The Central Bank of Nigeria (CBN) has announced that Point-of-Sale (PoS) banking agents must register with only one financial institution. The new measure is part of the latest agent banking guidelines introduced by the Central Bank of Nigeria.

According to a gazette released by the CBN on Monday, titled ‘Guidelines for the Operators of Agent Banking in Nigeria,’ it explained that the move is part of the process to maintain stability in the nation’s financial system. The CBN is setting standards in a market that has witnessed a surge in PoS operators post-COVID.

“Given the expansive nature of the Agent banking ecosystem and the sophistication of Agent banking operations due to technological advancement, it became necessary for the CBN to review the regulations on Agent banking, in line with current realities,” it said.

Under the new agent-banking rule, a PoS operator must now be appointed directly by a Financial institution and is allowed to carry out Agent banking services solely for one Principal for a specified period. This means that PoS operators who have deployed the services of multiple platforms to serve their customers must now choose any of the commercial banks, non-interest Banks, payment service Banks, microfinance Banks, Mobile Money Operators or super agents.

For more clarity, the new rule says PoS operators who use a combination of two or more terminals to serve customers must now stick to one. A PoS agent using any combination of OPay, Moniepoint, Smartcash, MomoPSB, Kuda, Nomba, and Palmpay terminals must now stick to one.

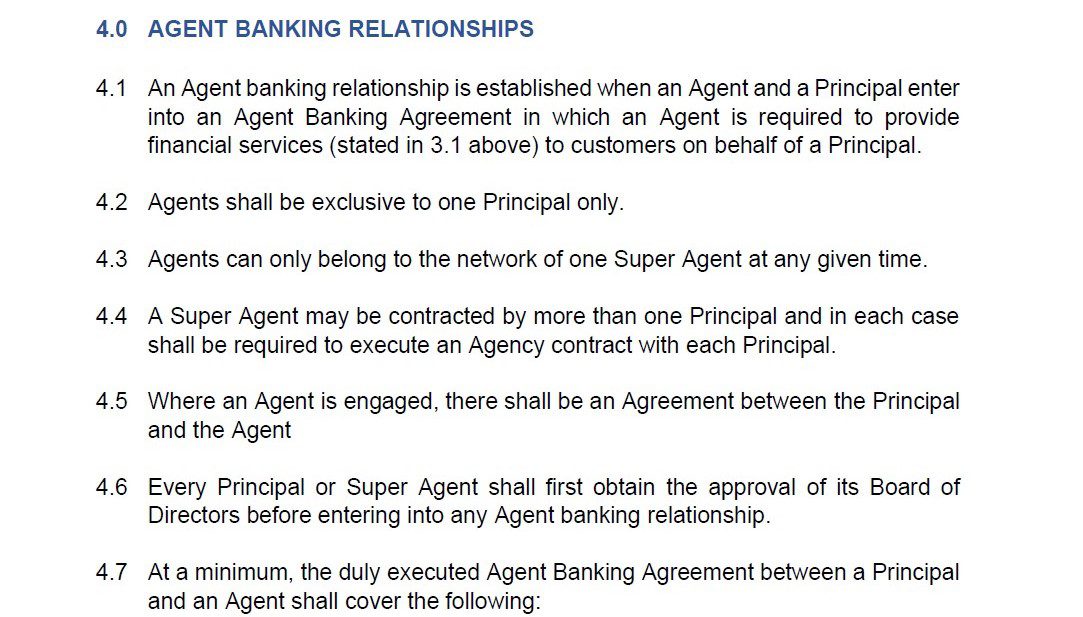

“Agents shall be exclusive to one Principal only. Agents can only belong to the network of one Super Agent at any given time,” section 4.2 and 4.3 of the document reads.

Aside from PoS operators, the guideline also mandates that every Principal or Super Agent must first obtain the approval of its Board of Directors before entering into any Agent banking relationship. However, PoS operators have from now till April 1 2026, to make this adjustment. While other regulations, such as the new daily transaction limit, are effective immediately.

The new rules come at a time when the Nigerian agent-banking industry is witnessing a surge in operators. Data from the Shared Agent Network Expansion Facility (SANEF) shows the country has over 2 million active POS terminals as of 2025, compared to fewer than 350,000 in 2019. This shows that the POS agents, super-agents, and fintech aggregators have grown into one of Africa’s largest informal financial networks.

The development also set measures to protect customers from fraud and tighten regulatory oversight in Nigeria’s rapidly expanding agent banking sector.

As part of that process, the apex bank reaffirmed a N1.2 million daily transaction cap for PoS and agent-banking operators under new operational guidelines. It also maintains a ₦100,000 daily withdrawal limit per customer and ₦500,000 weekly withdrawal cap, as stipulated in the 2024 document.

Read More: What the ₦1.2m daily POS limit means for daily banking in Nigeria.

New sanctions for PoS operators and banks

Aside from the agent-principal modalities, the CBN has introduced new sanctions across the banking agency industry. According to the guidelines, there’ll be a sanction of N20 million on PoS banking agent operators who adjust their ownership structure without obtaining regulatory approval.

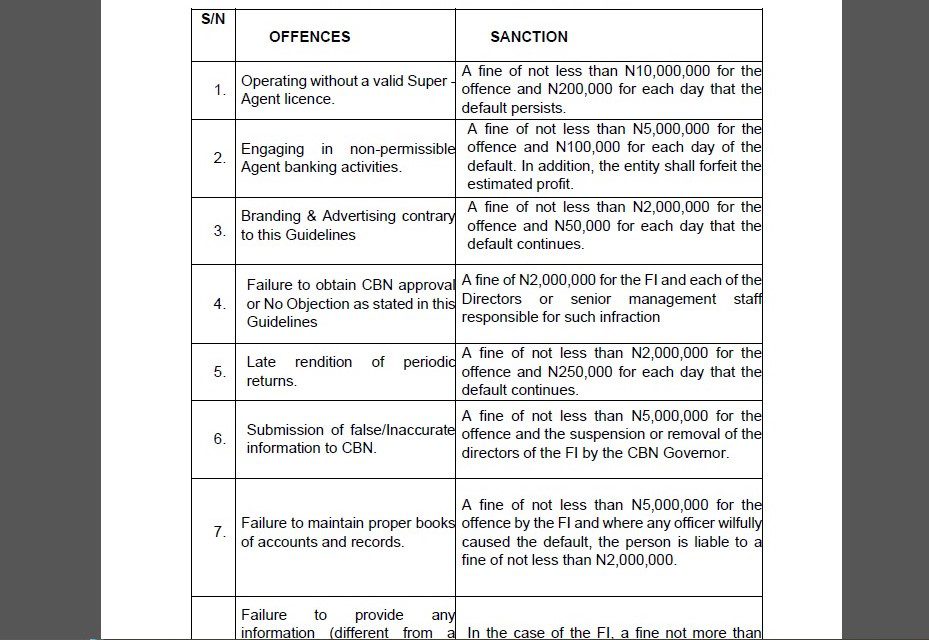

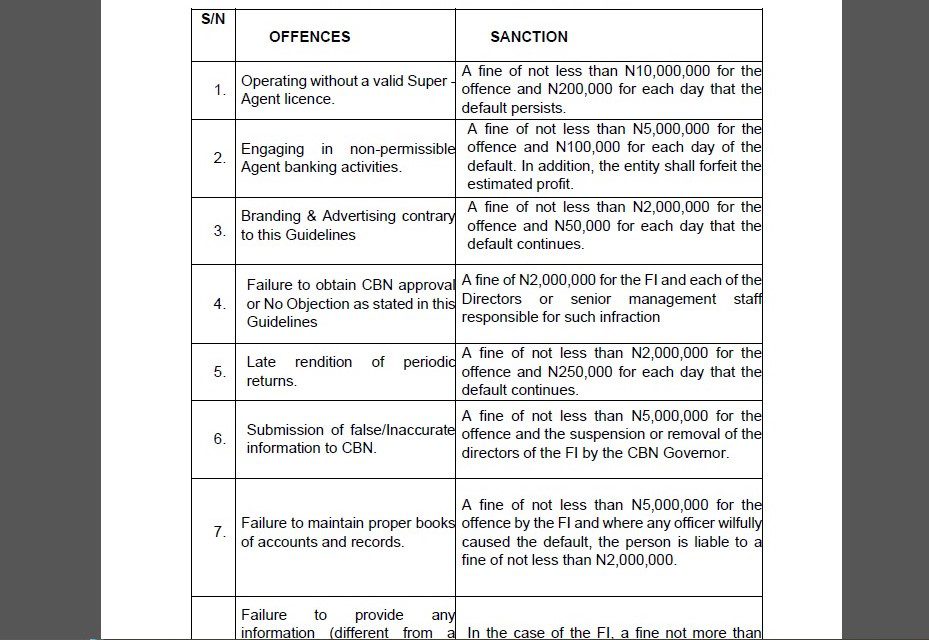

Under the revised guidelines, violators will face a minimum fine of N20 million, with an additional N500,000 penalty accruing for each day the infringement continues. The guideline itemised several offences and corresponding sanctions that apply to financial institutions and agents operating within the sector.

Some of them are:

1. Entities operating without a valid Super Agent license will be fined not less than N10 million, with an additional N200,000 for each day the violation persists.

2. Those engaged in non-permissible agent banking activities will face fines starting from N5 million, daily penalties of N100,000, and may be required to forfeit any estimated profits gained from such activities.

3. Branding and advertising practices that contravene the guidelines will attract fines of no less than N2 million and an extra N50,000 for each day the violation continues.

4. Failing to obtain CBN approval or a No Objection Letter when required will result in a N2 million fine imposed on the financial institution, with the same amount levied on each responsible director or senior management staff member.

5. Failure to maintain proper accounting records will incur a minimum fine of N5 million for the financial institution. Where the breach is deemed wilful, the responsible officer will face an additional fine of N2 million.

6. Changing a business name, corporate brand identity, or logo without the CBN’s approval or using names not previously approved will draw a fine of no less than N5 million, along with a mandatory reversion to the approved identity and a daily penalty of N100,000 for continued non-compliance.

7. Failure by principals or Super Agents to implement control measures such as geo-locking equipment used in agent banking will attract a minimum fine of N5 million, plus a daily penalty of N300,000 for the duration of non-compliance.

The CBN also mandates financial institutions to assist law enforcement agencies with investigations and prosecutions where fraud or related offences occur. Provided an agent is found to be involved, the principal institution must immediately suspend the agent pending the outcome of investigations and blacklist the agent if convicted.

The revised ‘strict’ guidelines look to build a controlled financial institution. It also aims to curb any form of unethical practices that open room for fraudulent activities.