President Bola Ahmed Tinubu, on Wednesday, asked the Senate to approve a fresh external borrowing of $2.3billion.

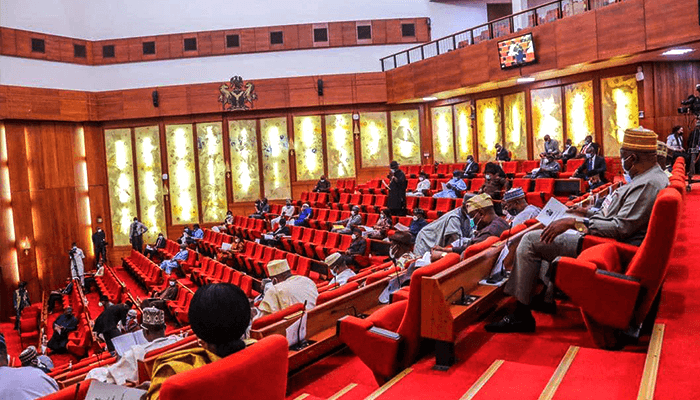

The President’s request, was contained in a letter read during plenary by Senate President Godswill Akpabio.

Tinubu said the new loan is to implement the 2025 Appropriation Act, refinance maturing Eurobonds, and expand Nigeria’s debt instruments to include Islamic finance products.

SPONSOR AD

“The 2025 fiscal framework anticipates $9.27bn in new borrowings to address the budget deficit, of which $1.84bn is earmarked for external sources at an assumed exchange rate of N1,500 to the dollar,” he said in the letter.

He explained that the external borrowing would be sourced through various instruments, including Eurobonds, syndicated loans, bridge financing, or direct loans from multilateral institutions — in order to optimise cost and manage risk effectively.

A key element of the plan is the refinancing of Nigeria’s $1.118bn Eurobond, issued in 2018 at a coupon rate of 7.625% and due in November 2025.

“This is a standard practice in debt capital markets,” the President wrote. “Refinancing through Eurobonds or syndicated loans will guarantee debt sustainability and boost investor confidence.”

Tinubu maintained that refinancing maturing obligations was part of routine debt management and vital for maintaining Nigeria’s fiscal credibility.