African startup funding has continued to witness an impressive rise as startups across the continent raised a total of $442 million in October 2025. This is according to data from African tech startup funding analytics company, Africa the Big Deal.

The total represents an impressive 215.7 per cent increase from the previous month of September, when startups across the continent raised $140 million. The difference isn’t so large when compared to the same month last year, when startups raised 254 million, representing a 74 per cent increase.

Indeed, the $442 million raised this month makes October the second most-funded month of the year, behind July, when startups raised $550 million. October also becomes the best-performing month of 2025 for equity funding, with a total of $334 million.

This represents an impressive 76 per cent of the total and could indicate a gradual return of investor confidence. This is particularly so considering that the equity share of funding has remained stable across two months.

Of the $140 million raised the previous month, $105 million, representing 75 per cent, came in the form of equity.

See also: African startups raised $140m in September to total $2.2bn in 2025

This is quite a shift in a year heavy with debts. For instance, compared with 2025’s most-funded month of July, of the $550 million raised then, $493 million came in the form of debt financing. This represents 89 per cent of the funding raised on the continent in July.

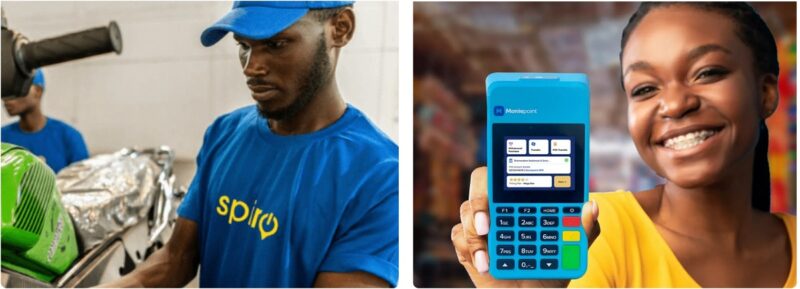

Spiro and Moniepoint lead October funding efforts

53 startups which raised at least $100,000 in October were responsible for the monthly haul recorded during the month.

Leading is Spiro with a $100 million raise. Considered the largest e-mobility raise on the continent (even though Moove’s $100 million raise would beg to differ), the round was powered by the Fund for Export Development in Africa (FEDA), Afreximbank’s investment arm.

Spiro’s new capital injection will expand its battery-swapping network and enhance local manufacturing. It will also be deployed to facilitate market testing in Cameroon and Tanzania.

Exactly a year after the first leg of its impressive $110 million unicorn-making raise back in October 2024, Moniepoint completed the second leg of the Series C round with a $90 million raise last month.

Development Partners International’s African Development Partners III fund led the round, with LeapFrog Investments providing significant backing. Other participants include Lightrock, Alder Tree Investments, Google’s Africa Investment Fund, Visa, the International Finance Corporation, Proparco, Swedfund, and Verod Capital Management.

The capital will support Moniepoint’s expansion efforts, bolstering its tools for African businesses and individuals while facilitating growth into new markets across the continent and beyond.

Following these big two is the Egypt-based cleantech Tagaddod, which raised $26.3 million in a Series A round. The round was led by The Arab Energy Fund (TAEF), with participation from FMO, VKAV, A15 Ventures, and other returning investors.

Tagaddod, which uses technology to collect, trace, and certify renewable waste-based feedstocks such as used cooking oil, acid oils, and animal fats, said the new investment will go into accelerating its regional expansion, enhancing its technology stack, increasing operational capacity, and laying the foundations for long-term leadership in the global SAF and biofuels ecosystem.

Next is Ctrack, a South Africa-based telematics startup which raised $23.4 million in equity funding. The round was led by Sanari Capital and 27four Investment Managers, two recognised leaders in South Africa’s investment space with strong B-BBEE credentials.

Sanari, through its 3S Growth Fund, contributed $14.4 million, and 27four Investment Managers invested $9 million.

The new capital will be used to accelerate the startup’s scale, growth and innovation of its businesses in Africa and the rest of the world.

Mawingu, a Kenyan internet service provider (ISP) focused on connecting underserved communities, secured $20 million in a Series C funding round in October. The investment was backed by Pembani Remgro Infrastructure Managers, a private equity fund focused on African infrastructure projects.

The new capital will be used to expand Mawingu’s network coverage in Kenya, helping the company move closer to its goal of providing meaningful internet access to one million East Africans by 2028. The company currently serves over 120,000 people.