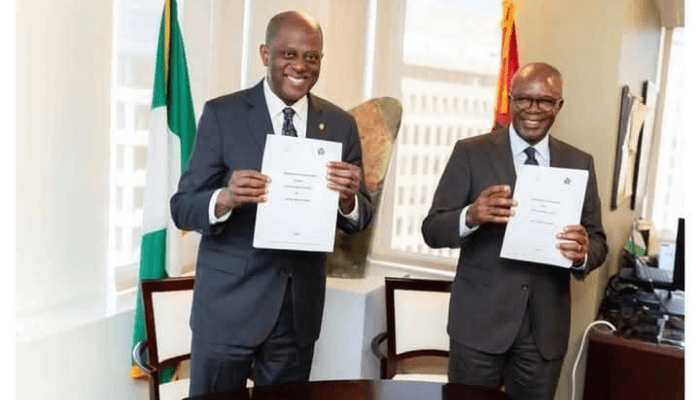

The Central Bank of Nigeria (CBN) and the Bank of Angola have signed a Memorandum of Understanding (MoU) to strengthen financial sector regulation and deepen economic cooperation between both countries, in line with Africa’s broader goals of integration and financial stability.

“Cardoso said the CBN had been “fortunate” to have implemented reforms early, allowing the economy to build resilience and buffers against potential shocks.”

The agreement, signed on the sidelines of the 2025 International Monetary Fund (IMF) and World Bank Annual Meetings in Washington, D.C., will enable the two apex banks to exchange technical assistance, enhance payment systems, and support financial sector development.

CBN Governor Olayemi Cardoso signed on behalf of Nigeria, while Manuel Antonio Tiago Diaz, governor of the Bank of Angola, signed for his country. Both leaders said the MoU “aligns with Africa’s broader goals of economic integration and financial stability” and marks a “critical development” in efforts to deepen bilateral cooperation and technical exchange.

Strengthening Africa’s financial backbone

Under the new framework, both institutions are expected to establish a bilateral forum for the reciprocal exchange and sharing of technical assistance to enhance capacity in executing central banking functions.

They will cooperate in the cross-border supervision of authorised institutions, exchange cybersecurity information, and collaborate on licensing, supervision, resolution planning, and implementation of resolution measures for cross-border financial establishments.

The MoU also calls for transparent and smooth periodic information exchange, with defined procedures to govern it. The cooperation will extend to exchange control, financial markets, foreign reserve management, currency management, and economic research.

It will also cover payment, clearing, and settlement systems management, banking supervision and regulation, financial sector development, and efforts to combat money laundering and terrorism financing.

According to both governors, the “outcome of the MoU implementation will be a win-win for both parties.”

Laying the foundation for financial integration

The partnership comes at a time when African central banks are seeking to consolidate regional financial cooperation as a means of driving economic stability and integration.

A financially stable Africa, the statement said, “comes with great benefits for the continent.” Beyond creating a larger single market, such stability would increase intra-African trade, boost productivity and competitiveness, and help attract more foreign direct investment.

The MoU, according to both central banks, will serve as a platform for institutional collaboration that promotes stability and strengthens the capacity of regulators to manage emerging risks in the financial system.

Nigeria showcases reform progress in Washington.

As part of efforts to boost investor confidence and strengthen Nigeria’s economic outlook, the CBN Governor and Doris Uzoka-Anite, the Minister of State for Finance, held a high-level engagement with global investors during the IMF and World Bank Annual Meetings.

They were joined by CBN Deputy Governor (Economic Policy) Mohammed Abdullahi, Special Adviser to the President on Finance and the Economy Sanyade Okoli, and other senior officials.

The session provided a comprehensive update on Nigeria’s macroeconomic reforms, fiscal-monetary coordination, and policies shaping the country’s growth trajectory.

Governor Cardoso highlighted “sustained stability in the foreign exchange market, steady accumulation of external reserves, and growing investor participation across fixed income and equities.”

He said, “Nigeria’s focus remains clear: strengthening our fundamentals, advancing reforms, and unlocking opportunities for sustainable investment and growth. We are encouraged by the progress made so far and remain confident that ongoing reforms are laying a stronger foundation for a more resilient economy.”

The Nigerian delegation reaffirmed the government’s commitment to policy consistency and continued reform momentum, creating an environment that is open, transparent, and attractive to long-term capital.

Participants at the meeting expressed optimism that Nigeria’s strengthened institutions, enhanced investor trust, and ongoing reforms will continue to drive sustainable growth and broaden opportunities for all stakeholders.

Building a resilient economy

Cardoso, who also led the Nigerian delegation to the meetings, said at the Intergovernmental Group of Twenty-Four (G-24) press briefing that “Nigeria’s economy has been fully restructured and is now resilient, with huge buffers against global risks.”

He noted that “the naira has equally emerged as a competitive currency, with the economy witnessing positive trade balances and large businesses moving from imports to exports of locally produced goods and commodities.”

According to him, “the positive economic indicators have combined to create resilient and strong buffers, keeping the economy in great shape.”

On the impact of trade tariffs, the CBN Governor said, “For us again, oil is basically the only commodity that was so exposed to the tariffs, and the impact of that was relatively modest. We now have a more competitive currency, with the result that, for once, we have a situation where we have a positive balance of trade surplus, and we expect it to be six percent in GDP for some time.”

He added, “So basically, what is happening is a complete restructuring of the economy, where we are encouraging people to go into domestic production and, of course, discouraging imports.”

Cardoso said the CBN had been “fortunate” to have implemented reforms early, allowing the economy to build resilience and buffers against potential shocks.

The CBN Governor also praised the G-24’s role in “finding solutions to global challenges through dialogue and exchange of ideas with global financial institutions,” noting that although global growth remains slow, “it is not as behind as would have been expected.”

IMF applauds reforms.

The IMF has credited Nigeria’s monetary tightening and exchange rate reforms for helping reduce inflation and restore market confidence.

Abebe Selassie, director of the IMF’s Africa Department, said the reforms “played a significant role in the gradual drop of the inflation rate to 18.02 per cent in September.”

He said, “The Fund is encouraged by the September inflation rate but advised that the government do more to bring down the cost of living for the people.”

Nigeria’s inflation rate declined to 18.02 percent in September 2025, down from 20.12 percent in August, marking a six-month streak of decline and the lowest in over three years.

Selassie added that the reforms “will further support the projected 3.9 per cent growth for 2025 and 4.1 per cent growth for 2026.”

He explained that to rein in inflation, the CBN “tightened policy aggressively, raising rates by more than 800 basis points and strengthening liquidity management.”

He also commended the bank’s decision to “halt central bank financing of government beyond statutory limits and re-anchor monetary policy on its core mandate”, describing it as instrumental in the inflation decline.

The IMF said Sub-Saharan Africa remains resilient, projecting growth of 4.1 percent in 2025 and a modest pickup in 2026, supported by macroeconomic stabilisation and reform efforts in key economies.

However, Selassie warned that overlapping monetary, fiscal, and external vulnerabilities persist. “Uncertainty remains, and risks are tilted to the downside,” he said. “Domestic revenue mobilisation and strengthened debt management can help bolster macroeconomic stability while funding essential development needs.”

He added that “average public-debt ratios have stabilised but at an elevated level”, with debt-service burdens rising and crowding out development spending in several countries, including Nigeria and Kenya.

Tax reforms are showing results.

The IMF also commended Nigeria’s tax reforms and the determination to raise non-oil revenue. Division Chief, Fiscal Affairs Department, Davide Furceri, said, “Nigeria has done significantly well in improving revenue through tax reforms and streamlining the tax code.”

He explained that on the revenue side, there is scope to improve mobilisation through tax administration reforms, noting, “Actually, Nigeria has done quite a lot in the past years. Many of the laws that have been passed have tried to streamline the tax code.”

Furceri added, “These are policies that go in the right direction. On the spending side, there is scope to improve efficiency and increase social spending to address social vulnerability in the country.”

Toward a more stable continent

The CBN–Bank of Angola MoU marks a tangible step toward financial cooperation and integration in Africa. By emphasising shared technical capacity, regulatory alignment, and transparent information exchange, both central banks say they expect the partnership to be a “win-win” outcome that enhances their respective financial systems.

As the two countries move to implement the agreement, the collaboration is expected to help consolidate Africa’s financial architecture, support investment, and promote the continent’s long-term vision of a stable and integrated economy.