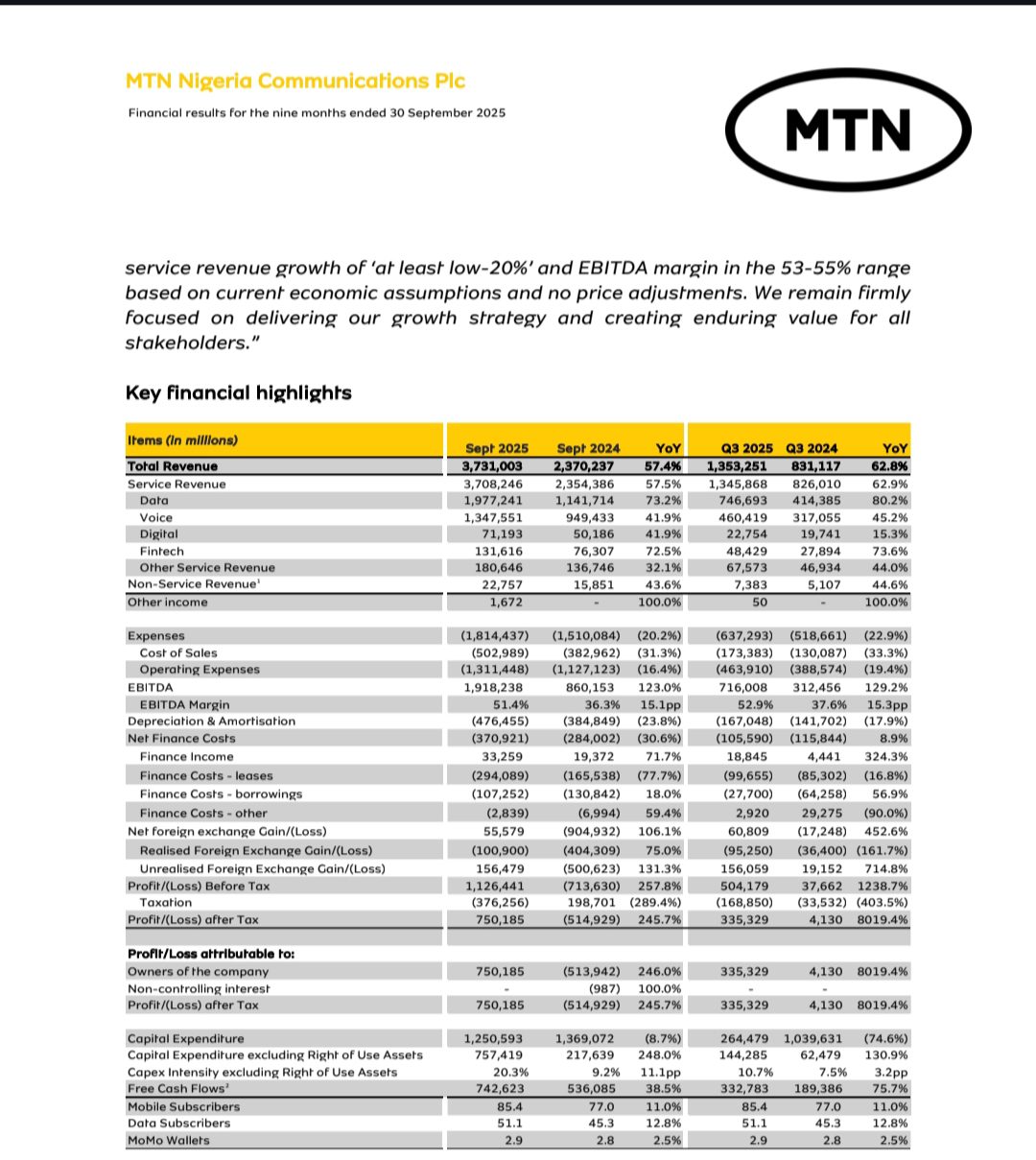

MTN Nigeria has delivered one of the most dramatic financial recoveries in the Nigerian telecoms space. For the nine months ending September 2025, the company reported a profit after tax (PAT) of ₦750.19 billion, a swing of +245.7 dividend% year-on-year from a ₦514.9 billion loss in the same period of 2024. This sharp reversal confirms its return to profitability and clears the path for resumed dividend payments.

The result also marks a restoration of positive retained earnings (₦142.7 billion) and shareholders’ equity (₦293.1 billion), reversing negative balances held just months ago. Following this, the Board approved an interim dividend of ₦5.00 per share, a meaningful signal of confidence to investors after years of suspended payouts.

What is behind this rebound? A few key drivers stand out.

First, topline revenue growth was strong and broad-based. Service revenue, the core telecom business, jumped by 57.5% year-on-year. Within that, data revenue surged 73.2%, reflecting robust usage growth, price adjustments, and rising smartphone penetration.

Voice revenue also grew 41.9%, aided by the expanding subscriber base and moderate tariff increases. Other segments also contributed, with fintech revenue rising 72.5%, digital services increasing 41.9%, and non-service revenue nearly doubling to 43.6%.

Underlying these revenue lifts was a rebound in volume and adoption. The total subscriber base climbed 11.0% to 85.4 million, while active data users rose 12.8% to 51.1 million.

Data traffic expanded by 36.3%, and average usage per user increased by 20.8% to 13.2 GB per month. Smartphone penetration now stands at about 65.1%, enabling richer service uptake.

On the network investment side, MTN deployed ₦757.4 billion in capex (excluding right-of-use), up sharply from ₦217.6 billion a year earlier. The expansion of fibre, fixed-wireless access (FWA), and network capacity is intended to sustain quality and support future growth.

On the cost side, the company managed to contain expense pressures. Operating expenses grew by only ~16.4%, while cost of sales (network costs, etc.) increased ~31.3%. Efficiency gains came from renegotiated tower leases and broader cost discipline.

The EBITDA (earnings before interest, tax, depreciation and amortisation) more than doubled (+123%) to ₦1.92 trillion, and the EBITDA margin widened by 15.1 percentage points to 51.4%.

Perhaps most dramatically, MTN moved from a huge net foreign exchange loss of ₦904.9 billion in 9 months of 2024 to a net forex gain of ₦55.6 billion in 2025. This reversal reflects a more favourable naira outlook, improved forex liquidity, and disciplined financial management.

Net finance costs still rose (~30.6% favourable) due to higher leases and borrowing costs, but these were offset by the forex gains and stronger earnings. Free cash flow grew 38.5% to ₦742.6 billion, even amid elevated capex spending.

0% spending. On the macro front, the naira strengthened (moving from ~₦1,535 to ~₦1,475 per dollar), and inflation cooled (from ~34.8% to ~18%) in the period, easing cost pressures. The Central Bank also trimmed the Monetary Policy Rate to 27%, which helped ease interest burdens. These broad conditions gave MTN more headroom to manage its cost base and benefit from favourable currency movements.

MTN Nigeria projects continued growth beyond 2026

MTN’s management has reiterated its guidance for the rest of 2025, expecting capex intensity to moderate, which should further fuel free cash flow generation. For 2026 onwards, the company targets service revenue growth of “at least low-20%” and EBITDA margins of 53–55%, assuming stable economic conditions and no further price shocks.

Yet risks remain. Currency volatility is perhaps the most glaring. A renewed devaluation of the naira could erode gains rapidly. Dollar-indexed contracts, such as tower leases, imported equipment, and debt, continue to expose MTN. In past years, forex losses have wiped out operating gains.

Interest rate shocks and higher borrowing costs are also a threat, especially given the company’s heavy capital expenditure commitments. And as network expansion continues, ensuring returns on that investment will be crucial. In the highly competitive Nigerian telecoms space, sustaining subscriber growth and ARPU (average revenue per user) gains will also test management’s execution discipline.

Still, this near-term performance is impressive. MTN Nigeria has proven it can pivot from deep losses to robust profits within a year, powered by data growth, cost control, and favourable macro tailwinds.

The reintroduction of dividends further underlines confidence. For investors and sector watchers, the key question now is whether MTN can lock in this momentum, manage its forex exposure, and deliver consistent growth in the face of external headwinds.