TAJBank Limited’s N20 billion Sukuk bond, offered earlier this year with a 20.5 per cent return per year, has recorded an oversubscription of 185.2 per cent, the institution disclosed on Friday, underscoring growing investor confidence in the Nigerian non-interest banking sector.

The transaction, the second tranche of the bank’s N100 billion Sukuk programme, which debuted nearly two years ago when the N10 billion offered attracted considerable interest from investors, rode on that earlier success.

The Mudarabah Sukuk recorded allotments totalling N57 billion, TAJBank said in a statement. Mudabarah, in Islamic banking, is an arrangement whereby one party provides capital, while the other invests it with an agreement for the two to share the returns based on agreed terms.

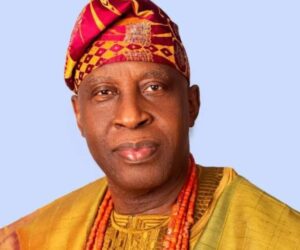

“Let me say that this outstanding performance of the Sukuk bond is a clear demonstration that the bank is enjoying growing investor confidence,” Founder and CEO Hamid Joda said.

That, he stated, was achieved, despite Nigeria’s current economic headwinds.

“This can only be attributed to the quality of innovative products and services, value addition TAJBank is delivering in the non-interest banking subsector of the banking system, especially when analysed within the context of the current realities in the debt instrument market today.”

The result highlights the growing appeal of ethical finance instruments, which comply with the Islamic principles prohibiting interest-based investments.

TAJBank, which commenced operations about six years ago as one of the country’s few fully non-interest banks, offers products tailored to the needs of investors seeking alternative financial instruments.

READ ALSO: NDIC seeks stronger alliance with CIBN in managing financial sector risks

Co-founder and Executive Director Sherif Idi said, “This investment feat is a clear demonstration that investors’ trust in TAJBank and we will continue to do our best to surpass their expectations through world-class products and services. As we always, our interest in the customers and investors.”

The success of the Sukuk affirms the growing global appeal of non-interest financing options, which may help Nigerian banks seeking an opportunity to scale and diversify their funding sources.