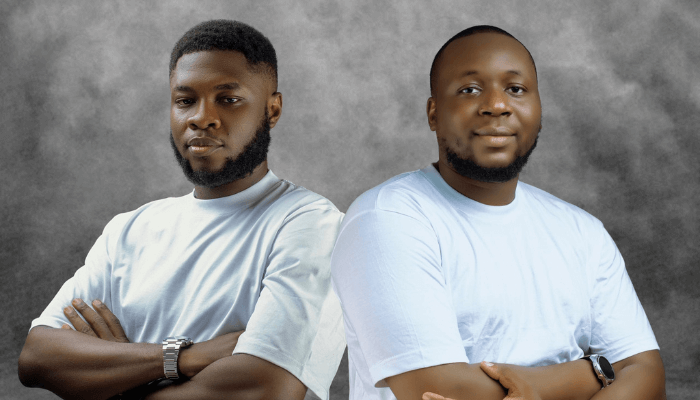

Lucrestack co-founders Damilola Parkinson and Olajide Bakare are rethinking how individuals and businesses across Africa send and receive money globally through their new platform, LupoFi.

For years, cross-border transactions have remained one of the biggest pain points for African entrepreneurs. Now, two Nigerian founders, Damilola Parkinson and Olajide Bakare, are tackling that challenge head-on with a new platform that aims to make global payments faster, safer, and more inclusive.

Their company, Lucrestack, recently launched LupoFi, a cross-border payment platform designed to help individuals and businesses send, receive, and settle international transactions seamlessly. The platform currently connects users across Africa with countries such as China, Saudi Arabia, Israel, Canada, the United States, and parts of Europe, with plans to expand into other regions.

Parkinson, Lucrestack’s Co-Founder and Chief Executive Officer, said the launch marks the next phase of their mission to simplify global financial connectivity.

“We have spent years building and refining infrastructure that powers cross-border payments for banks and fintechs,” he said. “LupoFi represents the evolution of that work, extending our enterprise-grade systems to individuals, entrepreneurs, and businesses that need reliable access to the global economy.”

While Africa’s digital economy continues to grow, many businesses still face friction when sending or receiving funds due to slow settlements and compliance challenges.

Bakare, Co-Founder and Chief Technology Officer, explained that the company’s solution is built around resilience and interoperability. “Our goal has always been to build systems that empower institutions to scale confidently,” he said. “With LupoFi, we are extending that reliability to those driving trade and innovation across Africa.”

Unlike most fintechs that depend on external processors, LupoFi is powered directly by Lucrestack’s proprietary infrastructure. The platform leverages blockchain technology and an OmniChain engine that enables instant settlement across multiple currencies, while its automated compliance layer ensures every transaction is verified in real time.

For Parkinson and Bakare, this innovation is more than technology. It is a tool for inclusion. “LupoFi is not just a product; it is a movement toward financial equity,” Parkinson said. “We are giving Africans the tools to participate fully in the global economy.”

As both founders put it, their mission is simple: to make it possible for Africans to trade and thrive without borders.