In partnership with

TGIF! ☀️️

Our friends at Founders Connect have produced a documentary exploring the Nigerian banking industry. It features Sterling Bank—a tier-2 commercial bank—tracing its origins from a merger of multiple banks and how it leveraged technology to redefine banking services in the country. You can watch it here.

Flutterwave, the fintech giant, has acquired a Payment System License from the Bank of Zambia to expand its payment solutions in the country as it continues its relentless growth march across the continent.

Fawry acquires stakes in three tech startups for $1.6 million

Image Source: Google

Image Source: Google

Fawry, Egypt’s fintech unicorn, has invested EGP 80 million ($1.6 million) to acquire stakes in three Egyptian tech firms: Dirac Systems (51%), Virtual CFO (56.6%), and Code Zone (51%). The move is part of its broader strategy to strengthen its B2B fintech vertical, Fawry Business.

Dirac Systems, which counts large retail chains like Coca-Cola among its clients, specialises in enterprise resource planning (ERP) solutions that streamline business operations. Virtual CFO offers financial management services tailored for startups and SMEs, providing expertise without the overhead of a full-time CFO. Code Zone is a strategic tech infrastructure acquisition meant to enhance Fawry’s technological capabilities.

Fawry’s latest move is part of a bigger shift seen across fintech companies in Africa: chasing enterprise clients over consumers. For example, Nigeria’s Flutterwave laid off 24 employees, about 3% of its staff, to double down on enterprise and remittances—two of its biggest revenue drivers. South Africa’s Stitch acquired ExiPay, an offline payment infrastructure provider, to entrench its value offering to the enterprise market it already serves.

For Fawry, there’s a strong incentive: it’s where the money is. In its 2024 half-year results, “Fawry Business,” which includes banking services, financial solutions for SMEs, and supply chain digitization, emerged as its biggest revenue driver.

Banking services, which cover card payment solutions via POS for large enterprises, saw a 70.2% year-on-year (YoY) increase, bringing in EGP 932.1 million ($18.4 million). Financial services, including SME lending, employee insurance brokerage, cash management, and payroll card solutions, recorded the highest growth at 113% YoY, though it generated less overall—EGP 377.7 million ($7.5 million). Meanwhile, supply chain solutions, which help merchants, suppliers, and sales agents digitise transactions, added EGP 160.1 million ($3.1 million) to the business.

With numbers like these, it’s clear why Fawry is doubling down on enterprise services. B2B is proving to be the company’s strongest growth engine, and its latest acquisitions only reinforce that direction. With these acquisitions, Fawry will deepen its services to large and small enterprises, and financial institutions, expanding its potential revenue basket.

Despite what seems like positive news, investor sentiment is saying otherwise; Fawry ($FWRY) traded at EGP 8 ($8) on the EGX at the close of market on Thursday, declining by 0.12%. However, the fintech giant will hope that this is only a minor slump as it picks up pace in the coming weeks leading to the announcement of its full-year financial performance.

Fawry currently has a market cap of EGP 26.49 billion ($523 million), nowhere near the $1 billion valuation that made it Egypt’s first unicorn before it went public. Yet, it remains one of the country’s most important fintechs.

Are you an Afincran?

If you’re building solutions for Africa, you already are. Join Fincra’s mission to empower Africa through collaborative innovation. Together, we’re building the rails for an integrated Africa. Join the Afincran movement—let’s drive change!

Africa’s internet is one cable cut away from chaos

Image Source: Google

Image Source: Google

Fixing a damaged submarine cable takes anywhere from five to fifteen days in Europe or North America. In Africa? Try six weeks—or longer. And when it does get fixed, it costs about $2 million per repair.

MainOne Equinix Solutions, Nigeria’s first private-led submarine cable operator, has suffered three major fiber cuts since its launch. Each repair dragged on for weeks, disrupting internet access in key cities like Lagos. Meanwhile, in March 2024, an underwater landslide off Côte d’Ivoire’s coast damaged four critical cables, leaving 13 West African countries—including Nigeria, Ghana, and South Africa—scrambling for months before full restoration.

Africa doesn’t have enough repair ships nearby, meaning vessels must be sent from other continents, wasting precious time. Governments don’t make things easier either—permits for repairs can take months and cost up to $1 million.

While North America and Europe have dozens of backup cables, Africa is dangerously reliant on just a handful. The continent has only 74 submarine cable systems, compared to Europe’s 152 and the U.S.’s 88. Worse, 90% of African countries don’t even have a single dedicated cable, making every break a potential catastrophe.

Solutions exist: regional investment in repair ships, faster government approvals, and more private-sector funding. The International Telecommunication Union (ITU) and the International Cable Protection Committee (ICPC) are pushing for better policies, but until governments and businesses act, Africa’s internet will remain one cable cut away from another blackout.

You can now integrate Paystack with GiveWP

GiveWP makes it easy to create donation pages and accept online donations on your WordPress site. With Paystack, you can securely receive payments for your donations effortlessly. Find out more here→

Showmax slashes subscription to ₦1,000 for Nigerian users for one month

Image Source: Bird Story Agency

Image Source: Bird Story Agency

If you are Nigerian, here is a list of things you can do with ₦1,000 ($0.67): buy 2 pairs of the newly launched gala sausage rolls, tip a taxi driver or subscribe for the new Showmax mobile package.

On Thursday, Showmax, the streaming service owned by MultiChoice, introduced a new mobile plan in Nigeria, as it courts new subscribers.

From February 28 to March 31, 2025, Showmax will offer a promotional deal called “Showmax Shikini Season.” New and returning subscribers can sign up for the General Entertainment (GE) Mobile plan at ₦1,000 ($0.67), down from ₦1,600 ($1.07), while the All Devices plan will be priced at ₦2,000 ($1.33) instead of ₦3,500 ($2.33).

The move comes shortly after MultiChoice raised subscription fees for its DStv service. The new mobile plan comes one year after Showmax’s 2024 app revamp which saw the streaming platform rejig its content line up through a partnership with Comcast’s NBCUniversal and Sky, an upgrade to the Peacock platform.

The revamp, which focused on a mobile first approach saw Showmax introduce new mobile-only plans including for Premier League football at ₦2,900 ($1.93), which is significantly cheaper than DStv’s premium sports offerings. The streamer also introduced a mobile-only entertainment subscription that cost ₦1,200 ($0.8) a month, while a mobile bundle of entertainment and the Premier League will only cost ₦3,200 ($2.13).

Showmax’s new ₦1,000 ($0.67) plan comes at a time when many Nigerians are grappling with soaring data tariffs and other rising living costs. By offering a more budget-friendly option, the streamer hopes to draw in mobile users searching for affordable entertainment, while working toward its ambitious target of 50 million subscribers and $1 billion in revenue.

The plan will also appeal to customers looking for alternatives to pricier services without straining their wallets. The real test for Showmax’s new ₦1,000 ($0.67) plan will come in the weeks ahead, as Nigerians decide if the price point offers enough value and relief in today’s tight economic climate.

The Moonshot Deal Book is Coming!

Introducing the Moonshot Deal Book—our exclusive collection of the most promising and investable startups in Africa. If you’re an investor looking for the most exciting investment opportunities on the continent, sign up to join the waitlist and you’ll be among the first to access this investor-focused resource once it is live. Join the waitlist.

Funding Tracker

Image Source: Mobolaji Adebayo/TC Insights

Image Source: Mobolaji Adebayo/TC Insights

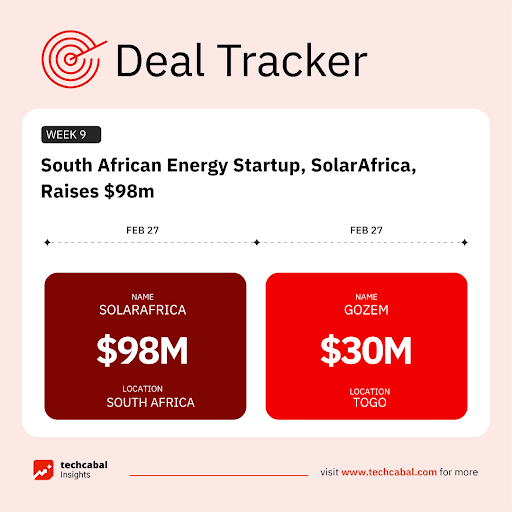

This week, SolarAfrica, an energy company, secured $98m in funding to implement the first phase of its 1 GW SunCentral solar project in South Africa. Investec and RMB backed the investment. (February 27)

Here’s the other deal for the week:

- Togo-based super app Gozem raised $30m in Series B funding, comprising $15m in equity and $15 M in debt. SAS Shipping Agencies Services and Al Mada Ventures led the funding round. (February 27)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, read our State of Tech in Africa review for 2024. Click this link to read it.

The World Wide Web3

Source:

| $79,557 |

– 6.68% |

– 26.12% |

|

| $2,110 |

– 8.85% |

– 32.26% |

|

| $0.5576 |

– 15.71% |

+ 22.77% |

|

| $126.94 |

– 8.23% |

– 45.00% |

* Data as of 06.30 AM WAT, February 28, 2025.

Events

- GITEX AFRICA 3rd edition is NOW OPEN for registration. Africa’s largest tech and start-up event will be held from 14-16 April 2025 in Marrakech, Morocco. Attend to see the leading brands in tech, and the most innovative startups, and network with tech leaders, investors, speakers and government delegations from across Africa and across the globe. Register here.

Written by: Emmanuel Nwosu, Faith Omoniyi, and Mobolaji Adebayo

Edited by: Olumuyiwa Olowogboyega

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 10 AM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

6 hours ago

18

6 hours ago

18

English (US) ·

English (US) ·