Nigeria, Africa’s biggest oil producer, has introduced a five per cent surcharge on petrol and diesel sales, a measure that has sparked debate among citizens, businesses, and policy analysts.

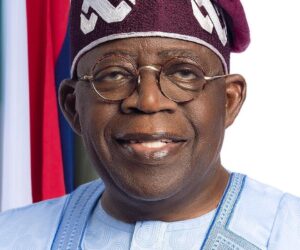

The levy is part of the newly signed Nigeria Tax Administration Act, one of four tax reform bills signed into law by President Bola Tinubu on June 26, 2025.

The regulation requires that the surcharge be applied to every supply or sale of refined fossil fuel products in Nigeria, whether locally produced or imported, with the money collected at the point of sale. Cleaner fuels such as renewables, household kerosene, cooking gas (LPG), and compressed natural gas (CNG) are exempt.

Read also: Dangote ships first petrol cargo export to United States

Is this levy really new?

Not entirely. Legal experts note that the five per cent fuel surcharge has been embedded in Nigerian law for nearly two decades. It first appeared under the Federal Roads Maintenance Agency (FERMA) Act of 2007, which mandated that a levy be paid on fuel sales to fund road maintenance.

“The ‘5% petrol surcharge’ is not new. It has been in our laws since 2007 under the FERMA Act,” said corporate lawyer Chima Amanda (@chima_amanda) in a post on X (formerly Twitter). “The problem is, it was never enforced back then, which is why most people don’t know it exists. What the new tax laws have done is to reintroduce it as part of harmonising all tax laws.”

In 2016, BusinessDay reported that the Senate directed the then Petroleum Products Pricing Regulatory Agency (PPPRA), now the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), to remit ₦634 billion to FERMA.

The sum represented what the agency should have collected as a five per cent fuel surcharge between 2007 and 2015.

In effect, what the Tinubu administration has done is not to create a fresh tax, but to revive a dormant provision that has never been systematically enforced.

When will it take effect?

Speculation has been rife that Nigerians will begin paying the levy from January 2026, but this is not accurate. The Act clearly states that the Minister of Finance must announce the commencement date through a government Gazette before enforcement can begin.

“For now, there’s no extra ₦500 tax on every ₦10,000 petrol purchase,” Amanda clarified. “If that ever changes, the government will make it official.”

This position was echoed by Taiwo Oyedele, chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, who stressed that enforcement will only begin once Finance Minister Wale Edun issues an official order.

“What is in the law is that this surcharge will take effect on a date in the future based on an order to be released by the Minister of Finance. We know the Minister is responsible enough to determine when it is appropriate to do so,” Oyedele explained in a video released by the State House.

Read also: Ten months, 10 price swings: Tracking petrol since Dangote Refinery’s debut

What the law says

The relevant provisions of the Nigeria Tax Administration Act spell out how the levy will work: Section 159: A five per cent surcharge is imposed on chargeable fossil fuel products provided or produced in Nigeria, to be collected at the time of supply or sale; Section 160: The surcharge is calculated based on the retail price of petrol and diesel; Section 161: The Minister of Finance must publish the commencement date in the official Gazette before collection begins and Section 162: The surcharge does not apply to kerosene, LPG, CNG, or renewable energy sources.

This framework effectively harmonises the FERMA Act provision into a broader national tax system, placing responsibility for collection and administration in the hands of the Federal Inland Revenue Service (FIRS).

Why it matters

The surcharge comes at a particularly sensitive time for Nigerians. The removal of the decades-old fuel subsidy in 2023 tripled petrol prices overnight, fuelling inflation and eroding household incomes. Since then, transport fares and the cost of goods have soared. Many Nigerians now fear that once implemented, the levy will further increase living costs.

Opposition voices have been quick to criticise the move. Peter Obi, former Anambra governor and Labour Party leader, described the new law as poorly timed. “Nigerians will pay a five per cent tax when buying their everyday fuel or diesel at a time when millions can hardly even afford the cost of transportation,” Obi said.

Consumer groups also worry that the surcharge could worsen inflationary pressures, particularly since diesel is widely used in Nigeria for powering businesses and transporting goods. “This is a policy that will reverberate across every sector, from food distribution to manufacturing,” said Lagos-based economist Tunde Agboola.

The government, however, argues the levy is a necessary step to fund infrastructure. According to Oyedele, the revenue will be earmarked for transport infrastructure projects, which could eventually reduce logistics costs and, in theory, lower prices for goods and services. “The idea is to dedicate this revenue to reducing the cost of transportation items and logistics, thereby helping to reduce inflation for Nigerians,” he explained.

Read also: PENGASSAN decry political interference in petroleum sector, call for reforms

The bigger picture

For the Tinubu administration, the fuel levy forms part of broader tax reforms aimed at simplifying Nigeria’s notoriously complex tax system and boosting government revenue. The government has committed to increasing its tax-to-GDP ratio, which currently lags behind the African average of around 16 per cent.

Yet the challenge remains political as much as economic. Implementing new taxes in a country grappling with double-digit inflation, currency depreciation, and widespread poverty is fraught with risks.