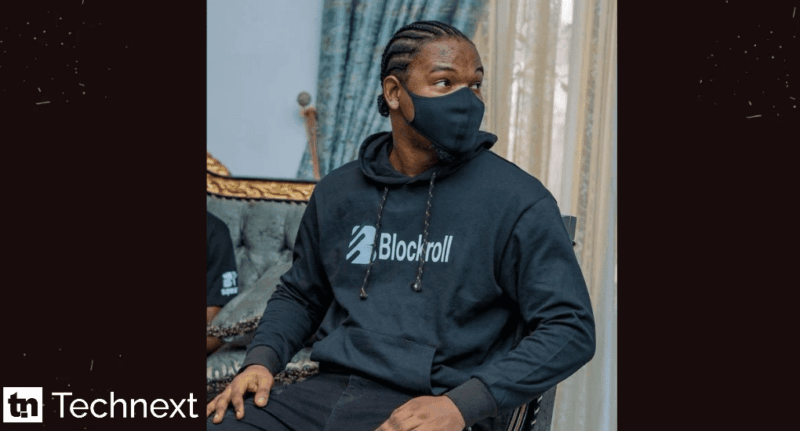

In 2022, while leading a Web3 project and educating hundreds about blockchain and NFTs, Sadiq Isiaka hit a wall that would shape the rest of his career.

The Owerri-born product manager and serial founder couldn’t find a reliable way to receive payments. International transfers were slow, expensive, and unpredictable. PayPal had frozen his funds years earlier, bank visits were frustrating marathons, and stablecoin payouts were often complex to convert into naira.

The issue wasn’t peculiar to him. Speaking to fellow founders and freelancers, Sadiq realised the pain was cutting across Nigeria and Africa: Africa’s gig workers and remote teams were losing opportunities and income to a broken cross-border payment system.

“I was having a shower one day, and it occurred to me,” Sadiq recalls. “If you can’t find a solution for this, why don’t you build one?” He recalls thinking.

That epiphany, during a shower moment in September 2022, became Blockroll, a platform that bridges blockchain technology and financial services to redefine how African freelancers and creators navigate the global gig economy.

Blockroll started as a response to an urgent operational challenge: managing grants in stablecoins and paying team members in both fiat and crypto without relying on clunky spreadsheets or risky vendors.

The idea took shape in late 2022 when Isiaka teamed up with his co-founder, Stephen Adeyemo, who is experienced in designing and building fintech products. By January 2023, they had announced the concept publicly and opened a waitlist, quickly filling it with freelancers, Web3 enthusiasts, and small business owners.

How Blockroll is solving real-world problems

Sadiq is no stranger to the challenges of building in Nigeria’s volatile tech ecosystem. A product manager with early backgrounds in User Experience Research and Technical Writing, his blockchain journey began a decade ago, though he initially dismissed it due to its association with scams.

It wasn’t until he sought a way to reward subscribers to his blog with digital coins that he dived headfirst into the world of cryptocurrencies. “I got bored with just consuming,” he says. “I wanted to create solutions, not just buy tokens someone else built.”

This drive to build rather than consume has become the cornerstone of Blockroll’s mission to empower African talent through seamless, secure, and innovative financial tools.

“For me, building stablecoin-powered solutions is about solving real-world remittance, financial, and payment challenges for Africans, not just selling crypto for the sake of it.” Sadiq Isiaka of Blockroll

This pain point inspired Blockroll, first launched officially as a web app in March 2024 after months of ideation, prototyping and private testing. The platform, whose latest version debuted as a mobile app in June 2025, offers multi-currency wallets, smart invoicing, and cards, all powered by stablecoins like USDC and USDT.

Unlike many finance solutions that leverage blockchain technology, Blockroll eliminates the need for freelancers to navigate complex wallet connections or understand gas fees.

“You don’t need to know what gas fees are to use Blockroll,” Sadiq emphasises. “Just sign up, get verified, and you’re ready to go.”

This user-centric approach has resonated with Nigeria’s growing freelance community, with the platform surpassing 1,000 users and processing nearly $100,000 in transaction volume within its first 60 days.

Nigeria’s crypto boom is not just a trend; it’s a lifeline for a country where 30% of the population remains unbanked, and even those with accounts face barriers to full financial inclusion. Blockroll capitalises on this by offering a seamless bridge between fiat and stablecoins, enabling freelancers to receive payments in Naira, USD, or cryptocurrencies without exorbitant fees or delays.

“With stablecoins, you keep 100% of what you earn,” Sadiq notes. “Unlike traditional systems where fees can eat up 15% of your income, Blockroll ensures you pay less than a dollar in transaction costs.”

The platform’s recent acceptance into the Circle Alliance Program and rollout of USDC on the Base blockchain further enhance its offerings. By covering gas fees and providing competitive conversion rates, Blockroll ensures users can move money effortlessly between ecosystems like Solana, Polygon, and Base.

“We’ve seen users move funds from the Base app to Blockroll and convert to Naira seamlessly,” Sadiq says. “That’s the flexibility we’re bringing to Africans.”

Beyond payments, Blockroll is redefining how freelancers build their brands. Features like smart invoicing allow users to send professional invoices in multiple currencies with just a few clicks, while an in-app Biohub tool lets them share portfolios and rate cards instantly.

“A thriving personal brand is key to landing high-paying gigs,” Sadiq explains. “We’re not just about payments; we’re about helping freelancers organise their work and grow their earnings.”

Navigating Nigeria’s regulatory maze

Building a crypto startup in Nigeria is not for the faint-hearted. Until recently, the regulatory environment was hostile, with bans on crypto exchanges like Binance creating uncertainty.

Sadiq recalls a pivotal moment when a potential partnership with a major Nigerian fintech collapsed upon mentioning crypto. “They said, ‘Sorry, we can’t work with a crypto startup,’ and that was it,” he recounts. Yet, with the Nigerian SEC signalling a more open stance in recent months, the tide is turning.

Blockroll has navigated this evolving space by prioritising compliance from day one. With a dedicated legal team, the platform adheres to KYC, anti-money laundering, and other regulatory requirements while partnering with licensed financial service providers.

“We ensure the problem doesn’t come from our end,” Sadiq says. This rigorous approach has allowed Blockroll to innovate without compromising user trust, positioning it as a trusted player in Nigeria’s crypto ecosystem.

A vision for Africa’s future

Sadiq’s ambitions for Blockroll extend far beyond Nigeria. Over the next five years, he envisions the platform becoming a household name for African freelancers, with plans to expand into other sub-Saharan countries facing high remittance costs and limited financial access.

“Sub-Saharan Africa has the highest remittance fees globally,” he notes. “We want to put Blockroll in the hands of every freelancer so they can receive money, grow their brand, and thrive without borders.”

Upcoming features include smarter invoicing with automated recurring payments and enhanced tools for brand building, such as integrated resume and portfolio builders.

Blockroll also plans to reintroduce virtual cards, enabling users to make global purchases with ease. “Our slogan is ‘Go borderless, be limitless,’” Sadiq says. “We’re building a full suite of financial tools so Africans can access opportunities anywhere in the world.”

Despite Nigeria’s impressive crypto adoption, Sadiq sees significant challenges in scaling the ecosystem.

“We’re still doing way less in volume compared to other regions,” he observes. “We need local infrastructure, smoother onboarding, and hybrid fiat-stablecoin systems.”

Marketing, he warns, is also a weak link. Too many Web3 products are built for existing crypto users, fighting over the same limited audience on X and Discord.

The key, he says, is to make crypto the “background technology” and market the solution as a fix for real-world problems, opening the door to partnerships with traditional media and reaching users who may not understand its technicalities but need its solutions.

“It should be about solving real-world problems for Africans, not selling crypto for crypto’s sake,” he explains.