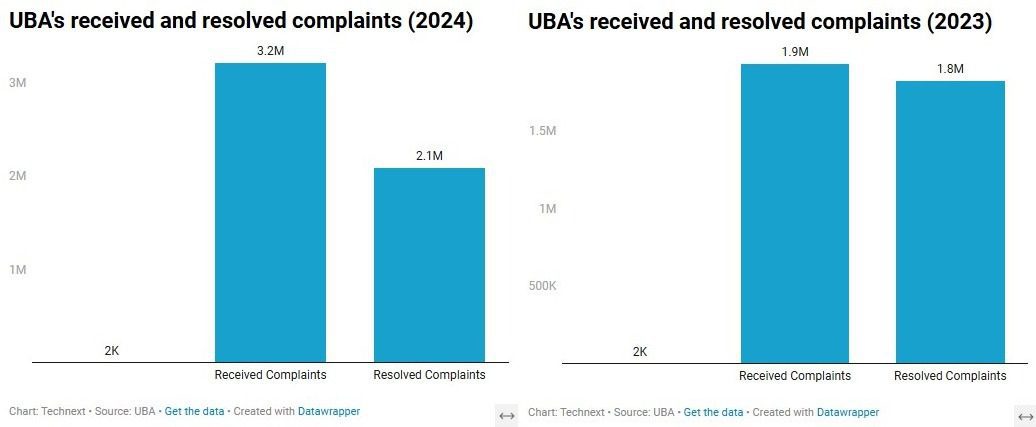

The United Bank for Africa (UBA) has revealed that it received 3,210,708 complaints surrounding unsuccessful transactions in 2024, a 66.3% jump from 1,930,518 in 2023. Data shows that the financial institution was able to resolve 75% (2,090,122) of the total complaints received in 2024.

According to the UBA 2024 sustainability report, made available on the Nigerian Stock Exchange (NGX) on Friday, the company noted that it continues to implement an effective complaints management platform and process that is easy to use and accessible to all customers.

While the bank received 3.2 million complaints in 2024, the total amount claimed from these complaints was N262.8 billion. Amount claimed refers to the money customers are requesting or claiming as a refund or reimbursement.

A year-on-year comparison of resolved complaints shows a 14.6% increase, from 1.8 million in 2023 to 2.1 million in 2024. Following the advent of resolved complaints (2.1 million), the total amount claimed dropped from N262.8 billion to N188 billion in 2024.

Following the resolution of complaints, UBA refunded N2.3 billion to customers in 2024 compared to N450 million in 2023.

Meanwhile, the report shows that total unresolved complaints in 2024 are over 1.1 million compared to 107,000 in 2023. On further breakdown, unresolved complaints escalated to the Central Bank of Nigeria (CBN) for intervention are 218, while those pending with the bank are 1,120,907.

Explaining the methodology of solving complaints, UBA said complaints made via its channels are routed to a team within the bank. This section is responsible for resolving the case within defined timelines, which are aligned with CBN complaint resolution timelines.

In addition, it explained that all cases are tracked and reviewed to identify root cause and fixes implemented to improve process, platforms, products and customer experience.

“Key Performance Indicators have been developed to effectively measure and monitor the efficiency and performance of the process, which is also periodically reviewed to ensure the bank is efficient at handling customer complaints, it added in the report.

Recall that in the reviewed Draft Guidelines on ATM operations, the CBN mandates that the resolution of failed on-us ATM transactions must be instant, while failed not-on-us ATM transactions shouldn’t exceed 48 hours.

Also Read: Access Bank customers paid ₦151 billion in bank charges in 9 months

UBA explained: processes of complaints and resolution surrounding unsuccessful transactions

The complaints and resolution processes are as follows:

(i) Customers can lodge complaints via any branch, calls, email, live chat, Leo and social media platforms.

(ii) Complaint is logged on the bank’s Complaints Management platform, and a notification will be sent to the customer with a case identification number.

(iii) When the complaint is reviewed, efforts are made to resolve it at first contact. Where this failed, the case is referred to the relevant department.

(iv) Once the complaint has been resolved and closed, the customer receives a notification to confirm the complaint has been resolved.

(v) Also, the customer is allowed to confirm satisfactory closure of the complaint or to dispute closure

(vi) Customers can escalate complaints for further review or investigation in line with CBN guidelines.