Moniepoint Inc. has responded to recent media reports suggesting that its UK arm, Moniepoint GB, recorded “heavy losses”.

In a statement sent to Technext by a company rep, the fintech insists that what some are calling a loss is in fact part of the early-stage “investment phase” typical of fintechs moving into new regulated markets.

“Moniepoint Inc. can confirm that Moniepoint GB’s financial results for the period February to December 2024 reflect the expected early-stage investment phase common across financial services firms entering new regulated markets,” the statement reads in part.

It continues, stating that, “Moniepoint GB’s focus is on serving the UK’s African diaspora and bringing financial happiness to a new market, an ambition that naturally requires upfront investment in compliance, infrastructure and people.”

The company also pointed to its April 2025 launch of MonieWorld as the first public manifestation of that strategy, with further product rollouts to follow.

“The launch of the MonieWorld digital financial services solution in April 2025 marked the first step in delivering that vision, with further products to follow. Moniepoint GB will continue to publish its statutory reports in line with regulatory requirements and standard reporting timelines,” the payment company added.

The timing of this clarification is crucial. Coverage claiming Moniepoint is “facing heavy losses after acquiring Bancom Europe to secure its UK licence” had begun circulating, drawing attention to the company’s UK push and the risks associated with expansion into regulated markets.

Moniepoint: Why the confusion over loss vs. investment?

Fintechs and other financial institutions entering new markets often absorb large upfront costs for licensing, compliance, staffing, and infrastructure before they generate materially positive returns. In this light, Moniepoint’s framing is not unusual. It is presenting its UK operations as a strategic play that must, by design, carry negative margins initially.

It’s also worth noting that Moniepoint’s parent brand has been on an aggressive growth trajectory. In October 2024, the company closed a $110 million Series C round, backed by investors including DPI, Google’s Africa Investment Fund, Verod Capital, and Lightrock. That fund was pitched in part to support expansion beyond Africa, including diaspora-focused services like MonieWorld.

That ambition, while understandable, must contend with regulatory friction, competitive pressures, and the challenge of monetising diaspora remittance corridors in an already crowded space.

The MonieGB strategy: a long game in remittance and diaspora banking

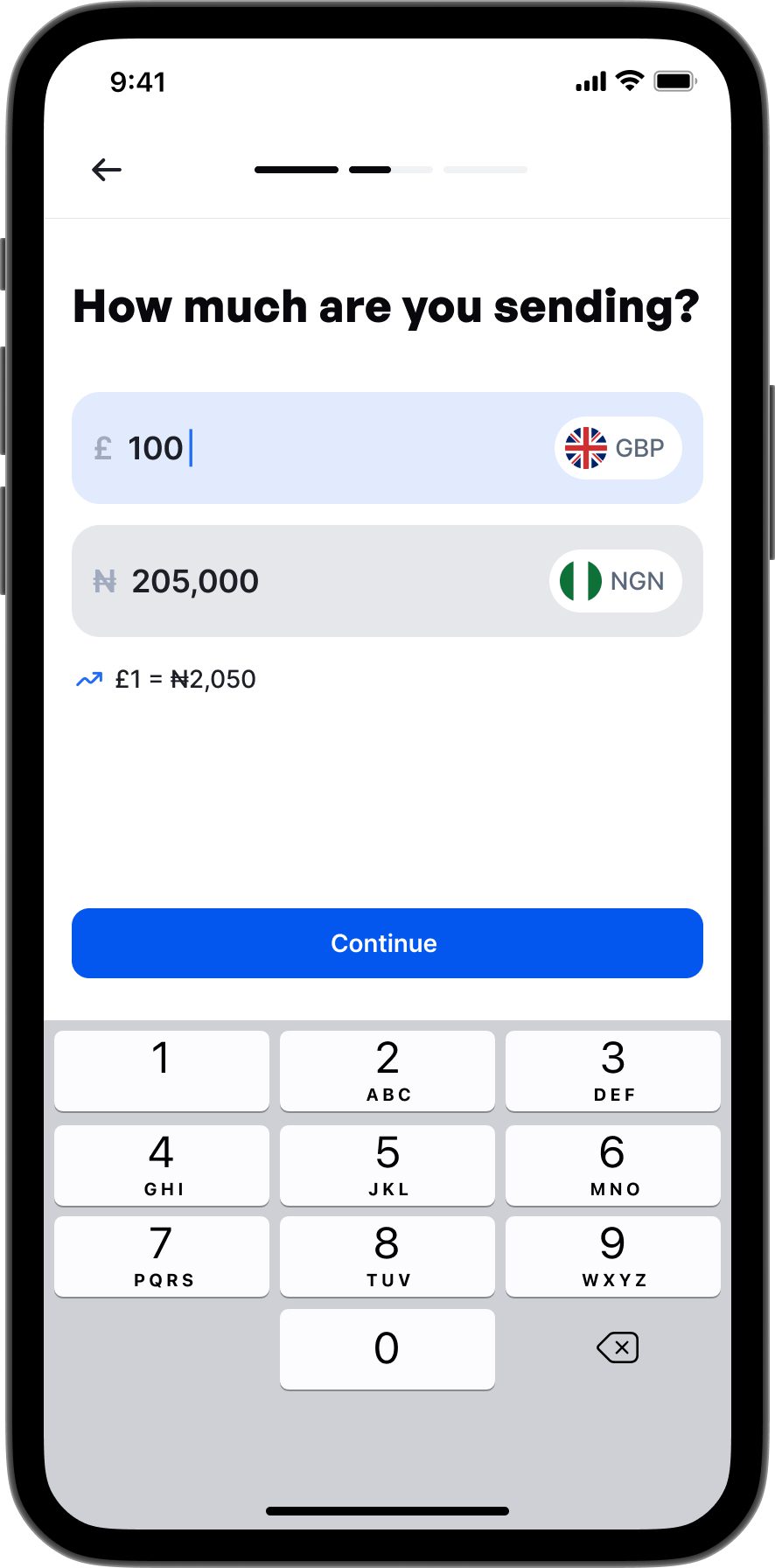

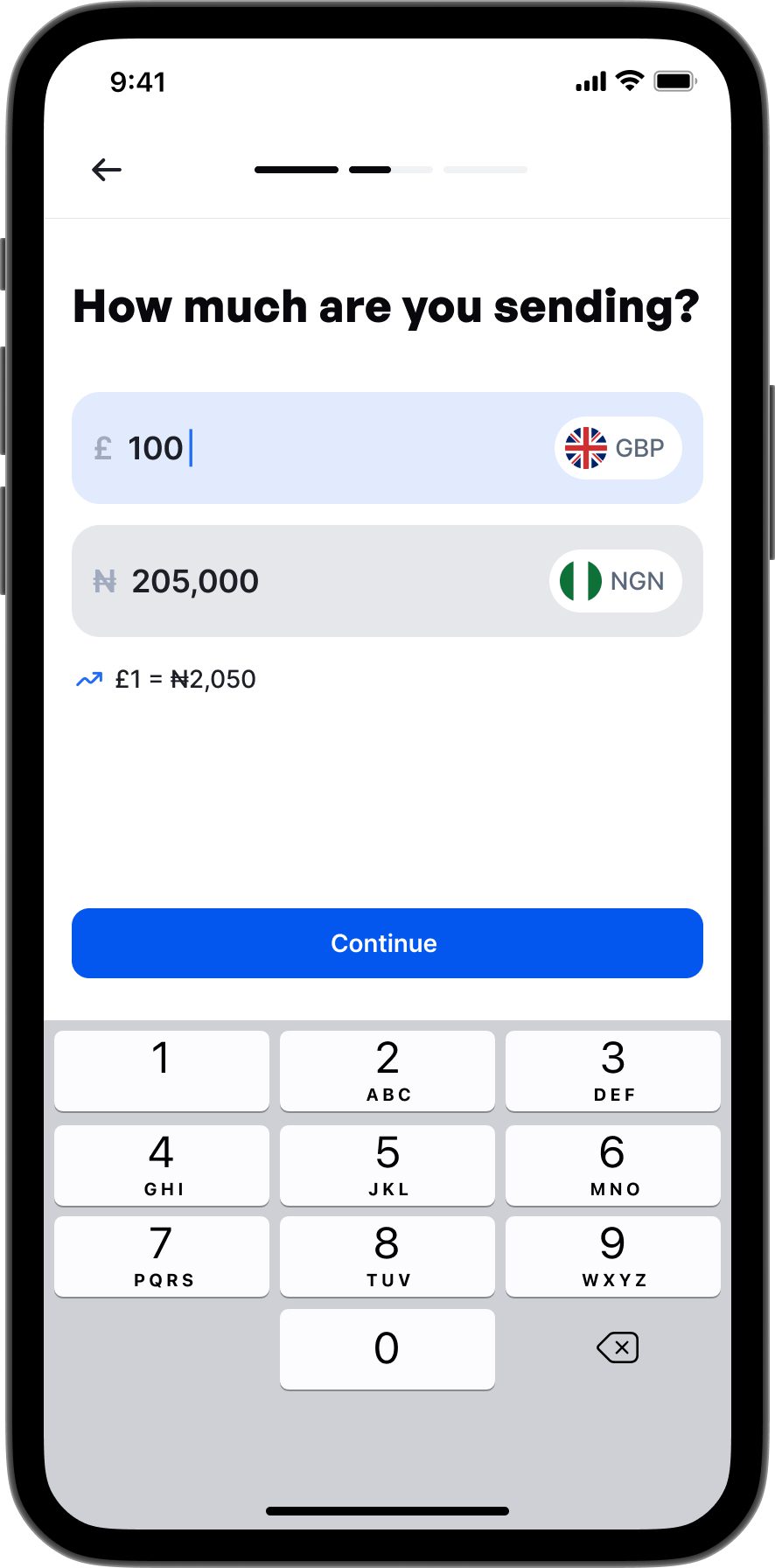

Moniepoint’s UK strategy is anchored on MonieWorld, a digital financial services offering tailored to African diaspora users, particularly Nigerians in the UK.

The platform enables UK-based individuals to send funds to Nigeria in as fast as 17 seconds, with competitive exchange rates and no transaction fees.

MonieWorld is built under Moniepoint GB, which operates as a distributor of PayrNet (a UK-regulated electronic money institution). The business taps into the fact that remittances from the UK represent a significant share of inflows to Nigeria. In 2024, global remittances to Nigeria grew by 9% year-on-year, and the UK diaspora accounted for nearly half of that total flow.

That market logic underpins Moniepoint’s positioning: capture customers by offering speed, transparency, and pricing advantage, then layer in additional financial services over time. The current cost burden is, from the company’s view, a necessary investment toward building scale and network effects in the UK-Nigeria remittance corridor.

Yet monetising remittances is notoriously difficult. Margins tend to be thin, regulatory overheads are high, and competition is fierce. Incumbent players like established remittance firms, challenger banks, and fintech remittance bridges already operate in that space. Moniepoint will need to differentiate not just on cost and speed, but also on trust, compliance, experience, and product depth to retain users and expand share.

Beyond that, Moniepoint must manage currency risk, cash flow timing mismatches, regulatory capital demands in both jurisdictions, and the challenge of customer acquisition in a foreign market where brand recognition is nascent.