2.7 billion every year in investments into Nigeria,” he said, crediting President Bola Tinubu’s support for giving the group the confidence to expand globally. “Without the President’s approval, we would not have achieved these feats. To God be the glory, we didn’t let him down.”

Founded in 2011, MSM Group began as a fertilizer supplier before branching into logistics, cement haulage, shipping, fintech, and travel. In recent years, it has steadily expanded in oil and gas while maintaining interests in agriculture, cement, and technology. Under Mairawani’s leadership, the planned IPO is expected to strengthen MSM’s balance sheet and unlock new capital for energy and infrastructure projects.

The company has also made significant progress in oil exploration. Since acquiring Oil Mining Lease (OML) 98, it has grown reserves from 118 million barrels to 244 million barrels within six months. “Our growth has been driven by technical expertise and the experience of our team, many of whom have over three decades in the upstream sector,” Mairawani said.