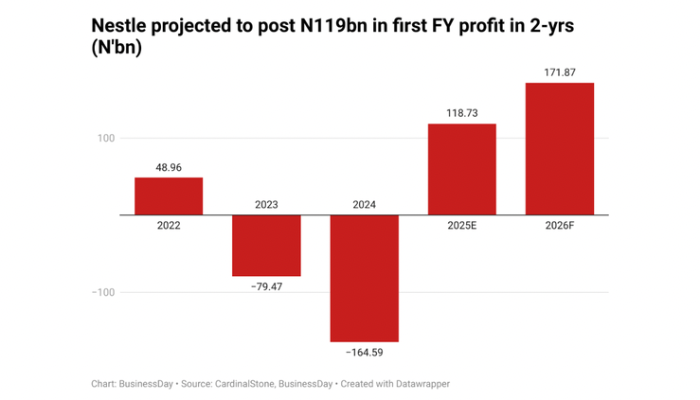

Nestle Nigeria Plc is estimated to rebound in the full year of 2025 after enduring two years of consecutive losses, driven by chronic naira volatility and sky-high inflation that have plunged earnings.

The subsidiary of the Swiss-headquartered consumer brand in Nigeria is projected to record a net income of N118.73 billion, reversing the N164.59 billion loss it reported last year, according to an estimate by Lagos-based consultancy and advisory firm CardinalStone.

That would be the highest profit ever posted by the country in more than a decade, even as turnover is also expected to rise to N1.23 trillion from N958.58 billion it recorded last year, buoyed by slight price adjustments, moderating inflation, and increasing consumer demand.

Consumer goods firms are leveraging on the rare stability of the naira, that’s hovered around the N1,500/1550 range for the past seven months, a condition that’s brought predictability and confidence to firms, especially those exposed to foreign exchange.

A slowing inflationary pressure that has decelerated for the fourth consecutive month to 21.88 percent in July meant a likely increased consumer demand for its core products popular in households, supporting the projected profitability milestone.

Read also: Nestlé Nigeria extends turnaround with N50.6bn H1 profit

Strong H1 earnings bode well for a return to profitability

Nestlé Nigeria Plc extended its rebound streak for a third straight quarter, posting a net profit of N50.6 billion in the first half of 2025, a sharp reversal from a N176.6 billion loss a year earlier, as the food giant capitalised on rising sales and a more stable macroeconomic backdrop.

Revenue surged 43 percent year-on-year to N581.1 billion, driven by resilient consumer demand and price adjustments, the company said in an unaudited financial statement released Tuesday.

Operating profit more than doubled to N130.4 billion, while profit before tax climbed to N88.4 billion, swinging from a N252.5 billion pre-tax loss in the same period of 2024.

The results mark a continuation of Nestlé’s recovery that began in the final quarter of last year, after the company was battered by foreign exchange losses stemming from the naira’s devaluation and broader macro instability.

“The robust topline growth of 43% and profit after tax of N50.6 billion in H1 2025 support our return to profitability,” said CEO Wassim Elhusseini. “This performance reflects our unwavering commitment to operational excellence… and the dedication of our team to drive sustainable growth in the face of evolving challenges.”

Nestlé also reported an equity improvement of N50.6 billion, aided by an early repayment of a $20 million inter-group foreign currency loan in the second quarter—a move analysts say likely helped reduce FX-related risks in a still-volatile monetary environment.

The company, known for brands such as Milo and Maggi, has been under pressure to navigate rising input costs, shifting consumer preferences, and Nigeria’s fragile recovery from a currency crisis that more than halved the naira’s value last year.

Still, Nestlé’s latest results suggest growing resilience. Its margin improvement and cost discipline are expected to help sustain earnings momentum through the second half, barring further macro shocks.

Looking ahead, Elhusseini said Nestlé will maintain its focus on “margin management” and innovation while continuing investments in community programs that “create sustainable value” for stakeholders.

Nestle offered over 100% returns YTD

Nestlé Nigeria has offered over 100 percent returns to investors between January till date as shares of the Lagos-based food giant closed at N1,870 on Wednesday, September 2025.

Nestle began the year with a share price of 875.00 NGN and has since gained 114 percent on that price valuation, ranking it 37th on the NGX in terms of year-to-date performance.

The stock is the 111th most traded stock on the Nigerian bourse over the past three months (Jun 3 – Sep 3, 2025). It has traded a total volume of 10.3 million shares—in 8,317 deals—valued at N16.7 billion over the period, with an average of 163,171 traded shares per session.