When President Bola Tinubu recently charged Nigeria’s judiciary to embrace cryptocurrency literacy, it sounded like a step forward for a country long caught between innovation and regulation.

Speaking through the Vice President, Senator Kashim Shettima, at a workshop for judges and justices organised by the Economic and Financial Crimes Commission (EFCC) and the National Judicial Institute (NJI) on Monday, the President called on the courts to understand blockchain and digital assets in order to better handle sophisticated financial crimes.

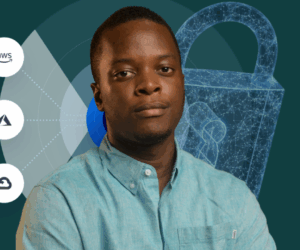

It was an acknowledgement that crime and commerce have gone digital. But according to Senator Ihenyen, Lead Partner at Infusion Lawyers and Executive Chair of the Virtual Asset Service Providers Association (VASPA), the President’s message, though welcome, misses a crucial point.

“President Tinubu’s call for the judiciary to deepen its understanding of blockchain technology and cryptocurrency to combat sophisticated financial crimes is commendable and essential,” Ihenyen said in a chat with TextNext. “It shows a crucial recognition that traditional judicial methods are inadequate for the digital age.”

But he warned that the focus on crypto literacy from a crime-fighting perspective risks reinforcing an old stereotype, one that frames Nigeria’s crypto ecosystem as a crime scene, rather than an opportunity to harness.

“Based on the reality of crypto adoption and the licensing regime in Nigeria presently, I think the position articulated in the speech is insufficiently holistic,” he said. “It risks resulting in reactionary approaches rather than building a more solid foundation for effective enforcement.”

Nigeria’s crypto journey over the years

Nigeria’s crypto story is one of global leadership. Despite regulatory hurdles, the country consistently ranks among the top markets for grassroots cryptocurrency adoption.

According to Chainalysis’ latest Geography of Cryptocurrency report, the country received $92.1 billion in on-chain value between July 2024 and June 2025, nearly half of Sub-Saharan Africa’s total of about $205 billion. For millions of Nigerians, especially freelancers, small businesses, and young tech-savvy users, crypto is not a criminal tool but a survival strategy.

“Crypto adoption in the country is not the story of crime, but a story of resilience; of grassroots connection,” Ihenyen said. “Are there bad actors and criminals? Of course, as with other countries in the world. But Nigeria is a global leader in grassroots crypto adoption, often ranking among the top countries worldwide.”

The reasons are economic, not illicit. “This adoption is largely in response to macroeconomic factors and certain frictions in financial access,” he explained. “Nigerians use crypto for legitimate purposes like investments, payments, remittances, cross-border trade, and participating in the global digital economy. These legitimate uses cry out for smart regulation, not reactions.”

That distinction matters. Ihenyen fears that if the judiciary’s education centres only on the forensics of crypto fraud, it will reinforce what he calls Nigeria’s “negative enforcement and regulatory bias”.

“If judges only view crypto as an instrument of fraud,” he said, “their rulings could inadvertently stifle legitimate, economically productive activities, pushing the market back to the same underground space we have been working hard to pull it out from.”

The problem isn’t just perception; it’s policy. Nigeria’s regulatory environment for digital assets has been inconsistent at best.

In 2021, the Central Bank of Nigeria (CBN) issued a controversial directive barring banks from facilitating crypto-related transactions. That restriction effectively cut off crypto exchanges and startups from the formal financial system.

Two years later, the same CBN rolled out Guidelines for Virtual Asset Service Providers (VASPs), a partial reversal that reopened the door for crypto operations, albeit narrowly. Around the same time, the Securities and Exchange Commission (SEC) also released its own digital asset framework.

In March 2025, President Bola Ahmed Tinubu signed into law the updated Investments and Securities Act (ISA) 2025, which classifies digital assets, including cryptocurrencies, as securities, thereby placing them under the regulatory purview of Nigeria’s Securities and Exchange Commission (SEC).

But according to Ihenyen, the rules remain fragmented and prohibitive. “While the CBN’s review of its restrictive stance in late 2023 was a commendable step forward, the licensing process for VASPs remains challenging and prohibitively expensive for many local innovators,” he said. “High capital requirements and registration fees, especially at this nascent stage, make it difficult for startups to comply.”

He added that the government’s regulatory inconsistency undermines its own goal of judicial competence.

“It may be counterproductive to demand that the judiciary be grounded in a subject where the executive and regulatory branches are yet to establish clear, harmonised rules of engagement,” he said.

Indeed, Nigeria’s digital asset rules continue to shift, from P2P trading crackdowns to the undefined legal status of stablecoins. For judges, that’s a problem. “A judge cannot apply a clear legal precedent if the core regulatory classification is subject to shifting policy or high barriers to entry into a nascent market,” Ihenyen said.

His prescription is straightforward: legislative clarity. “The government should prioritise finalising a clear, unified, and competitive national VASP Act or comprehensive digital asset framework or code,” he said.

“This legislative clarity must precede or run concurrently with judicial training to give judges a reliable and stable legal foundation to interpret. This is essentially what the rule of law is about.”

From crime control to digital competence

For Ihenyen, Nigeria’s fixation on enforcement misses a bigger opportunity: using blockchain to improve governance, efficiency, and transparency.

“The overwhelming focus on tackling crime has the unavoidable effect of always positioning the government in a reactive stance,” he said. “Whereas the reality of the technology demands a proactive approach to harness its benefits.”

Blockchain, he argued, isn’t just about financial speculation or digital currencies. “We need to understand that the promise of blockchain technology is not just about financial assets,” he said. “It’s a fundamental digital infrastructure for more secure record-keeping, land registry, supply chain transparency, identity management, and governance.”

He believes the Tinubu administration can take the lead by adopting blockchain for public sector transparency. “The President’s Office has an opportunity to advocate for this technology’s use across government,” Ihenyen said.

But that would require a coordinated, national approach. “The President’s call should be expanded to a National Virtual Asset Strategy,” he suggested, “which the National Blockchain Adoption Policy tried to help steer in 2023.”

That strategy, he said, should include “judicial and law enforcement training, regulatory capacity building, a clear path to competitive licensing for local innovators, and government adoption of blockchain for efficiency and transparency.”

Senator Ihenyen’s comments capture a sentiment shared by many in Nigeria’s tech ecosystem: that the country’s digital future depends less on control and more on clarity.

“Training judges is essential for adjudicating the negative uses of crypto,” he said. “But true digital competence goes beyond enforcement. The judiciary is only the end of the enforcement pipeline. The beginning must ensure a conducive business climate and a well-equipped licensing and regulatory regime.”

Tinubu’s call for crypto literacy may mark a turning point. But without a coherent framework, the judiciary, and indeed, the country, may struggle to balance innovation with oversight.

As Ihenyen put it, “This is the only way we can build trust and confidence in the sector and promote integrity, transparency, and accountability for the level of sustainable growth that assures a safe and sound economy for the country.”