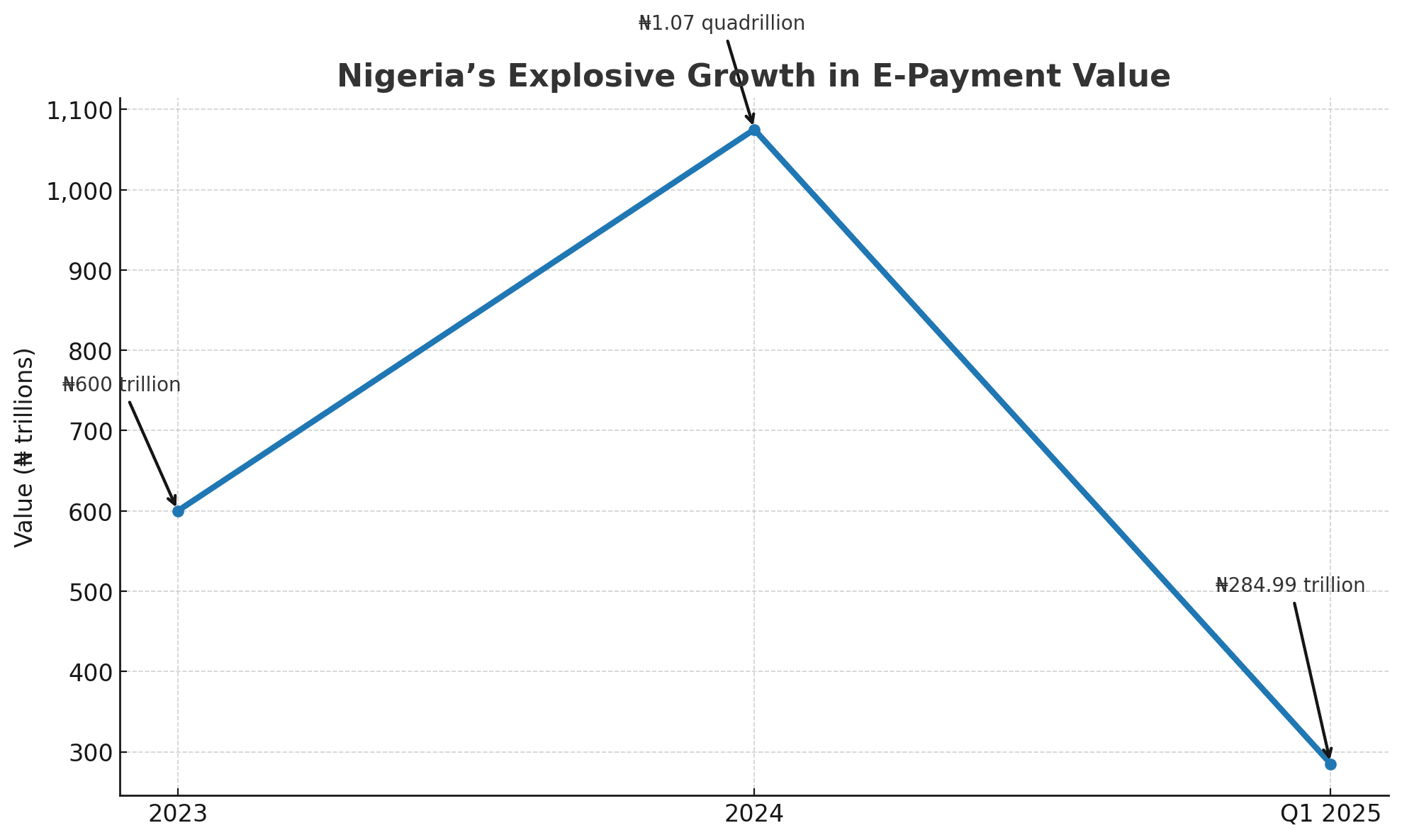

In 2024, more than ₦600 trillion moved through Nigeria’s electronic payment channels. That figure, drawn from the payment rail operator Nigeria Inter-Bank Settlement System, is not just a statistic. It is a window into a silent transformation taking place across the country’s financial landscape.

Behind those trillions is a quiet revolution – payments, credit, and insurance are no longer confined to banks or fintech apps alone. They now live inside ride-hailing platforms, retail checkout systems, logistics dashboards, and even informal market tools.

This shift, driven by embedded finance, is not just changing how money moves in Nigeria. It is redrawing the boundaries of what it means to be a financial service provider.

Between January and July 2024, the NIBSS Instant Payments system alone processed ₦566.4 trillion in real-time transfers, an 86% jump from the previous year. By the first quarter of 2025, e-payment transactions hit ₦295 trillion, up from ₦237.11 trillion in Q1 2024.

The growth is not only fast. It is systemic.

The shift: Platforms become banks (Without being banks)

This revolution is happening quietly, beneath the surface of everyday life.

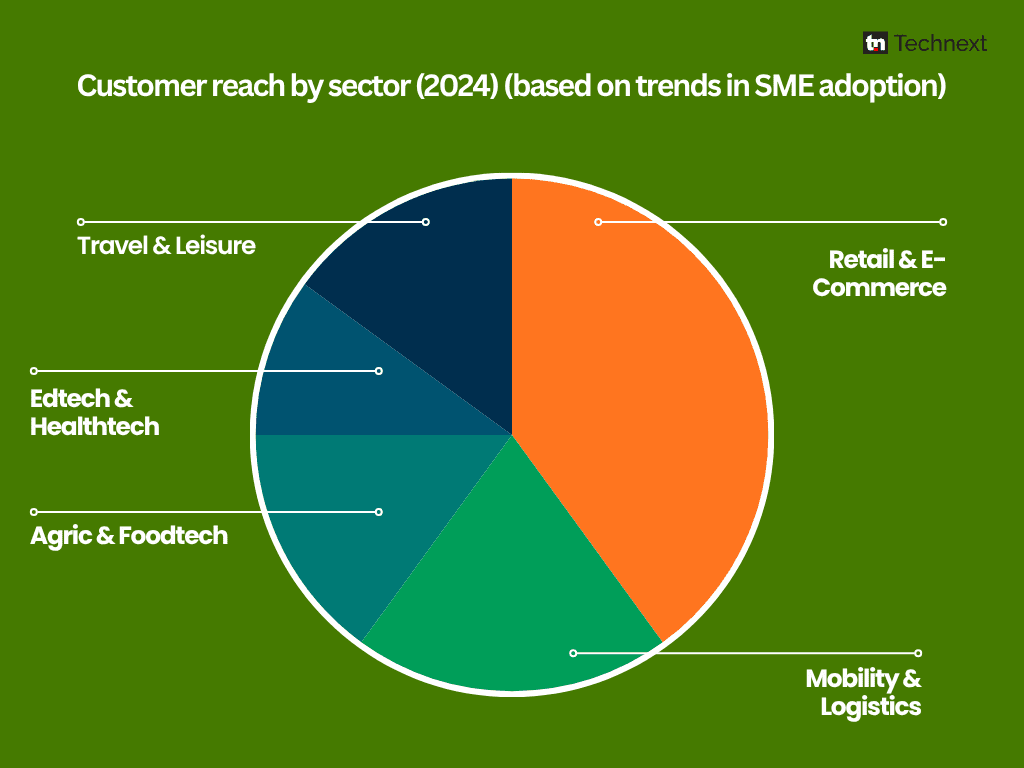

A market woman in Ojuelegba uses a retail app not just to sell provisions but to accept cardless payments and access microloans. A ride-hailing driver in Lagos receives fare payments and short-term credit through the same app that powers their daily work. A logistics startup in Ibadan gives its merchants access to real-time settlements and business insurance without sending them to a bank.

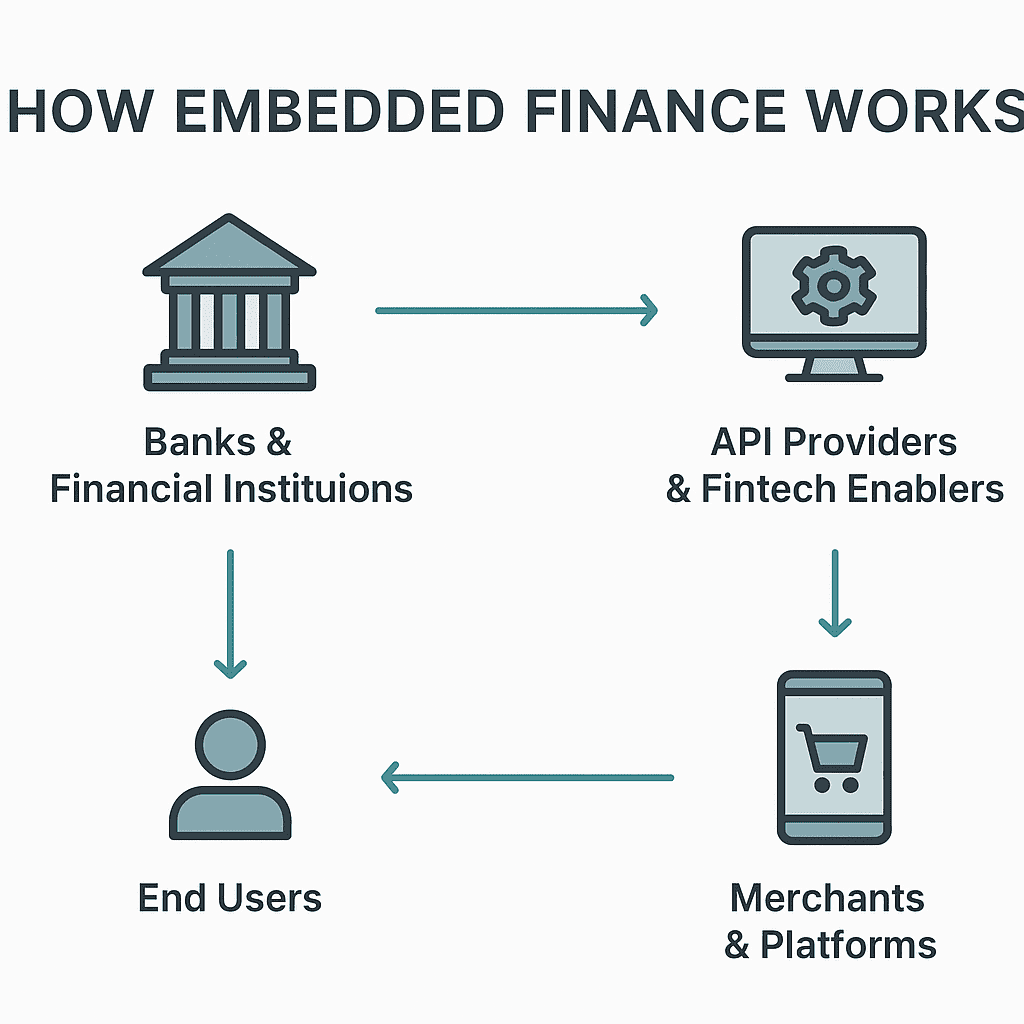

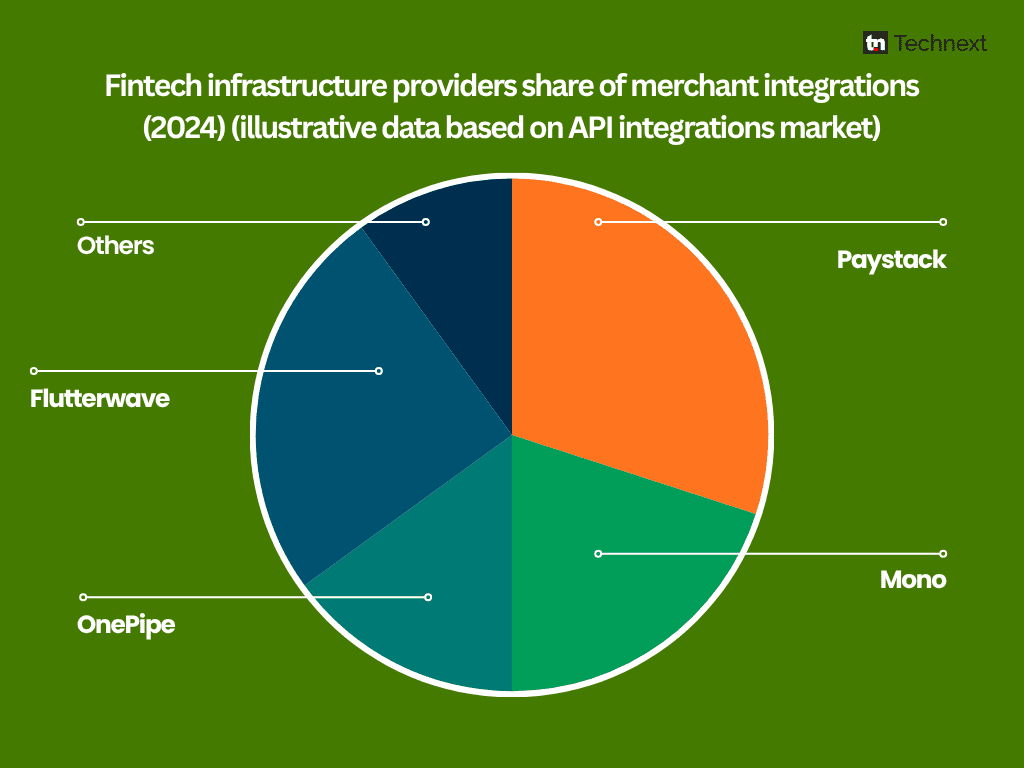

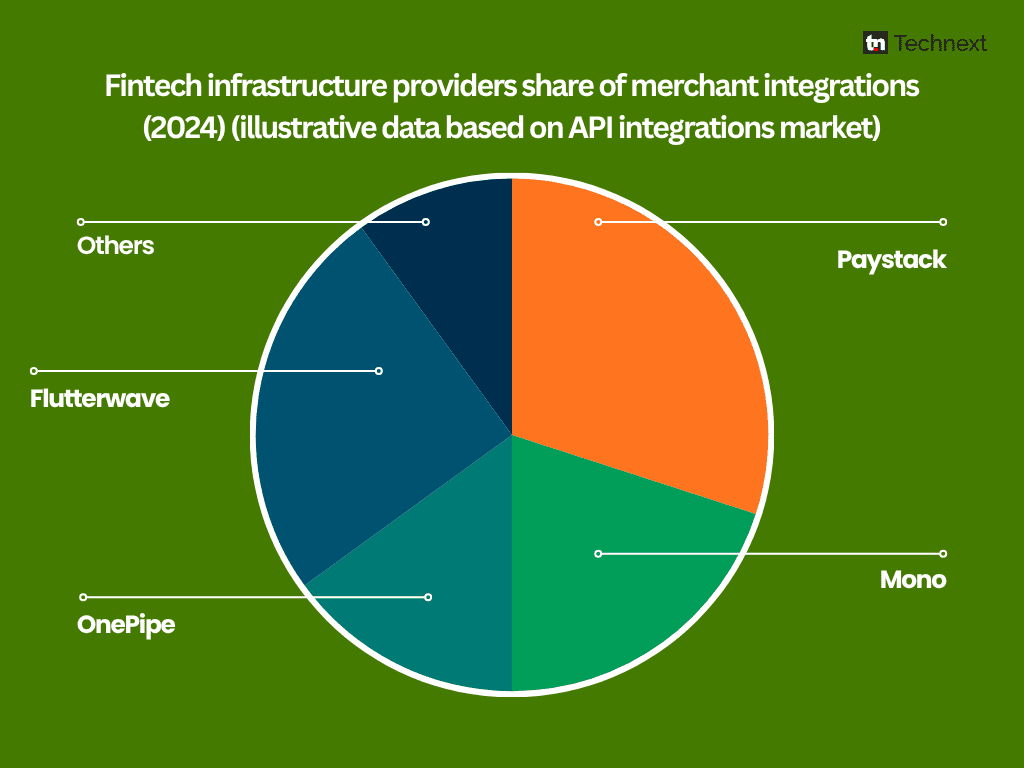

These are not isolated innovations. They are part of a rapidly expanding embedded finance infrastructure. Fintech infrastructure players like Mono, Okra, OnePipe, and Paystack have turned their APIs into building blocks for thousands of businesses.

Paystack, for instance, now powers over 200,000 businesses. In July 2024 alone, the company processed ₦1 trillion in transactions. This is a number that would have been unthinkable just a few years ago. Mono, which builds open banking APIs, says its platform has handled over 150 billion transactions and serves more than 7 million users across Nigeria.

OnePipe has turned its technology into a gateway for banks-as-a-service, allowing businesses to embed account creation, lending, and payments directly into their platforms. Its partnerships with Nigerian banks such as Fidelity and Access Bank make it possible for merchants to open accounts, process payments, and offer financial services — all without ever becoming a bank themselves.

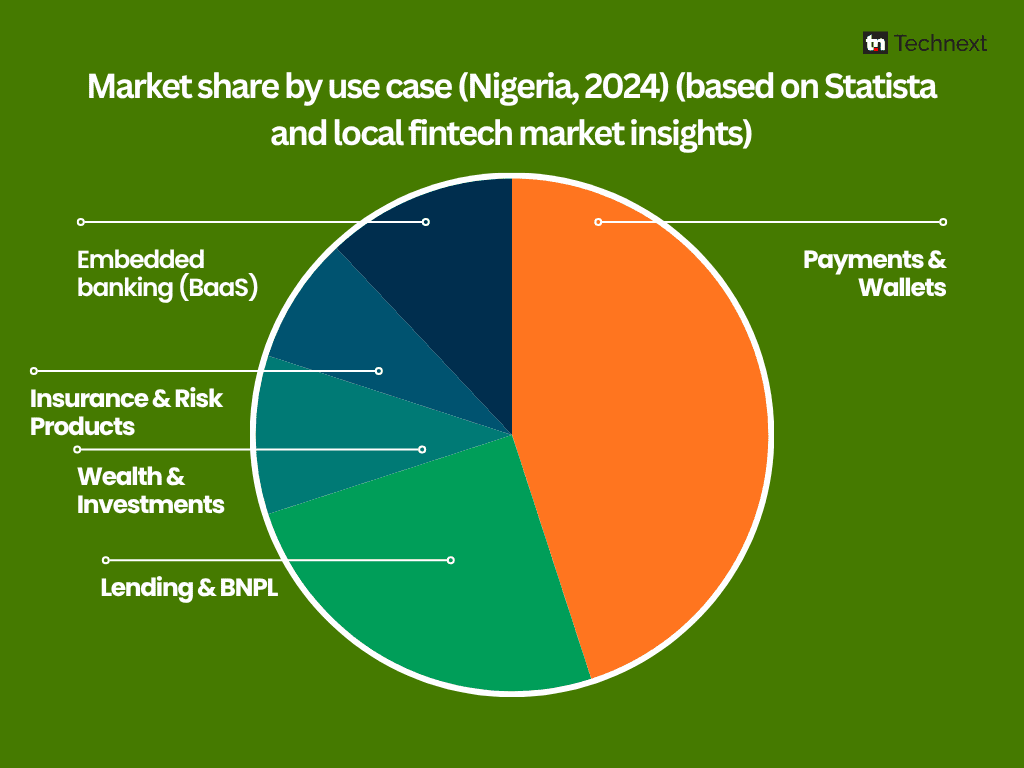

This is the core of embedded finance: a model where financial tools are quietly integrated into non-financial platforms, powering transactions in the background. It is why retailers now act like microbanks, why ride-hailing apps process credit, and why e-commerce platforms can offer instant insurance.

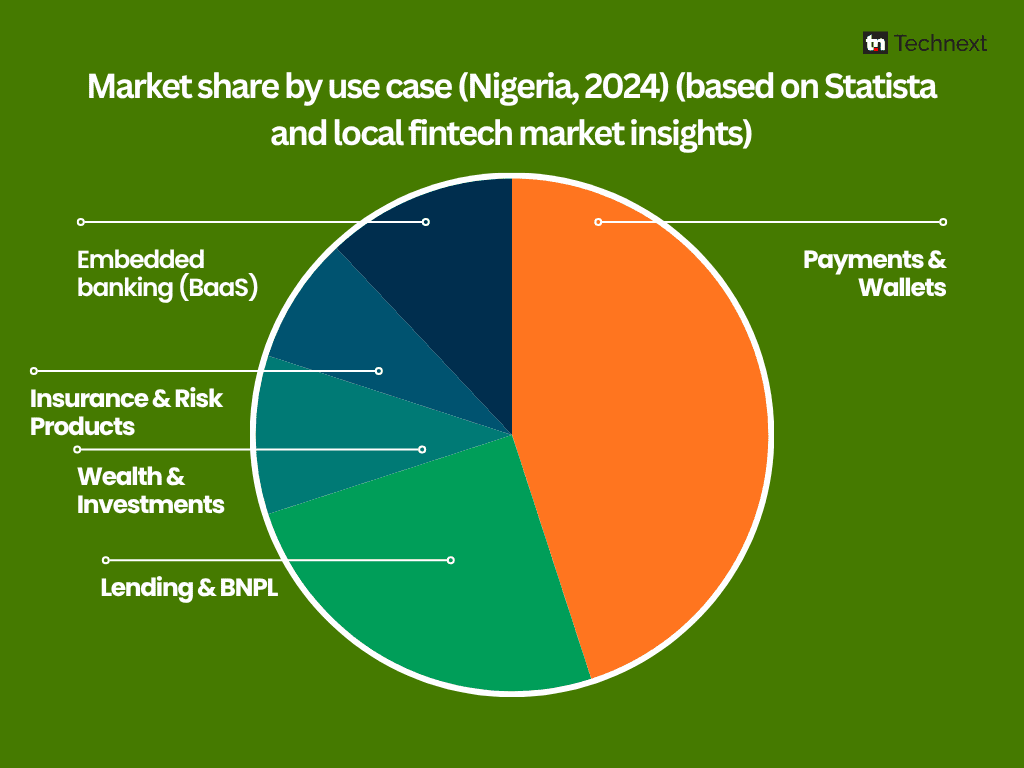

This is also big business. Nigeria’s embedded finance market was valued at around $3.99 billion in 2024 and is projected to grow to $4.34 billion in 2025, expanding at an annual rate of 8 to 13 per cent. The embedded lending segment alone is expected to reach $1.62 billion next year.

Even traditional sectors are playing catch-up. Payment Service Banks like 9 Payment Service Bank, Hope PSB, MoneyMaster, MOMO, and SmartCash are plugging into the same infrastructure that fintech entities built.

This is proof that the lines between banks, telcos, and fintech startups are rapidly blurring.

What comes next

The numbers tell a clear story, but they also reveal a challenge. As embedded finance goes mainstream, the question is no longer whether it will define Nigeria’s digital economy, but how well the system can be managed as it scales.

Nigeria’s regulators, particularly the Central Bank of Nigeria, have already laid the groundwork with open banking guidelines and rules for payment service providers. But embedded finance is different from traditional fintech. It spreads financial capability across industries, making oversight more complex. A single retail platform may now process as much money as a small financial institution, without looking like one.

This creates both opportunities and pressure. For businesses, embedded finance reduces barriers to offering financial services and helps them build deeper relationships with customers. For consumers, it means faster payments, easier access to credit, and fewer steps between wanting a service and paying for it. But for regulators, it means building oversight mechanisms that can monitor not just banks, but also every platform that behaves like one.

The rapid expansion of embedded finance also raises questions about infrastructure concentration. A small number of API providers power a huge number of businesses. If one major infrastructure provider falters, the ripple effect could be widespread.

In this sense, Nigeria’s future in this space is not just about scale, but also about resilience. How do you secure trillions of naira moving through layers of third-party platforms? How do you regulate thousands of merchants acting as financial access points? And how do you ensure consumer protection in a system where the financial service provider may not be obvious to the end user?

The signals are clear. Embedded finance is no longer a buzzword whispered in fintech circles. It is already part of the country’s infrastructure that facilitates money movement in Nigeria. It lives inside apps, platforms, and everyday experiences; quietly, efficiently, and at a massive scale.

Policymakers now face a strategic moment. If embedded finance is supported with the right infrastructure, security frameworks, and regulatory clarity, it can accelerate financial inclusion faster than any standalone bank ever could. If not, it could create blind spots big enough to threaten the stability it helped build.

The choice ahead is not whether to embrace embedded finance. That decision has already been made by the market. The real choice is how to shape and secure it.