Nigeria and South Africa are poised to exit a global financial watchdog’s “gray list” as soon as next month, marking a change in fortune for two of the continent’s biggest economies.

The two nations were put under heightened scrutiny by the Financial Action Task Force in February 2023 for shortcomings in tackling illicit financial flows. Assessors from the Paris-based FATF conducted on-site visits in recent weeks and subsequent feedback on the action plans for those countries — as well as for Burkina Faso and Mozambique — noted significant progress, according to people familiar with the matter who asked not to be identified as the deliberations are private.

The watchdog’s recommendations are closely tracked by global investors who’re wary of conducting business in places found to be deficient in anti-money laundering regulations.

All four countries are expected to come off the list on Oct. 24, the final day of an FATF plenary in the French capital, the people said. No final decisions have been made. Listings are determined based on a consensus among the group’s membership, which includes the US, UK, European Commission, China, Japan and India.

Nigeria and South Africa exiting the list “would certainly be good for sentiment,” said Lauren van Biljon, senior portfolio manager at Allspring Global Investments UK Ltd.

“It would be confirmation that the reforms and measures put in place in the wake of the gray listing are both significant and sticky,” she said. The direct market impact may be fairly modest though a short-term lift in asset prices is possible, Van Biljon said.

Countries added to the list require closer monitoring, and the designation may cast serious doubt over the integrity of their financial systems.

A 2021 report by the International Monetary Fund found gray-listed countries experienced “a large and statistically significant reduction in capital inflows.”

South Africa’s National Treasury said it would comment after the FATF makes its decision public next month. It also referred Bloomberg to a statement issued in July after the FATF’s on-site visit in which it said South Africa had substantially completed all 22 action items required to be removed from the list.

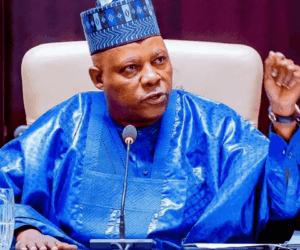

“We are excited” about the ramifications of Nigeria being removed from the list, said government spokesman Temitope Ajayi. It would be “a culmination of the remarkable work the government is doing in fulfilling our global obligations and making Nigeria more attractive to investors,” Ajayi said.

Mozambique has completed the 26 actions needed to be delisted, said Luís Abel Cezerilo, national coordinator for the country’s removal from the gray list.

“We expect a good result, but we don’t know — we need to wait,” he said by phone on Monday. The country’s removal from the list would come at a crucial time, just as TotalEnergies SE is anticipated to resume its $20 billion natural gas export project, Cezerilo said.

Madi Tapsoba, an official with the Inter-Governmental Action Group against Money Laundering in West Africa, said Burkina Faso has implemented all 37 measures needed to exit the list. A finance ministry official and a government spokesman didn’t respond to calls and text messages seeking comment.

A spokesperson for the FATF declined to comment.

Under the presidency of Mexican official Elisa de Anda Madrazo, the FATF has revamped its gray-listing criteria. It has placed a greater emphasis on scrutinizing the body’s wealthiest members, while putting less of a focus on jurisdictions classified as least-developed countries, which typically pose a lower systemic risk.

Apart from setting standards on countering money laundering and terrorist financing, the group also conducts research to inform best practices on emerging issues, from virtual assets to sextortion.