…Constitutes 75% of tax revenues

…Surpass 2021 & 2022 combined tax earnings

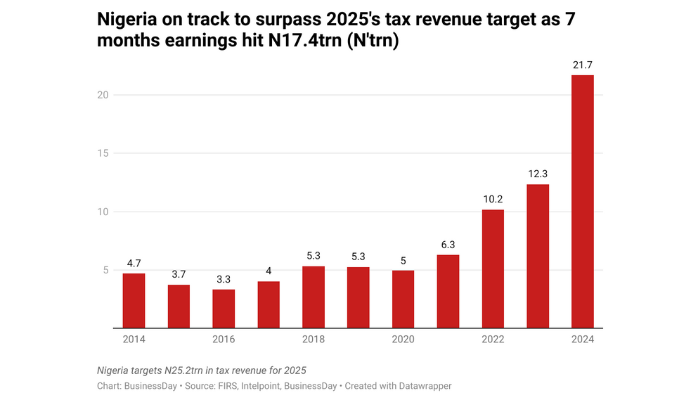

Nigeria’s push to grow revenue beyond oil is paying off as the non-oil sector drove the nation’s tax revenue to N17.4 trillion in the first seven months of 2025.

Non-oil tax revenue stood at N13.07 trillion, representing 75 percent of the total revenue (oil and non-oil) reported over the period.

The non-oil taxes saw a 23.36 percent increase from the previous year, whereas oil taxes rose 18.31 percent to N4.25 trillion over the reviewed period, according to BusinessDay’s calculations from a government document.

This means that January to July tax revenue accounted for 69 percent of the full-year target of N25.2 trillion.

Hence, Nigeria collected more taxes in the seven months to July this year than it did in 2022 and 2021 combined – when tax earnings stood at N16.5 trillion.

Analysts expect the figure to rise further, putting the country on track for its best year yet.

Why tax earnings are rising

The Federal Inland Revenue Service said the surge is driven by “effectiveness of revenue diversification initiatives, strengthened tax-compliance measures and enhanced enforcement strategies.”

That corroborates the views of Samuel Oyekanmi, research and insights lead at Abuja-based Norrenberger Financial Group, who linked the recent surge in tax revenue to a combination of expanded levies and improved compliance.

“The government has, in recent years, made tax collection efficiency a clear priority, and this is now reflected in stronger revenue performance. Notably, the significant growth in import value added tax (VAT) has also been influenced by the devaluation of the naira,” he said.

A bright spot

The non-oil sector is gradually becoming a bright spot for Nigeria’s revenue stream, especially as volatility in oil prices continues to slow Africa’s top crude producer’s biggest FX earner.

This shift became particularly evident from 2019, when the VAT rate was raised from five percent to 7.5 percent, resulting in a marked increase in VAT collections. Similarly, several additional levies have been introduced on corporates, including the Nigeria Police Trust Fund (NPTFL), the National Agency for Science and Engineering Infrastructure (NASENI) levy, and the Electronic Money Transfer Levy Regulations (EMTL), further broadening the non-oil revenue base.

“A substantial share of Nigeria’s federation revenue has been derived from non-oil sources, primarily taxes and tariffs, as the government intensifies efforts to diversify away from its longstanding dependence on oil,” said Oyekanmi.

Given the consistency of this trend, Oyekanmi sees non-oil revenue being a critical component of federation revenue in the years ahead, especially amid slowing oil prices.

Read also: Here is what Nigeria can learn from Vietnams $245n non oil export success

Oil price volatility

Oil prices have averaged $70 per barrel so far this year, which is $5 lower than the assumptions in the country’s budgetary framework. That volatility may not be ending anytime soon in what could exert pressure on the nation’s fiscal side.

Samuel Sule, chief executive officer of Renaissance Capital Africa, attributed the tax bulge to increased oil production and stable macro conditions, calling for sustained reform momentum.

“Consistency and continued implementation of current reforms should lead to an even more sustainable economy,” said Sule, who heads the Lagos-based consultancy and research firm.

More revenue means narrower fiscal deficits, which the International Monetary Fund (IMF) sees widening by 4.7 percent this year due to lower oil income.

Fiscal deficit impact

For a country that spends about half of its revenue on debt servicing with little remaining for capital investment, a growing tax income may pave the way for improved fiscal performance.

“The impact on the fiscal deficit is dependent on the utility of the gains. It does, however, mean more resources for budgetary purposes, including debt service,” Sule said.

Tax reform bills

The growing revenue data predates the implementation of new laws that are aimed at lifting the ratio of tax to gross domestic product (GDP) to 18 percent by 2030, from about 13 percent currently.

The tax act billed to begin next January is expected to unlock new revenue streams by taxing the rich more, simplifying collections, blocking all leakages, while giving respite to lower-income earners.

“The implementation of the new comprehensive Tax Act is expected to enhance monitoring and compliance further. While the Act simplifies tax payments and reduces the burden on lower-income Nigerians, it is projected that, in the medium to long term, it will become a key driver of non-oil revenue growth for the federation,” Oyekanmi said.