Nigeria is an economy primarily driven by cash, with a limited range of credit facilities. And with this comes questions on how to generate, build, and sustain wealth, investments being one of them. However, there is no single path to investing, and the options are vast. Such as mutual funds, fixed income securities, Exchange Traded Funds (ETFs), and so on.

“Beginners usually start with the goal to become financially free and independent, but they don’t break it down to what it means for them,” said Tijesunimi Oresanya, Manager, Solution Architecture (CEMEA) at Visa. “They should define their goals from the start. For example, I want to invest long-term or short-term. This will determine your risk tolerance and the type of investments appropriate for you.”

For those considering different investment instruments and investment platforms, Oresanya highlights the need to pay attention to the details, especially the brokerage fees: “Sometimes investments come with some fees. The platform brokering for you may require a percentage for their service; beginners usually don’t factor this in when analysing an opportunity. A 1% fee over a long time can be very significant.”

What are some Nigerian investment platforms?

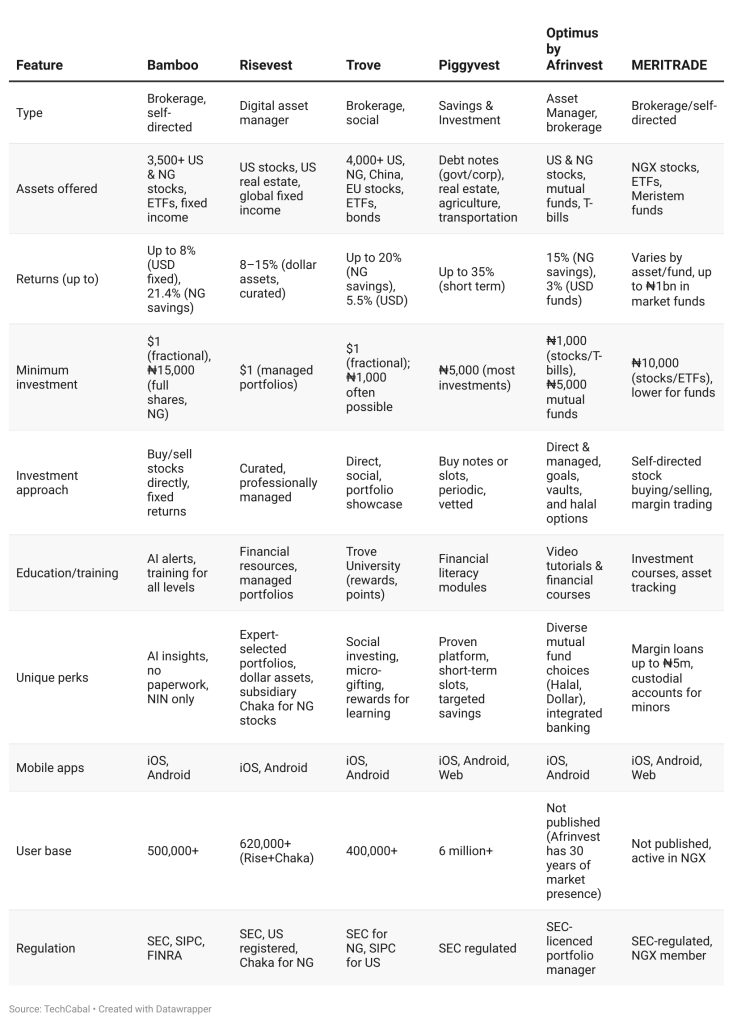

From conversations with financial advisors to recommendations from long-standing users, I pooled a list of apps you can explore if you are considering investing in the Nigerian stock market. So, whether you opt for a digital wealth manager or brokerage apps through which you can begin trading directly, here are a few you can consider in no particular order.

1. Bamboo

Bamboo offers opportunities to invest and training resources for beginners and seasoned investors seeking to learn about the investment landscape. With 3.5k+ stocks to choose from and over 500,000 users, the app leverages AI-driven market insights to alert users on investment opportunities.

The investment app also allows you to begin trading with zero paperwork, requiring only your contact details and National Identification Number (NIN). With Bamboo, you can trade stocks and ETFs, invest directly in Nigerian and US stocks, and manage your investments, all within the app. Its fixed income allows for up to 8% annual returns in USD and up to 21.4% annual returns on Naira savings.

The investment app offers the option to invest with low minimums, starting as low as $1. Bamboo’s mobile app is available to download on the App Store and the Play Store.

TL;DR: Invest in U.S and Nigerian stocks

- No Paperwork, just your NIN and contact details

- Invest with as low as $1

2. Risevest

Risevest allows you to make dollar-dominated investments in Global and U.S markets, including U.S real estate. These investments can yield returns ranging from 8% to 15%.

However, Rise is not a brokerage app, but functions as a digital wealth or asset manager. It does not offer direct trading. But rather curates and presents portfolios in US stocks, US real estate, and global fixed income assets, to balance risk and reward, while you choose how much you want to invest.

Along with curating the stocks with long-term payoffs, Rise has investment experts and professionals to manage these investments on behalf of users. Compared to other platforms, Risevest. Risevest and its subsidiary, Chaka, accumulate a customer base of 620,000 users. The app is accessible on your smartphone on the Play Store or App Store.

TL;DR: Invest in dollar-denominated assets

- Users cannot trade directly, but have their assets managed by Risevest experts

- Invest in US stocks, real estate, or global fixed income portfolios

3. Trove

Along with providing a platform to invest in over 4,000 US and Nigerian assets, Trove also offers learning resources through its product, Trove University, where you can learn about investing and earn points. You can then use your points to redeem rewards such as airtime or data, and trading fee credits.

Through microinvesting, Trove also allows you to gift shares to others, such as family and loved ones. Through leveraging the community, the app allows for social investing, where you can connect with friends within the app and explore other investors’ holdings. Trove shows breakdowns of others’ investment portfolios, including their bonds, stocks, and track records. The app has no minimum investment amount, and yields up to 20% annual returns on Nigerian savings and 5.5% on U.S. dollar savings.

The app aggregates a customer base of over 400,000 registered users. Trove is available as a mobile app on the App Store and the Play Store.

TL;DR: Social investing tools to connect with friends and seasoned investors

- Offers investment education for users to earn points and redeem rewards

- Allows low minimums to invest with as little as $1

4. Piggyvest

Originally a savings app, Piggyvest presents an array of investment options within a 6-12 month timeframe, and up to 35% returns. With their product, Investify, you can purchase ‘Corporate Debt Notes’, backed by companies with as little as ₦5,000. Or you can purchase ‘Sovereign Debt Notes’, backed by the government, with about ₦12,000 to ₦ 19,000, and are short to medium term. Piggyvest also offers pre-vetted opportunities to invest in real estate, agriculture, and even transportation.

However, some of these opportunities are available periodically and sell out quickly, so you will have to be on the lookout. Nearly 6 million people have used the app’s savings and investing platform. You can invest through the web app or the mobile app available on the App Store or the Play Store.

TL;DR: Can invest with as little as ₦5,000

- Investments are within a 6-12 month timeframe

- Pre-vetted opportunities in real estate, agriculture, and transportation

5. Optimus by Afrinvest

Through Afrinvest Asset Management Limited, a portfolio manager licensed by the SEC, you can invest in US and Nigerian stocks, mutual funds, fixed deposits, and other high-yield options. With Optimus by Afrinvest, you can invest in Nigerian stocks and treasury bills.

Optimus by Afrinvest offers investment banking, asset management, and consulting services. The app also offers a variety of mutual funds, such as the Afrinvest Halal Fund, which are Shariah-compliant. Then the Afrinvest Plutus Fund, which you can invest in with as little as 5,000, and the Afrinvest Dollar Fund for short to medium investments for dollar flows. The investment app also creates a provision for savings, all in one place. Optimus has a provision for you to invest with ₦1,000 or less and is available on the App Store or the Play Store.

TL;DR: – Invest in Nigerian stocks and treasury bills with ₦1,000 or less.

- Includes unique mutual funds like Afrinvest Halal Fund (Shariah-compliant), and Afrinvest Dollar Fund for dollar-denominated investments.

- Savings features & investment options, in one secure platform.

6. MERITRADE by Meristem

Meristem allows you to be your own broker through its online stockbroking platform, MERITRADE. That is, you can buy and sell your stocks directly. You can create an account to buy shares for yourself, or a custodial account for a minor. Meritrade allows you to track shares purchased earlier and provides technical and fundamental advice on stock recommendations.

As of February 2025, the Meristem Equity Market Fund had over ₦1 billion in assets, highlighting strong investor confidence. The app offers Margin Trading, enabling investors to borrow funds against their current holdings. New investors can access a margin loan for up to ₦3million, and existing users can take a loan for up to ₦5million. Meritrade also offers basic investment courses and is available on the App Store or the Play Store.

TL;DR: Enable investors to borrow against their current holdings to purchase shares

- Allows tracking of shares purchased long ago

- Can buy and sell stocks for minors

Users also diversify their investments to balance risk and rewards. One long-term investment app user, Lydia Oke, said, “What I’m looking to achieve with Naira investment is different from what I’m looking to achieve with dollar investments.”

At the time of this article, she decided on multiple investment platforms: Meristem for Naira investments, Bamboo for her dollar investments, and Stanbic for mutual funds, to have a diverse portfolio with respective strengths.

How can you invest in the Nigerian stock market?

To invest in the Nigerian stock market, you need to open a brokerage account. You can do so through brokerage houses such as Afrinvest, CSL by FCMB, FBNQuest, and Stanbic IBTC. You can also set up a brokerage account from your mobile device through Investment apps such as Bamboo or Piggyvest. Here are the documents usually required to set up your broker account:

- A Nigerian bank account

- Your Bank Verification Number (BVN)

- A passport photograph

- A valid means of identification. This could be your driving licence, an international passport, or a National Identification Card.

- Utility bill for proof of address.

After creating your broker account, you obtain a Central Securities Clearing System (CSCS) account to invest in the Nigerian stock market. Your brokerage house will create the CSCS account 24 to 48 hours after your documents are verified. Your CSCS account is the electronic storage location for your stocks and share certificates. After acquiring your CSCS account, fund it through your Nigerian account, and you can begin trading. You can either trade through brokerage houses or brokerage apps.

The stock market has operating hours, which are timeframes to trade. The Nigerian stock market opens by 9:30 am, and trading runs till 2:30 pm.

What investment can you start with ₦10,000?

You can purchase one unit of corporate debt notes on PiggyVest for as low as ₦5,000, and more than one unit if you choose. Risevest also allows you to invest in global markets with a minimum amount of $10 (₦14,909.77). You can also invest in Bamboo’s fixed income products with as little as $1 and earn a 7.5% dollar-denominated interest.

How can you make ₦1,000 a month investing?

With a fixed deposit investment plan, you can work out an arrangement with your bank to receive monthly returns on your investment, instead of rolling it over to the next month. However, rolling your interest to the next month allows your deposit to compound and pay in the long run.

How can you invest with ₦100?

Optimus by Afrinvest allows you to invest as low as ₦100 in mutual funds from their mobile application. Risevest and Trove allow you to microinvest and purchase fractions of shares with as low as $1 (₦1490.98).

*Exchange rates were calculated at ₦1490.98 is to $1. Please note, respective investment apps have their own exchange rates.

TechCabal is not a financial advice platform. Readers are encouraged to independently evaluate all risks and consult with qualified financial, legal, and tax professionals before making any investment decisions.

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 15–16! Meet and learn from Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Get your tickets now: moonshot.techcabal.com