When Nigeria slipped from second to sixth place in the 2025 Chainalysis Global Crypto Adoption Index, critics pounced. To them, the fall confirmed what they had long suspected: that Nigeria’s crypto dominance was little more than smoke and mirrors.

After all, how could a country battling 30% inflation, poverty, a battered naira, and limited internet access sustain the world’s highest adoption rates?

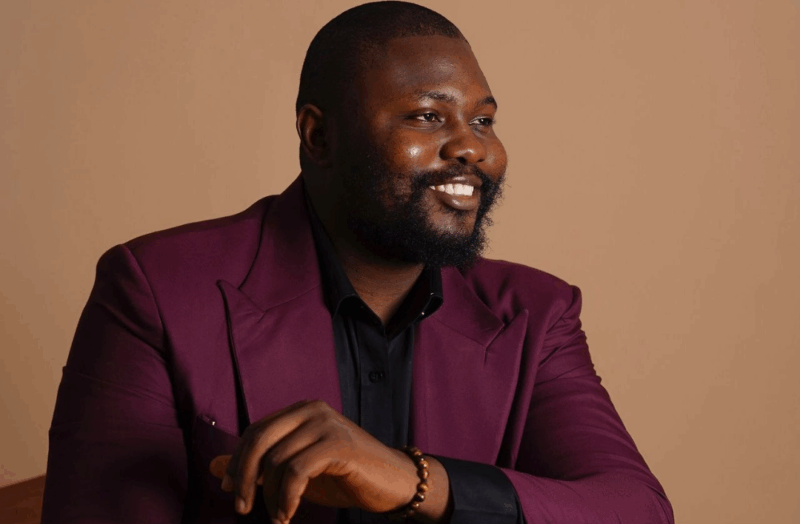

But for Emmanuel Onuoha, blockchain builder, founder of OpenWaver and Web3 Nigeria, and one of the country’s most visible Web3 advocates, the sceptics are missing the point. Nigeria’s crypto revolution, he argues, was never about rankings. It’s a lifeline.

“Crypto here is not hype,” he says flatly. “It’s survival.” It’s about survival, ingenuity, and the grassroots fire of millions of everyday Nigerians who have woven digital assets into the fabric of their lives.

Onuoha’s journey mirrors the country’s pivot into crypto. When COVID-19 lockdowns wiped out his offline businesses and dried up his coding gigs, he turned to blockchain out of necessity, not speculation.

“The main spark was the COVID-19 era,” he recalls. “I could sit in my home, work, build something, experiment. That promise of freedom was everything.”

That freedom became OpenWaver, a Web3 product development firm, and later Web3 Nigeria, a grassroots platform amplifying local builders. Five years later, Onuoha is not just a developer but a community voice, championing Nigeria’s place in the global crypto story.

The Chainalysis puzzle

The numbers raise eyebrows. Between July 2024 and June 2025, Nigerians processed $92.1 billion in on-chain value, more than half of Sub-Saharan Africa’s total. Yet in the Chainalysis ranking, Nigeria slid to sixth, behind India, the U.S., Pakistan, Vietnam, and Brazil.

Onuoha insists the data isn’t fabricated. It’s just incomplete.

“Every volume generated in Nigeria is mostly individual, normal people volume, not institutions,” he explains. “Meanwhile, in the U.S. or India, you have ETFs and institutions moving megabillions.”

In other words, Wall Street drives America’s rank; Lagos street traders drive Nigeria’s. Chainalysis’s methodology, tilting towards institutional flows, obscures that distinction.

Also Read: Nigeria fuels Sub-Saharan Africa’s $205bn crypto surge despite slip in global ranking

Crypto as a toolkit, to a trend

Look beyond the charts, and the picture sharpens. Inflation has shredded the naira, losing over 70% of its value since 2023. Forty per cent of Nigerians remain unbanked. Sending $200 in remittances through a bank costs up to 10% in fees.

Crypto patches the holes. Stablecoins power cheaper remittances. Binance’s P2P marketplace keeps naira trades alive. Wallet apps like Trust Wallet count Nigeria among their top user bases.

“Almost everyone has heard of crypto here,” Onuoha says. “Even teenagers in secondary schools are farming airdrops, writing, and doing something to make ends meet.”

And it’s not just trading. Products like Osusu (digitised market-women savings) and carding services that let corner shops convert crypto to naira are quietly reshaping everyday life.

The sceptics’ blind spots

Critics often cite Nigeria’s low GDP per capita, patchy internet, and reliance on feature phones as proof that widespread adoption is impossible. Onuoha disagrees.

“Those aren’t enough hindrances,” he says. “The strength is awareness. Nearly ninety per cent of Nigerians have heard of crypto, and almost half already own some. That’s not hype. That’s reality.”

Indeed, surveys confirm it: 46% of Nigerians own digital assets, and 90% plan to invest further, among the highest intent rates in the world.

So why the disconnect? Because outsiders measure adoption through a lens that favours big money over small miracles. “If outsiders tell our story, they’ll miss the grassroots fire,” Onuoha warns.

Why Nigeria’s web3 startups continue to struggle with VC funding while adoption surged

Here’s the paradox: Nigeria leads in usage but lags in funding. While fintech startups raised hundreds of millions in 2024, blockchain startups across the country barely scraped together $20 million.

The few exceptions, Credi’s $22 million raise and Onboard Wallet’s Coinbase backing, were powered by foreign VCs. Most local founders lack the networks to tap into that capital.

“What we need are ingrown funds,” he argues. “Without visibility, no matter what you’re building, nobody will know about it.”

To bridge the gap, Web3 Nigeria runs an “Emerging Product Spotlight”, showcasing five Nigerian-built projects every month. Still, Onuoha admits, visibility without capital is a half-win.

From crackdowns to cautious embrace

In 2021, Nigeria’s central bank banned banks from servicing crypto firms, forcing the industry underground. Four years later, the landscape looks different.

The 2025 Investments and Securities Act now recognises digital assets. The SEC has issued 19 licences. The Central Bank approved a naira-backed stablecoin (cNGN), which has proven to be a success with about 602.9 million in circulation, over 75,000 on-chain transactions and a staggering 20.1 billion total trading volume as of 15th September 2025.

Also Read: Nigeria slips to 6th as India and U.S. lead in Chainalysis 2025 Global Crypto Adoption Index

These moves mark progress, but Onuoha wants boldness. “We need a high level of governmental embrace,” he says. “Why can’t Nigeria have a national Bitcoin fund, like El Salvador?”

For him, regulation shouldn’t just restrict; it should enable. “With clarity, builders will build, institutions will invest, and adoption will deepen.”

Fighting the “Yahoo Boys” stigma

No story about Nigerian crypto escapes the fraud question. Detractors insist that scammers and “Yahoo boys” inflate the numbers. For instance, the EFC chairman recently warned that there’s a thin line between genuine crypto users and scammers, raising concerns about the growing cases of bad actors operating in the ecosystem.

Onuoha rejects that. “With blockchain, everything can be traced. Nothing is hidden,” he says.

Rather than tarring the entire ecosystem, the way forward is to spotlight utility-driven builders with visible identities. “We need more products with IRL use cases. More founders are putting their faces to what they’re building. That’s how you counter Ponzi narratives.”

Despite the hurdles, Onuoha is bullish. He believes Nigeria could be a top-three (if not top) global blockchain powerhouse by 2030, but only if three things align:

- Governmental embrace: real adoption of blockchain in public services.

- Institutional investment: Nigerian and global money backing local projects.

- Builder innovation: products solving everyday Nigerian problems.

“If those three things are in place, we’ll stay at the top,” he predicts.

For him, it’s personal. “This technology changed my life,” he says. “And for millions here, it’s not about hype. It’s about resilience.”

Beyond the rankings, Chainalysis can count volumes, but it can’t measure vitality. Nigeria may rank sixth on paper, but on the ground, it’s second to none: a nation of young people hacking inflation, market women digitising savings, and builders carving out global relevance.

“Nigeria’s crypto adoption isn’t fading,” Onuoha insists. “It’s just that our story isn’t being told right.”

And if local voices like the media and Web3 Nigeria succeed in telling it, the world may finally see Nigeria’s crypto reality for what it is: not hype, but a grassroots revolution in motion.