The Personal Income Tax Calculator, accessible via a QR code or by following this link, emerges at a time when Nigeria is grappling with economic challenges, including low revenue generation, a heavy reliance on oil, and the need to broaden its tax base.

It comes amid the nation’s ambitious tax reform agenda, spearheaded by the Presidential Committee on Fiscal Policy and Tax Reforms, chaired by Taiwo Oyedele. In 2023, President Bola Ahmed Tinubu established this committee to overhaul the nation’s fragmented tax system, aiming to simplify compliance, enhance revenue mobilization, and reduce the tax burden on low-income earners.

The Nigeria Tax Bill, one of four proposed reform bills, consolidates various tax laws, including the Personal Income Tax Act, Companies Income Tax Act, and others, into a unified framework. A key focus of the bill is reforming PIT to make it more equitable and progressive, exempting low-income earners while ensuring higher earners contribute more fairly.

The calculator’s primary goal is to demystify these changes by offering a user-friendly way to estimate tax liabilities under the existing system versus the proposed framework.

Functionality and user experience

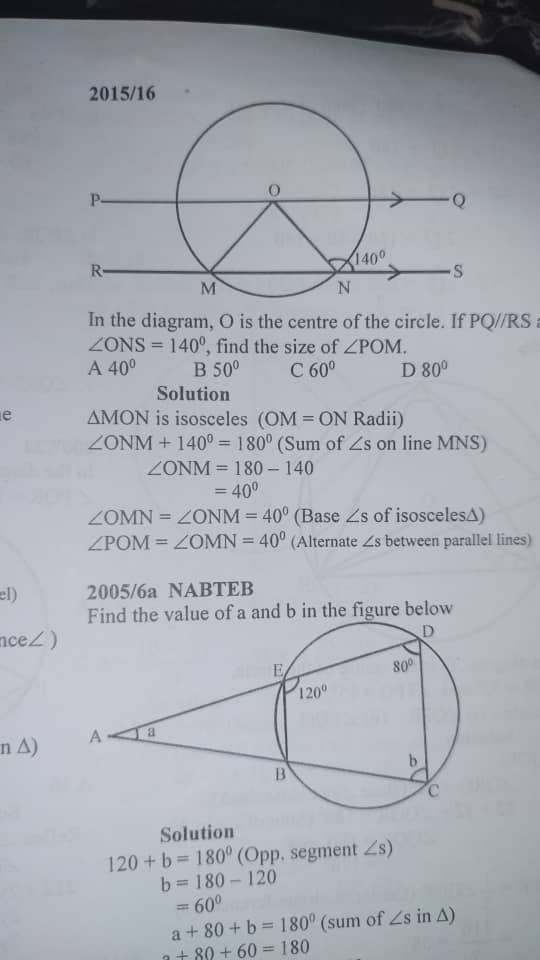

The Personal Income Tax Calculator is designed for accessibility and ease of use. Users are prompted to enter their annual or monthly income, after which the tool calculates the tax due under the current PITA rates and the proposed Nigeria Tax Bill rates. This comparative approach is valuable because tax reforms often involve complex changes to income bands, rates, and reliefs.

For example, the current PIT system in Nigeria, governed by the Personal Income Tax Act (PITA) of 1993 (as amended), features progressive tax rates ranging from 7% to 24%, with a tax-free allowance of ₦200,000 plus 20% of earned income. It then increases to 7% on the first ₦300,000, 11% on the next ₦300,000, 15% on the next ₦500,000, 19% on the next ₦1.6 million, and 24% above ₦3.2 million. Tax-deductible contributions, like pensions (7.5-8% of income) and National Housing Fund (NHF) payments (2.5%), reduce taxable income.

The proposed Nigeria Tax Bill shifts this structure. It reportedly exempts incomes below ₦800,000 annually (₦66,667 monthly), raising the tax-free threshold significantly. For higher earners, rates may climb to 25% on incomes exceeding ₦50 million (₦4.17 million monthly), reflecting a steeper progressive curve.

The calculator uses these frameworks to compute and compare tax liabilities, offering insights into potential relief for low earners (e.g., zero tax for ₦600,000 annually) or increased burdens for the wealthy (e.g., higher tax on ₦60 million).

Step-by-step guide to using the calculator

Access: Visit bit.ly/PITCalculatorNg or scan the QR code from official sources using a smartphone or device.

Enter Income: Input your annual or monthly earned income (e.g., salary), excluding non-taxable amounts unless specified.

Adjust for Deductions: If prompted, add pension or NHF contributions; otherwise, subtract these manually before entering your income.

Calculate: Submit your data to view tax due under current PITA rates and the proposed bill side-by-side.

Review: Analyze the results to see how reforms might affect you—e.g., tax elimination for low incomes or increases for high earners.

Relevance to Nigerian taxpayers

Nigeria’s tax-to-GDP ratio, historically one of the lowest globally at around 6-8%, underscores the need for reform. The government aims to increase revenue to fund infrastructure, healthcare, and education, but this often raises concerns about overburdening citizens, especially low- and middle-income earners.

The calculator addresses this by offering a personalized lens into the reforms. For instance, if the proposed bill raises the tax-free threshold or lowers rates for lower earners, a common feature in progressive tax proposals, it could reassure struggling households.

Strengths of the Calculator

- Accessibility: Requiring only a QR code scan or a short URL, the tool is designed for ease of use, catering to Nigeria’s growing smartphone population.

- Transparency: By presenting side-by-side comparisons, it fosters trust and encourages informed debate about the tax bill.

- Educational Value: For a populace unfamiliar with tax mechanics, this tool doubles as a learning resource, highlighting how income, deductions, and rates interact.

Limitations and areas for improvement

However, the calculator is not without potential flaws. First, its accuracy depends on the data it incorporates. If the Nigeria Tax Bill’s details are still evolving (as tax legislation often does), the tool risks presenting outdated or speculative figures. Second, its scope appears limited to personal income tax, excluding other taxes (e.g., VAT or company income tax) that might also change under the reform package, potentially giving users an incomplete picture. Third, the reliance on user inputs assumes a level of financial literacy, knowing one’s exact income or deductible contributions, that not all Nigerians possess, particularly in the informal sector, which employs over 80% of the workforce.

The calculator reflects a broader push for digital tools in tax administration, following examples like Deloitte’s Nigeria Income Tax Calculator and SMEPayroll’s PAYE Calculator. However, the reforms, and by extension, the calculator, face challenges. Nigeria’s history of tax evasion, especially among high-net-worth individuals, and resistance to centralized tax administration could undermine the bill’s success.

By equipping citizens with this calculator, the government signals an intent to involve them in the process, countering narratives of top-down imposition. Yet, its success hinges on public awareness and adoption, areas where Nigeria has historically struggled due to poor communication and infrastructure gaps.

3 hours ago

15

3 hours ago

15

English (US) ·

English (US) ·