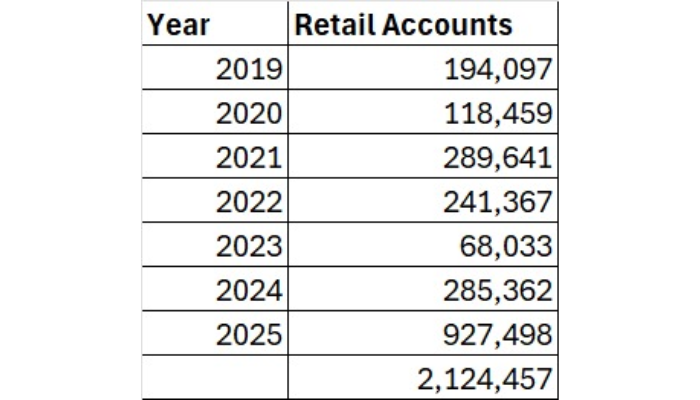

Nigeria’s stock market is witnessing renewed enthusiasm from local investors, with more than 2.124 million new retail investment accounts opened between 2019 and November 18, 2025, the strongest growth in seven years.

BusinessDay analysis shows a fluctuating but upward trend in new retail accounts. In 2019, 194,097 accounts were opened. The number dropped to 118,459 in 2020, but surged to 289,641 in 2021. Activity slowed to 241,367 in 2022 and plunged to a seven-year low of 68,033 in 2023.

However, momentum returned in 2024 with 285,362 new accounts, surging to an all-time high of 927,498 in 2025, the highest yearly onboarding in seven years.

Read also: AfDB rallies African stock exchanges to reinvent continent’s financial future

“The growth in retail participation at a time when institutional and foreign investors are slowing down shows that local investors are becoming more confident and more informed,” said David Adonri, vice chairman, Highcap Securities Limited.

Adonri, who noted that the rise in retail activity is a positive indicator of market resilience, stated that retail investors are gradually becoming a stabilising force in our market.

“It reflects the impact of technology, easier access and sustained market education.”

He said NGX has seen 12 companies leverage NGX Invest, raising over N2.3 trillion in 15 transactions.

“The success of NGX Invest underscores the transformational impact of technology on capital formation and market participation. We are not only enabling issuers to raise capital through seamless digital offerings, but we are also witnessing a fundamental shift in investor behaviour, driven by stronger market awareness, the banking recapitalisation exercise, and the ease of onboarding enabled by CSCS’s API,” said Temi Popoola, group managing director/CEO of NGX Group and chairman of Central Securities Clearing System Plc (CSCS).

He said, “Through our infrastructure, new mobile applications developed by our trading license holders are providing intuitive entry points into the market, and NGX Invest is accelerating this momentum by expanding access to public offers in a fully digital format. Importantly, we are seeing a notable rise in participation from younger investors and women, signaling a more inclusive and dynamic investment landscape.”

He also commended the Securities and Exchange Commission (SEC) for regulatory support that has enabled the digital evolution of the market.

Investor participation on Nigerian Exchange Limited (NGX) surged in the first 10 months of 2025, with total transactions climbing to N9.57 trillion, more than double the N4.47 trillion posted in the corresponding period of 2024.

Domestic investors remain the dominant force in Nigeria’s stock market, accounting for N7.54 trillion in trade in the first 10 months of 2025, up 102.4 percent from N3.73 trillion in the same period of 2024.

The recent ‘Domestic and Foreign Portfolio Participation Report’ released by NGX shows that the market recorded its strongest activity level over the period, driven by heightened interest from Pension Fund Administrators (PFAs), high-net-worth investors, and a steady rise in retail participation.

Foreign portfolio investors (FPIs) traded N2.03 trillion during the period, representing a 172.4 percent increase from the N744 billion recorded a year earlier.

The report indicates that FPIs strengthened their market share to 21.18 percent, up from 16.65 percent, while domestic investors’ share moderated to 78.82 percent from 83.35 percent.

Read also: Retail investors’ stock deals nearly double in chase for returns

Institutional investors led domestic activity with N4.6 trillion in transactions, compared with N1.8 trillion in the corresponding period of 2024. Retail investors also expanded their footprint, trading N2.9 trillion between January and October 2025, up from N1.9 trillion in the same period last year.

On capital flows, foreign inflows rose sharply to N1.12 trillion, up from N344 billion in 2024, while outflows increased to N909.54 billion from N400.04 billion.

Providing broader context, NGX noted that domestic transactions have grown by 33.15 percent over the last 18 years, from N3.56 trillion in 2007 to N4.74 trillion in 2024. Foreign transactions increased by 38.31 percent over the same period, rising from N616 billion to N852 billion. For 2025 so far, domestic activity stands at N7.54 trillion, while foreign transactions total N2.03 trillion.