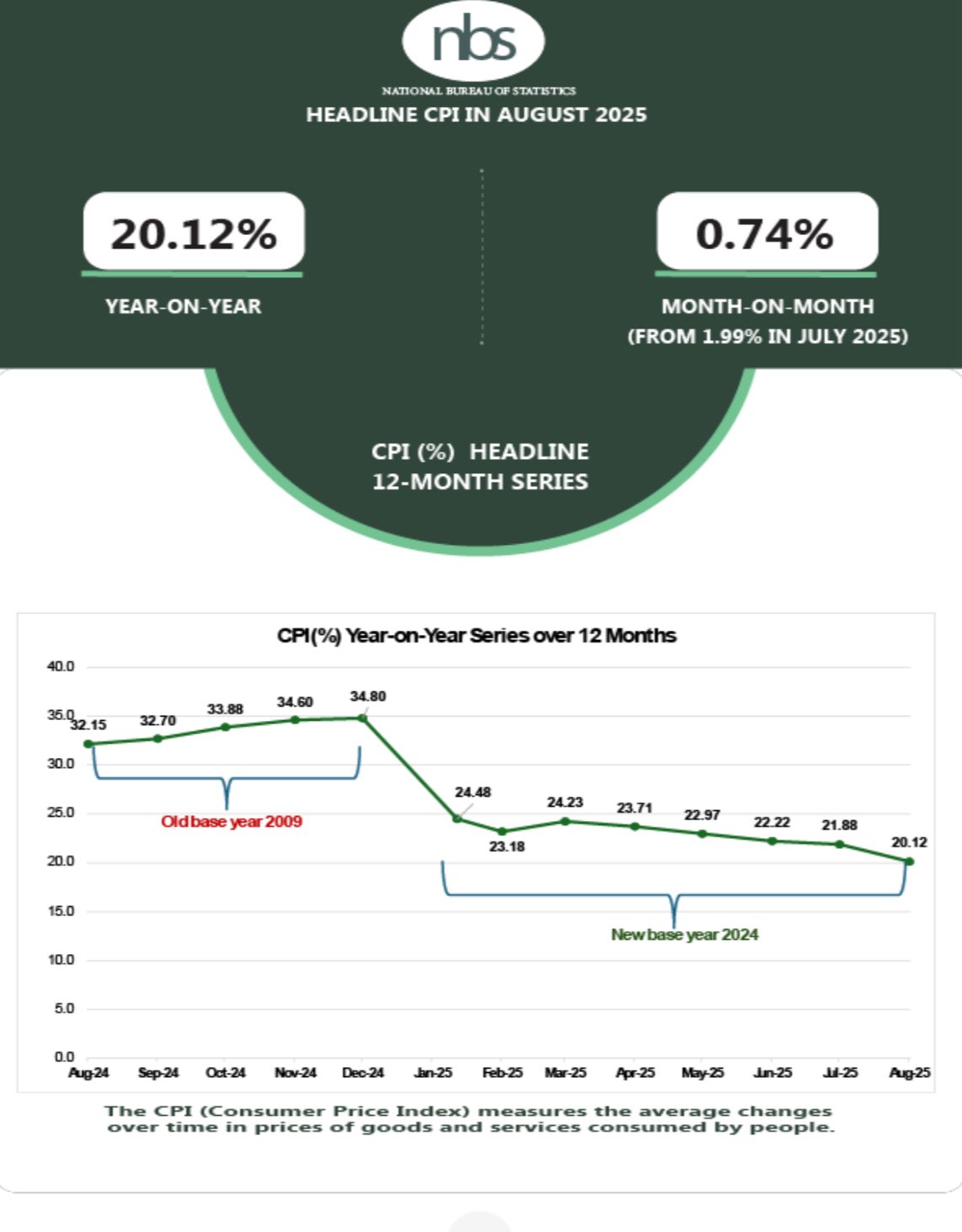

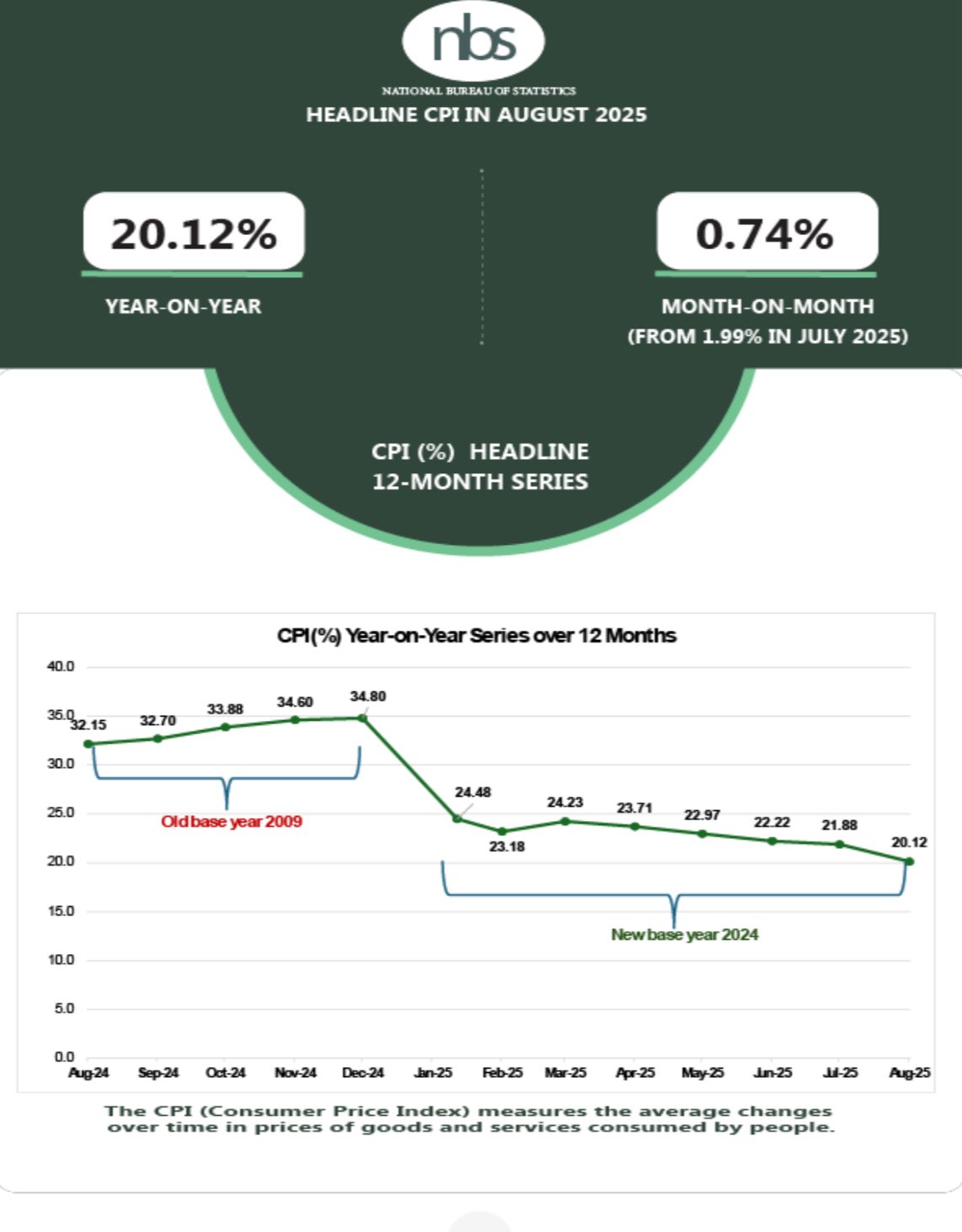

Nigeria’s inflation rate eased further in August 2025, with headline inflation dropping to 20.12% year-on-year from 21.88% in July, according to the latest Consumer Price Index (CPI) report released by the National Bureau of Statistics (NBS). While prices are still rising, the pace of increase has eased, raising cautious optimism that the economy may finally be recovering.

The report showed that on a month-to-month basis, prices rose by 0.74% in August. This was lower than the increases recorded in previous months, indicating a softer pace of price growth across goods and services. For many Nigerians who for months have endured the painful hikes in food and fuel prices, that slowdown is a welcome shift, even if the overall inflation rate remains painfully high.

Food inflation, which has consistently been the largest driver of headline inflation, also moderated slightly. Prices in this category increased by 1.65% month-on-month in August. While food costs are still rising, the slower rate of increase provides some relief for households that spend most of their income on staples such as rice, bread, and vegetables.

These numbers matter beyond just the percentages, as inflation is not just an abstract figure but plays out in daily life at the market stalls, in transportation fares, and in household bills. A modest fall from 21.88% to 20.12% may not necessarily mean prices are dropping substantially, but it does suggest that the relentless squeeze on incomes is beginning to ease ever so slightly. For workers whose wages have not kept up with the cost of living, even a slower rise in food prices can be the difference between getting by and falling short.

Possible reasons for the easing inflation

The easing trend follows months of aggressive monetary tightening by the Central Bank of Nigeria (CBN). The bank has held its benchmark interest rate at 27.5%, one of the highest in Africa, in a bid to contain inflation and stabilise the naira.

Analysts say the latest figures may reduce the immediate pressure on the CBN to raise rates further, although the headline rate remains far above the bank’s target. Yet they believe that several factors are behind the slowdown. One is the adjustment made earlier this year when the NBS rebased the Consumer Price Index, changing the way inflation is calculated to reflect newer spending patterns.

Another is the relative cooling of food price pressures after months of volatility caused by supply disruptions and high transport costs.

For the CBN, the August numbers provide some relief. The steady decline in headline inflation may reduce immediate pressure to hike interest rates further. But policymakers remain cautious. Inflation at 20% is still far above the bank’s target and one of the highest in Africa. Any fresh shock, whether from currency pressures, fuel costs, or supply disruptions, could still push inflation higher in the coming months.

For now, the moderation in August provides cautious optimism that the worst of the recent price shocks may be easing.

Compared with last year, when inflation surged above 30% following the removal of fuel subsidies and currency reforms, the latest figures represent a significant improvement. However, at 20.12%, remains among the highest in the region, and the cost of living crisis continues to weigh heavily on households.

To sustain this disinflation, economists believe it will require not just monetary tightening but also structural reforms to boost agricultural production, stabilise power supply, and ease the bottlenecks that make goods more expensive to move around the country. Without addressing these underlying issues, Nigeria risks settling into a cycle where inflation falls briefly only to surge again.

For ordinary Nigerians, however, the story of inflation is less about macroeconomic signals and more about what happens when they step into a market. A slower rise in prices means they might be able to buy a little more with the same amount of money, or at least avoid the shock of prices doubling within weeks. That modest improvement is why the August report, while not transformative, is still an important milestone.

Meanwhile, all eyes will be on whether September continues this easing trend. If month-on-month inflation stays below 1% and food price increases remain moderate, the annual headline rate could keep falling. That would bring Nigeria closer to stability after a turbulent period.

Still, for many households, the hope is that disinflation will eventually translate into something more tangible: prices that are not just rising more slowly, but a cost of living that finally feels affordable again.