1

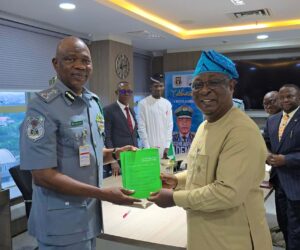

L-R: Director-General of the Infrastructure Concession Regulatory Commission, Jobson Ewalefoh; Partner & Africa Head of Infrastructure KPMG, Dimeji Salaudeen and Chief Executive Officer, APM Terminals Nigeria, Frederik Klinke at the end of the CEO Roundtable session on The Future of Infrastructure Funding at the Nigerian Economic Summit in Abuja on Wednesday.

APM Terminals Nigeria has highlighted continuity and consistency in policy regulations as key to providing an enabling environment for foreign investment to flow into Nigeria. This was highlighted by the Chief Executive Officer of APM Terminals Nigeria, Frederik Klinke, at the 31st annual Nigerian Economic Summit which concluded in Abuja on Wednesday.

The summit had the theme, The Reform Imperative: Building a Prosperous and Inclusive Nigeria by 2030.

At a CEO Roundtable panel discussion on the Future of Infrastructure Funding in Nigeria, Klinke described Nigeria’s inclusion in every global investor’s portfolio as crucial to their long-term strategy for Africa.

He said, “What investors are concerned about is long term predictability; there must be policies in place that would not change. There is a lot of positivity around the reforms being taken by the government. However, there has to be the right regulatory environment for predictability that guarantees that the rules will not change.

“The same goes for the commercial terms of these investments. When you operate in a volatile inflation and forex environment like Nigeria, investors understand that but there has to be assurance that the regulation in place allows for such volatility by enabling investors to adjust tariffs when inflation runs high. If that is not in place, that it becomes a huge hindrance to business.”

Other panelists who shared their recommendations on the topic include Executive Director, InfraCredit, Daniel Mueller; Director-General, Nigeria Country Office, Africa Development Bank, Abdul Kamara; and Chief Executive Officer, ARM-Harith Infrastructure Investments Limited, Rachel More-Oshodi.

Earlier, Nigeria’s Vice President, His Excellency, Kashim Shettima, during the opening ceremony had assured delegates to the summit that while Nigeria’s challenges were daunting, they were not insurmountable.

L -R: Chief Executive Officer, ARM-Harith Infrastructure Investments Limited, Rachell More-Oshodi; and Chief Executive Officer, APM Terminals Nigeria, Frederik Klinke. at the CEO Roundtable session on The Future of Infrastructure Funding at the Nigerian Economic Summit in Abuja on Wednesday.

He said, “Every reform we have introduced has emerged from deep reflection and the courage to act in the interest of the nation. Our ticket to achieve inclusive and lasting prosperity is our series of sound policies, strong partnerships and the commitment of the private sector. This is why we must use this platform to develop actionable recommendations to drive sustainable growth and strengthen our nation’s resilience. The government is ready to receive and implement recommendations that will emerge from your deliberations through the relevant MDAs. We will industrialise Nigeria through power, logistics and technology.”

Director-General of the Infrastructure Concession Regulatory Commission, Jobson Ewalefoh, described as unanimous the reality that political risk was Nigeria’s biggest hindrance to investors.

He said, “The discussion before us goes beyond the funding of physical assets. Our infrastructure gap represents a significant challenge and transformative opportunity. Public resources can no longer support the transformation we envisage. This is exactly where ICRC serves as a catalyst; to regulate and oversee PPE projects.

“As a country, we cannot run away from the fact that we have an infrastructure challenge. This is what we are trying to do differently at ICRC; we are trying to create solutions for the problems. We have begun this by streamlining the BPE process. Lots of people want to invest in Nigeria. Nigeria is open for business and the ICRC is available to guide investors.”