Nigeria’s foreign exchange reserves have surged to $41.046 billion as of August 20, 2025, marking the highest level since December 2021 and representing a significant milestone in the country’s economic recovery trajectory. This 44-month peak signals a fundamental shift in Nigeria’s external sector dynamics and carries profound implications for various stakeholders across the economic spectrum.

“Furthermore, the strong reserve position enhances Nigeria’s credit profile internationally, potentially leading to improved sovereign ratings and reduced borrowing costs. This creates a virtuous cycle where improved creditworthiness facilitates access to cheaper international financing for development projects.”

The reserve accumulation story

The current reserve level represents a remarkable turnaround from the volatility witnessed in the first half of 2025, when reserves fluctuated between $37 billion and $39 billion. The bulk of the growth has come in the last five weeks, after a relatively sluggish first half of 2025 when reserves fluctuated between $37 billion and $39 billion, demonstrating the concentrated nature of recent gains. The reserves, which can now cover approximately 10 months of imports, significantly exceed the internationally recommended benchmark of three months’ import cover. This buffer provides Nigeria with substantial protection against external shocks and enhances the country’s ability to meet its international obligations. Starting from $40.88 billion at year-end 2024, this translates to an increase of about $124 million, or 0.30 percent, for the year, with most gains concentrated in recent weeks. This pattern suggests that specific policy interventions and external factors have converged to drive this positive momentum.

Driving forces behind the surge

Several factors have contributed to this remarkable accumulation. Buoyed by increasing foreign exchange inflows into the country, the reserves have benefited from improved oil production, enhanced export earnings, and strategic Central Bank of Nigeria (CBN) policies. Nigeria’s daily average crude oil production improved by 3.6 percent month-on-month in June 2025 to 1.5 million barrels per day (mbpd), contributing significantly to export earnings. This production increase, combined with relatively stable oil prices, has provided the foundation for foreign exchange accumulation. The CBN’s policy reforms have also played a crucial role. The net reserves jumped to $23.11 billion at the end of December 2024, a significant leap from the $3.99 billion recorded at the end of 2023, indicating that structural reforms implemented by the central bank are yielding positive results.

Implications for the Federal Government

For the federal government, the $41 billion reserve level provides unprecedented fiscal space and policy flexibility. The enhanced buffer allows for more aggressive infrastructure development programmes without compromising external stability. It also strengthens Nigeria’s negotiating position with international creditors and development partners. The improved reserves position supports the government’s ability to service external debt obligations while maintaining confidence in the naira. This stability is crucial for long-term planning and enables the federal government to pursue more ambitious development projects without the constant fear of balance of payments crises. Furthermore, the strong reserve position enhances Nigeria’s credit profile internationally, potentially leading to improved sovereign ratings and reduced borrowing costs. This creates a virtuous cycle where improved creditworthiness facilitates access to cheaper international financing for development projects.

Impact on state and local governments

State and local governments stand to benefit significantly from the improved external sector stability. The stronger naira, supported by robust reserves, reduces the local currency cost of servicing any external obligations these subnational entities may have. More importantly, the stability in the foreign exchange market reduces inflationary pressures, which directly benefits state and local government budgets. Lower inflation means that budget allocations can deliver more value, enabling better service delivery to citizens. The improved external sector also attracts foreign direct investment (FDI), which often flows to states with strategic advantages. States with ports, industrial clusters, or natural resource endowments are likely to see increased foreign investor interest, translating into job creation and internally generated revenue growth.

Read also: Nigeria depletes foreign reserves by $2bn YtD to $38.88bn

Private sector transformation

The private sector emerges as perhaps the biggest winner from this development. Manufacturers who have struggled with foreign exchange scarcity for raw materials and equipment imports now have greater confidence in planning and executing expansion projects. Import-dependent businesses can now operate with more predictable exchange rates, reducing the currency risk premium they previously had to build into their pricing models. This improved predictability enhances business planning horizons and encourages medium- to long-term investments. For exporters, the stable external environment supported by strong reserves creates an enabling environment for international trade. Export financing becomes more accessible as banks gain confidence in the sustainability of foreign exchange availability. The financial services sector particularly benefits as foreign exchange intermediation becomes more efficient. Banks can now offer more competitive foreign exchange services to their customers, while the reduced volatility lowers their operational risks.

Industrial sector revitalisation

Nigeria’s manufacturing and industrial sectors, which have been constrained by foreign exchange shortages, now have the opportunity for genuine revival. The pharmaceutical industry, which relies heavily on imported active pharmaceutical ingredients, can now plan production schedules with greater certainty. The automotive assembly sector, textile industry, and other manufacturing subsectors that depend on imported machinery and raw materials can now operate more efficiently. This stability is likely to attract new investments in manufacturing, potentially reversing years of deindustrialisation. The agricultural processing industry stands to benefit significantly, as processors can now import modern equipment and technology to add value to Nigeria’s abundant agricultural produce. This development supports the federal government’s agricultural transformation agenda.

Monetary policy implications

The strengthened reserves position provides the CBN with greater latitude in monetary policy implementation. The central bank can now focus more on domestic price stability without the constant concern about external sector pressures. Interest rate policy becomes more flexible as the CBN is not forced to maintain artificially high rates solely to defend the currency. This flexibility allows for more growth-supportive monetary policy stances when macroeconomic conditions permit. The improved reserves also enhance the credibility of the CBN’s foreign exchange interventions. Market participants are more likely to respect official exchange rate signals when they are backed by substantial reserves.

Investment climate enhancement

International investors view foreign exchange reserves as a key indicator of macroeconomic stability. The $41 billion level signals to foreign investors that Nigeria has the capacity to honour repatriation guarantees and provides comfort for long-term investment commitments. Portfolio investors, who have been wary of Nigerian assets due to foreign exchange constraints, may begin to return to the market. This return of hot money flows, while requiring careful management, provides additional liquidity to the capital markets. Foreign direct investment prospects improve significantly as multinational corporations gain confidence in their ability to repatriate profits and dividends. This confidence is particularly important for investments in capital-intensive sectors like telecommunications, energy, and manufacturing.

Risk management and sustainability

While the current reserve level is impressive, sustainability requires continued focus on structural reforms. The concentration of recent gains in just five weeks suggests that the improvement may be sensitive to short-term factors that could reverse. Maintaining this level requires sustained oil production improvements, continued fiscal discipline, and structural reforms that enhance the economy’s foreign exchange earning capacity. Diversification of export earnings beyond oil remains crucial for long-term sustainability. The CBN must also manage the reserves judiciously, avoiding the temptation to use them for discretionary interventions that do not address fundamental supply and demand imbalances in the foreign exchange market.

Conclusion: A foundation for transformation

Nigeria’s foreign reserves reaching $41 billion represent more than just a statistical achievement; they provide the foundation for comprehensive economic transformation. The federal government offers fiscal space and policy flexibility. For states and local governments, it promises stability and reduced inflationary pressures. For the private sector and industries, it delivers the predictability and confidence necessary for investment and growth. However, this achievement must be viewed as a beginning rather than an end. The true test lies in sustaining these gains while leveraging the improved external position to drive structural transformation of the economy. Success in this endeavour will determine whether this reserve accumulation becomes a footnote in Nigeria’s economic history or the foundation stone of a new era of sustained prosperity. The stakeholders across all tiers of government, private sector players, and industrial operators must now align their strategies to maximise the opportunities presented by this improved external sector stability. The window of opportunity is open, but it requires deliberate action to ensure that this positive momentum translates into tangible improvements in the lives of ordinary Nigerians.

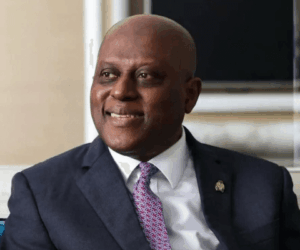

Dr. Oluyemi Adeosun, Chief Economist, BusinessDay Media