Only a few know that the groundwork for what we now know as Fintech was laid by the Central Bank of Nigeria (CBN). Following a banking crisis in 2007, the apex bank launched the Payments System Vision 2020. The goal was to modernise payments and reduce reliance on cash.

Early players like Interswitch (founded in 2002) and eTranzact pioneered shared infrastructure for digital transactions, established platforms for ATMs, POS terminals, and online payments that the entire ecosystem would later rely on.

Yet, the true fintech boom was catalysed by the proliferation of affordable mobile phones and improved internet penetration between 2010 and 2017. The CBN’s implementation of the cashless policy (which started around 2012) forced businesses and consumers to adopt digital transactions, creating demand for new, faster services.

This rapid growth, fueled by a young population, increasing smartphone adoption, and significant foreign venture capital, transformed Nigeria into Africa’s leading Fintech hub, setting the stage for the powerful female executives.

In 2025, the Fintech space is dotted by women who have become the sector’s most important architects. From launching multi-million user apps for savings and investment to leading key payments firms, their ingenuity is attracting global attention and reshaping the continent’s digital economy.

Here is a review of the 10 most notable in our estimation:

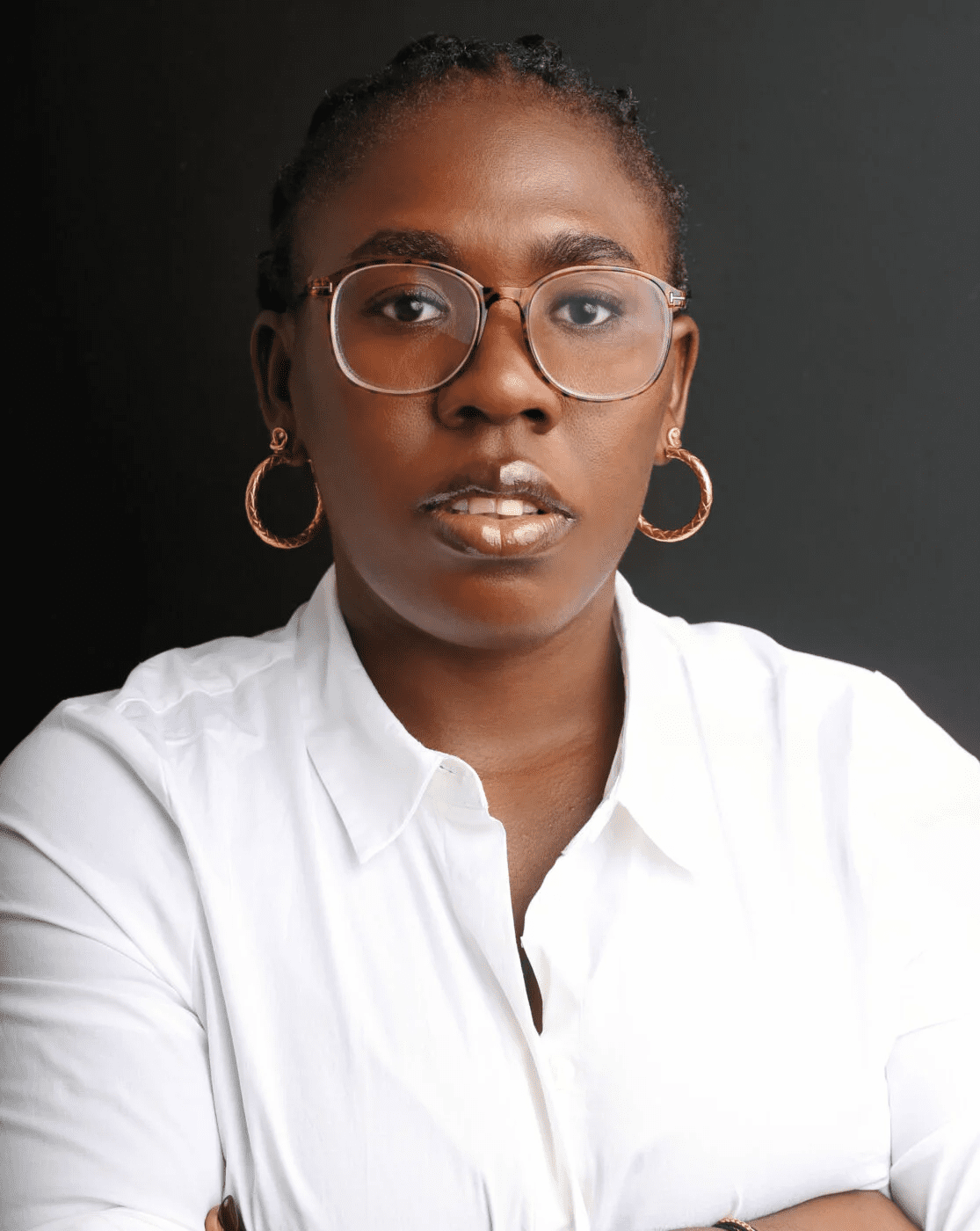

Odunayo Eweniyi of PiggyVest

Leading Nigeria’s fintech evolution is Odunayo Eweniyi, Co-founder of Piggyvest. The platform that fundamentally redefined personal finance for millions of Nigerians was launched in 2016 as Piggybank.ng.

Within just four years of its founding, it crossed the one million user mark, demonstrating the speed and urgency with which Nigerians adopted the modern savings tool.

Eweniyi’s vision was to build a secure, transparent, and easy-to-use digital vault that combined automated savings with high-yield investment options. Today, the platform boasts millions of users, attracting both local and international investors, and stands as one of Africa’s most successful fintech stories.

By transforming the simple act of saving into a modern, accessible wealth-building tool, Eweniyi cemented her status as a crucial leader in the ongoing drive for massive-scale financial inclusion and personal economic empowerment.

Ifeoma Uddoh of Shecluded

Leading this revolution is Ifeoma Uddoh, founder of Shecluded, the nation’s first FINTECH for women.

Uddoh’s mission is personal, stemming from her experience with economic hardship and her professional observation of systemic bias during her decade-long career in Strategy Consulting and Analytics at firms like PwC. Then, she realised that the biggest barrier for female entrepreneurs was not a lack of drive, but a critical gender financing gap.

Launched in 2019, Shecluded was created to correct this imbalance. The company doesn’t just offer loans; it provides a holistic ecosystem of capital access, financial education, and business growth resources, using proprietary algorithms to assess creditworthiness beyond the narrow, biased parameters of traditional institutions.

Her goal was to provide Nigerian women with the financial leverage, knowledge, and network needed to scale their businesses.

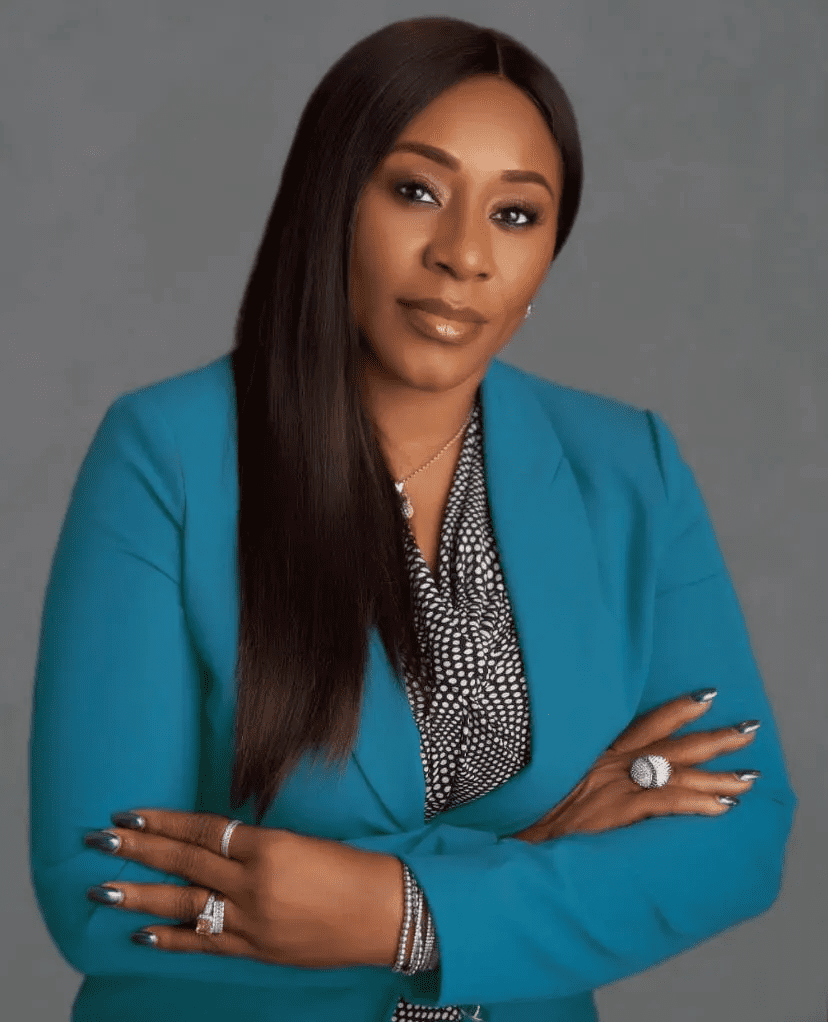

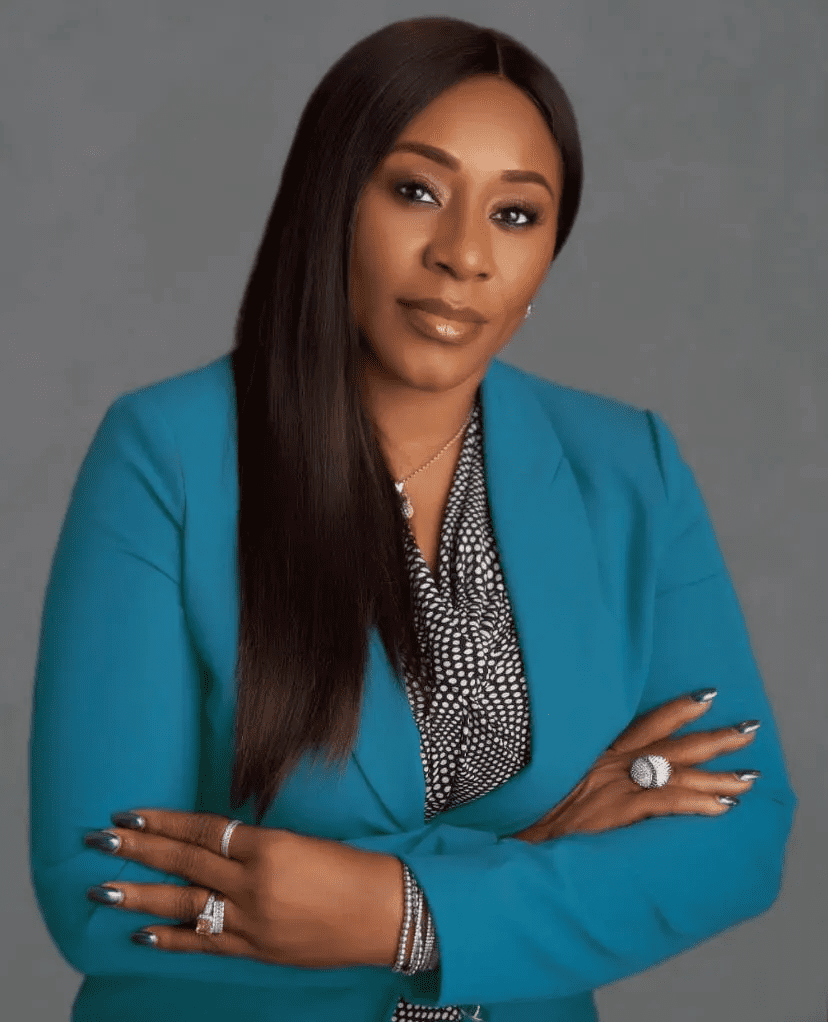

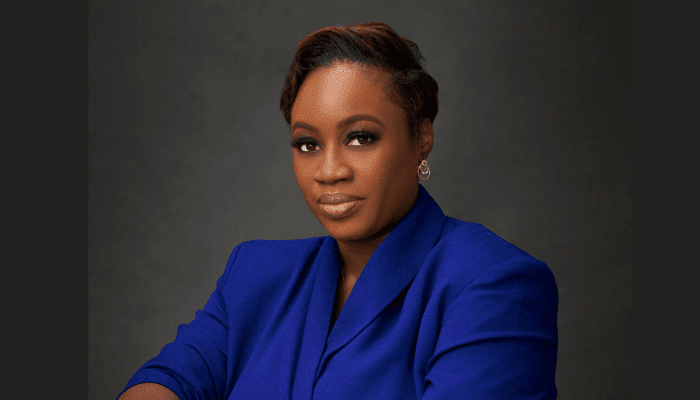

Chinyere Don-Okhuofu, Divisional CEO, Sales Network at Interswitch Group

Bringing decades of foundational experience to the payments backbone is Chinyere Don-Okhuofu, a top executive at Interswitch.

Interswitch was founded in 2002, and it marked the true beginning of modern electronic payments in the country by owning Nigeria’s first transaction switching and processing infrastructure.

Don-Okhuofu, who serves as the Divisional Chief Executive Officer, Sales Networks, is responsible for ensuring the widespread adoption and deepening penetration of this infrastructure across various sectors.

With extensive experience in banking and financial control, she is focused on driving the sales strategy that ensures organised businesses, from retailers to large corporations, adopt Interswitch’s digital solutions.

Oluwatosin Olseinde of Money Africa

The fourth on the list is Oluwatosin Olaseinde, simultaneously operating two powerhouse brands: MoneyAfrica and its sister investment platform, Ladda.

She established MoneyAfrica in 2018 as one of the continent’s most trusted platforms for financial literacy and education, directly addressing the critical knowledge gap that often hinders participation in wealth creation.

Complementing this is Ladda, which was launched in 2020. It serves as the practical application of that knowledge, functioning as a full-service fintech platform. It also offers users carefully curated investment portfolios, modern stock trading tools, and essential services like digital gift cards and payment services.

By linking education with accessible, easy-to-use investment products, Olaseinde is directly empowering a new generation of Africans to actively participate in the global financial markets, driving a democratisation of wealth.

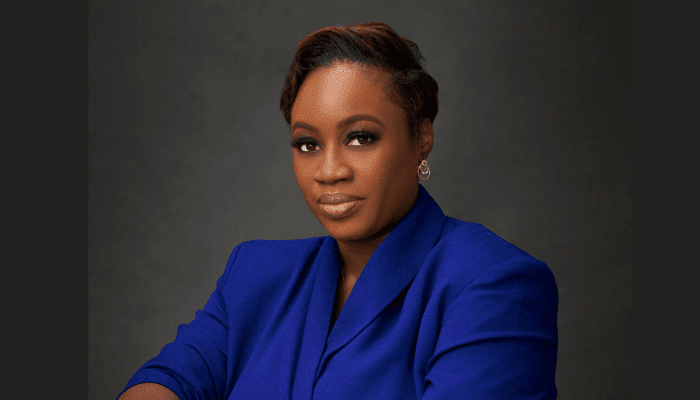

Foyinsola Akinjayeju, CEO of EFInA (Enhancing Financial Inclusion and Advancement)

A critical pillar supporting Nigeria’s digital ecosystem is Foyinsola Akinjayeju, CEO of Enhancing Financial Inclusion and Advancement (EFInA), an institution whose work provides the data and strategic roadmap for the nation’s financial evolution.

EFInA was established in late 2007 and, while not a fintech company itself, it serves as the crucial development organisation guiding the entire sector. It operates at the intersection of data, policy, and innovation, producing the definitive Access to Financial Services in Nigeria (A2F) survey.

This research identified persistent gaps in inclusion, particularly among women, youth, and rural populations. Under her leadership, EFInA is driving the strategic agenda to move beyond mere access to financial services toward true financial health and empowerment.

Yanmo Omorogbe, co-founder of Bamboo

Further expanding the global reach of Nigerian finance is Yanmo Omorogbe, co-founder of Bamboo. Recognising that local markets offered limited investment opportunities for rapidly growing African wealth, Omorogbe co-founded Bamboo in 2020 to directly address this critical need.

Bamboo is a leading brokerage app that tears down the geographical walls that historically prevented Africans from accessing international capital markets.

By offering a secure and seamless platform for users to buy, sell, and hold shares in U.S. and Nigerian publicly listed companies, Omorogbe is creating access to global assets, including major tech stocks and ETFs.

Uche Uzoebo, CEO of the Shared Agent Network Expansion Facilities (SANEF) Limited

Another female fintech leader on the list is Uche Uzoebo, the current CEO of the Shared Agent Network Expansion Facilities (SANEF) Limited. While the other women build digital platforms, Uzoebo’s role is to ensure the physical and operational backbone of financial services reaches every corner of Nigeria.

She was appointed to the leadership role in February 2025, succeeding the pioneer CEO. With over 20 years of experience in banking, Uzoebo oversees the vast network of shared agents.

Her focus is on leveraging SANEF’s mandate to rapidly scale financial inclusion by ensuring that even those without bank branches or internet access can access essential financial services, thereby linking the nation’s high-tech fintech revolution to the low-tech reality on the ground.

Ife Durosinmi-Etti of Herconomy

Finally, bridging the gap between social community and financial infrastructure is Ife Durosinmi-Etti, Founder and CEO of Herconomy.

Originally launched as a community platform in 2019, Herconomy has rapidly evolved into a full-fledged fintech platform designed explicitly to drive economic empowerment for women.

Durosinmi-Etti’s vision centres on the principle that financial freedom requires more than just a savings product; it needs a supportive ecosystem. Herconomy provides access to digital savings tools, curated grants, valuable scholarships, and a powerful network that facilitates business and personal growth.

This platform addresses the multi-faceted challenges women face in accumulating wealth and accessing capital, positioning Herconomy as a unique and influential force in Nigeria’s gender-focused fintech landscape.

Solape Akinpelu, Founder and CEO of HerVest

Championing an explicitly gender-focused approach is Solape Akinpelu, Founder and CEO of HerVest, established in 2019. HarVest is an inclusive fintech platform that employs a Gender Lens Investment (GLI) strategy to address the significant financial exclusion gap faced by African women.

Akinpelu recognised that simply providing access wasn’t enough; the solutions had to be tailored to women’s needs, particularly in the agricultural sector.

It offers targeted savings plans, loans, and impact investment opportunities, allowing urban women to invest in and provide capital to underserved smallholder female farmers and women-led SMEs in rural areas.

Tomilola Majekodunmi, Co-Founder and CEO of Bankly

Focusing directly on the foundational issue of cash is Tomilola Majekodunmi, Co-Founder and CEO of Bankly.

Launched in 2019, Bankly’s core mission is to solve insecurity and inefficiency of the informal cash-based savings system known as ajo or esusu for Nigeria’s unbanked and underbanked population.

Majekodunmi, drawing on her extensive finance background, created a hybrid physical and digital model to digitise cash “to the last mile.”

Bankly relies on a vast, trusted network of agents to help individuals in the informal sector, such as market traders and farmers, to convert their daily physical cash savings into secure, digital wallets, often via vouchers.

This strategy provides security against theft and fraud, builds essential savings histories for future credit access, and effectively integrates millions of cash-dependent Nigerians into the formal financial system.