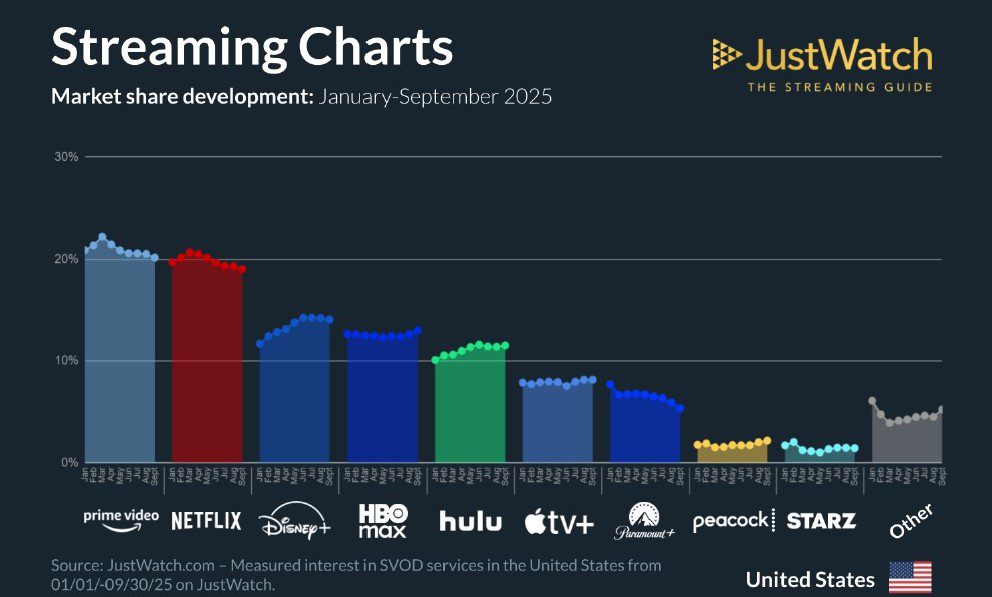

Video streaming giants Netflix, alongside Amazon’s Prime Video, have both witnessed a 1% point decline in their market share on a quarter-on-quarter (QoQ) basis. While both still maintain dominance in the Q3 2025 report, the development reflects a growing catch-up from other streaming platforms.

According to a report released by the global streaming search engine company JustWatch, as seen by Technext, Netflix and Prime Video are facing a threat to their market share from platforms such as Disney+, HBO Max, and Hulu in the subscription video on demand (SVOD) market.

These companies are closing in the gap on the long-time leaders in a U.S. market of 20 million monthly users.

Aside from the QoQ slip, both Netflix and Prime Video also lost 2% points year-on-year (YoY) in Q3 2025. This is also a continuous decline in a market that has witnessed increasing growth of other streaming platforms across the North America region, most especially in the U.S. and Canada.

However, Netflix and Prime Video still maintain their top spots amid threats to their dominance in the U.S. Netflix maintains second spot with 19% market share, while Prime Video holds the number one spot with a 20% share.

For the sake of perfect market competition, the development might be a win-win. After years of dominance, the U.S. streaming landscape is becoming more competitive than ever. For instance, Disney+, with 14% share, stands as the strongest contender, gaining 2% points YoY.

Also, HBO Max holds 13% of the market with a 1% point gain QoQ, and Hulu follows with 11%, gaining 1% YoY.

See the ranking below:

- Prime Video – 20%

- Netflix – 19%

- Disney+ – 14%

- HBO Max – 13%

- Hulu – 11%

- Apple TV – 8%

- Paramount – 6%

- Peacock Premium – 2%

- Starz – 1%

- Others – 6%

According to JustWatch, the market shares are calculated based on user engagement on its platforms: website, TV, and mobile apps. The company possesses 40 million monthly users across 140 countries.

“User interest in the U.S. is measured by adding movies or TV shows to their watchlist, clicking out to a streaming service or filtering multiple streaming services and marking titles as ‘seen’,” it added.

Also Read: Netflix shares dip as American users cancel subscriptions amid transgender movie row.

Netflix is in another mixed environment

For the streaming giant, the dominance threat is gaining momentum.

Netflix has seen its popularity drop in Africa following a series of price adjustments across the region. For instance, the company introduced a 21.4% increase to its premium monthly subscription plan in Nigeria in June. South Africa subscribers also witnessed a 13% to 20% price hike in April.

Additionally, the growing influence of YouTube and Reels on Facebook, Instagram, and TikTok is diverting users’ attention. When Netflix stopped reporting subscriber numbers, experts claimed that Netflix made the change due to its declining subscriber growth rate, even though it ended 2024 with a 302 million subscriber base.

However, the threat is spreading in the United States.

Earlier this month, Netflix dipped in investors’ confidence and suffered public criticisms. The company’s shares dipped by 31% to trade around $1,167 per share, after Elon Musk supported the trending boycott of the platform amid its transgender movie row.

Amid that wave and the social media #CancelNetflix, some Americans cancelled their subscription and backed out. The movie featured a main character who is openly transgender, with many arguing that the content was not suitable for kids.

Netflix will find alternative ways around these issues and restore its hold. Thus, the streaming giant is set to make a statement and expand its video streaming offerings for its users by bidding to stream the UEFA Champions League.

Netflix is not new to live streaming events. The platform’s early ventures into live sports have shown promise as the company streamed an NFL game on Christmas Day and drew strong viewership for the Mike Tyson–Jake Paul bout. It also holds exclusive rights to the 2027 and 2031 Women’s World Cups.