President Bola Ahmed Tinubu has ordered Nigeria’s financial and capital market regulators to closely monitor the growing use of stablecoins and digital currencies across the country.

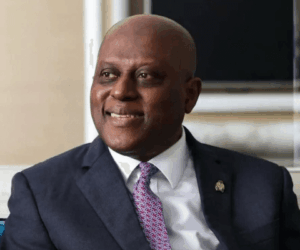

Speaking on Tuesday at the 18th Annual Banking and Finance Conference of the Chartered Institute of Bankers of Nigeria (CIBN) in Abuja, Tinubu represented by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun warned that the growing shift away from traditional banking poses new challenges that must be proactively addressed.

“There is a digital revolution. So many people now are not using the banking system to make payments. They’ve turned to stablecoins. They’ve turned to digital currency,” the President said. To this end, I have directed capital market authorities and banking authorities to get hold of this narrative and track it whilst it is still evolving.”

Following the enactment of the Investment and Securities Act 2025, the Securities and Exchange Commission (SEC) has already stepped up regulatory oversight of digital assets.

Under the new law, digital currencies are now legally recognized as securities, empowering the SEC to license and supervise Virtual Asset Service Providers, including exchanges and custodians. These providers must now comply with strict Know Your Customer (KYC) and Anti-Money Laundering (AML) standards.

President Tinubu also highlighted the need for Nigeria to move beyond economic resilience and embrace full reinvention.

He stressed that tools such as digital technology, artificial intelligence, and open banking must be harnessed to drive industrial growth, boost productivity, and create employment opportunities.

“Yes, our GDP is growing, but the percentage of industrial contribution from manufacturing is not where it should be to create the jobs we need,” he stated. “The innovation is there for the adoption of digital, AI, and open banking to enhance efficiency.”

He further emphasized the importance of preparing Nigeria’s young population projected to become the world’s largest workforce by 2050.

“Our young population is an asset. By 2050, Nigeria will provide the largest workforce in the world. That is why we are making investments in education, infrastructure, and digital skills to prepare our youth for the opportunities of tomorrow,” he said.

On fiscal reforms, Tinubu spoke about efforts to increase transparency and efficiency in government revenue generation.

He referenced the integration of government accounts with the Central Bank of Nigeria, which, he said, would enhance revenue visibility and optimisation.

“That linkage with the Central Bank, the revenue optimisation team, now gives us full visibility on government finances. That will yield dividends. It will lead to increased government revenues,” he explained.

The President also called for financial inclusion that goes beyond access, insisting it must result in decent job opportunities, especially for the youth.

“Households need reliable access to affordable financial services and reputable loans. Inclusion really means jobs, quality jobs, attractive jobs, particularly for our young men and women,” he added.

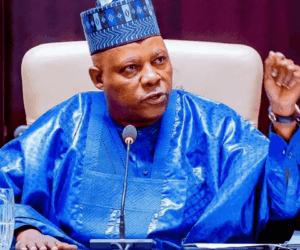

Meanwhile, the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, revealed that the apex bank is targeting $1 billion in diaspora remittances monthly by 2026.

He described remittances as one of Nigeria’s most consistent sources of foreign exchange.

“The Nigerian diaspora is one of the most vibrant in the world,” Cardoso said. “If we are able to harness even a fraction of their earnings and direct them into our economy, the impact will be transformative. That is why we are targeting at least $1bn every month in remittances by 2026.

He noted that CBN partnerships with commercial banks like Access Bank and Zenith Bank on international outreach had already boosted inflows, with monthly remittances rising from $250 million to $600 million.

Also speaking at the conference, the President and Chairman of the CIBN Council, Prof. Pius Olanrewaju, said the annual gathering continues to shape strategic decisions for Nigeria’s economic future.

He cited over N2.5 trillion raised by listed banks since 2024 and the growth of net domestic credit to the private sector, which now exceeds N82 trillion.

Olanrewaju added that Nigeria’s non-oil exports had grown significantly, with 236 products generating $3.23 billion in the first half of 2025—a 19.6% increase from the same period last year.

He also praised President Tinubu for signing four tax reform bills into law in June 2025.

These reforms consolidate more than 100 tax-collecting agencies into a single body, the Nigeria Revenue Service, which will take effect from January 2026.