Kogi State governor, Ahmed Usman Ododo, has said that his administration will resist any attempt to derail the prevailing peace and security of lives and property...

A disturbing scene unfolded on Friday outside the Manhattan courthouse where former US President Donald Trump was being tried, as a man set himself on fire...

A forex trading app could be proprietary meaning built by a forex broker and exclusively for clients of that forex broker. For example, the HFM Mobile...

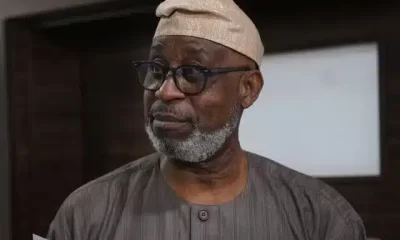

Minister of Solid Minerals Development Dele Alake has threatened to take decisive action against those involved in the illegal extraction of minerals, including uranium, in Kwande...

President Bola Tinubu has appointed Emomotimi Agama as the director general of the Securities and Exchange Commission (SEC). Ajuri Ngelale, special adviser to the president...

Nigeria and Cameroon have signed an agreement on transboundary ecosystem conservation and sustainable management of forestry and wildlife resources. At the signing of the agreement in...

President Bola Tinubu has approved the appointment of Emomotimi Agama as the Director-General of the Securities and Exchange Commission (SEC). A statement by presidential spokesman, Ajuri...

Reality star, Nina Ivy, celebrates her son’s birthday as she shares difficulties with his birth and how he was diagnosed to never walk again. The ex-BBN...

The Economic Community of West African States (ECOWAS) said it has released $9 million for humanitarian activities within the region in 2024. At a press conference...

The National Bureau of Statistics (NBS) has revealed that the average pump price of fuel rose by 153.65 per cent in March, selling for ₦696.79 against...