Market watchers are expecting Nigeria’s inflation to extend its slowdown as the National Bureau of Statistics (NBS) prepares to release August consumer price data.

Several analysts project the disinflation trend to continue, with forecasts pointing to decreases in year-on-year and month-on-month inflation figures.

Analysts say the disinflation could result in the interest rate cut when the Monetary Policy Committee (MPC) meets next week.

Analysts at Coronation Merchant Bank Research projects that headline inflation will ease to 21.45 percent year-on-year in August, down from 21.88 percent in July.

On a month-on-month basis, a slight moderation to 1.74 percent is expected.

Read also: Nigeria’s inflation shows signs of lasting relief as prices cool again

The bank attributes the anticipated decline to improved food supply, driven by early harvest season for crops such as maize, groundnuts, pumpkins, and vegetables, particularly in the southern and middle-belt regions.

However, they caution that persistent structural challenges such as inadequate storage infrastructure and poor road conditions may slow the pace of improvement.

Coronation analysts also highlight other disinflationary drivers, including moderating imported food inflation supported by relative naira stability, which appreciated slightly to N1,531.57/$1 in August.

Easing energy costs have helped to lower production and transport expenses, although ongoing logistics bottlenecks remain a drag. Stronger foreign exchange (FX( reserves, now at $41.27 billion, along with steady portfolio inflows, have also supported robust FX liquidity and enhanced market confidence, enabling the Central Bank of Nigeria (CBN) to intervene effectively and sustain short-term currency stability.

Disinflation sentiment rising

The CBN’s June 2025 Inflation Expectation Survey further supports the outlook for easing inflation. The proportion of respondents expecting stable inflation in the near term rose to 52.7 percent in June, up from 50.8 percent in May, the highest in three months. Meanwhile, the share of respondents anticipating higher inflation dropped to 33.5 percent from 35.9 percent, reflecting a shift in sentiment as inflationary pressures appear to be softening. The July headline inflation reading showed signs of easing, declining to 21.9 percent from 22.2 percent in June.

FBNQuest also notes a similar trend in sentiment. Its analysis indicates that medium-term expectations of inflation stability are improving. The share of survey respondents expecting stable inflation over the next three months rose to 38.6 percent in June from 35.9 percent in May. While the majority still foresee higher inflation in the six-month outlook, the share declined slightly to 39.3 percent, down 180 basis points from the previous month. Business respondents appeared more optimistic than households, with 60 percent and 40.7 percent of businesses expecting stable inflation over one- and three-month periods, respectively, compared to 44.5 percent and 36.3 percent of households.

Echoing the broader consensus, United Capital Research forecasts that inflation will decline to 20.83 percent in August, citing key contributors such as falling food prices, stable energy costs, especially petrol and the naira’s relative stability against the dollar.

Read also: Nigeria’s inflation outlook: A turning tide amid policy coordination

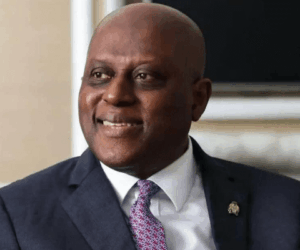

MPC should stay cautious – Kale

As the MPC prepares for its September 22, 2025 meeting, Yemi Kale, group chief economist and managing director of Research and Trade Intelligence at the African Export-Import Bank (Afreximbank), has urged caution in the committee’s interest rate decision.

The CBN announced that the 302nd meeting of its Monetary Policy Committee (MPC) will take place later this month at the CBN head office in Abuja.

Responding to the question on whether it is time for a rate cut as the MPC meets on September 22, Kale said at the Intra-African Trade Fair in Algiers that while inflation has begun to ease from its peak, it remains elevated and the monetary policy credibility is still under scrutiny.

According to him, the CBN current stance of keeping the policy rate above 20 percent has played a key role in attracting foreign portfolio inflows (FPIs), which have helped to stabilise the FX market and support reserve accumulation.

However, Kale warned that this policy comes at a structural cost. Elevated interest rates tend to deter foreign direct investment (FDI), as investors opt for safer, short-term returns in government securities rather than long-term commitments in sectors such as infrastructure, manufacturing, or services. The result, he said, is a trade-off between short-term liquidity stability and long-term productive capital inflows.

“Cutting rates too early could reignite inflation and undermine FX stability,” he explained. “But holding rates too high for too long entrenches reliance on volatile FPIs and crowds out both domestic investment and critical FDI needed for industrialisation and job creation,” he said.

Kale expects the MPC to take a cautious stance in September, either holding rates steady or making only a marginal cut pending further confirmation of a sustained decline in inflation.

“The real challenge is sequencing,” he said. “Once inflation shows a durable downtrend and FX buffers are stronger, Nigeria will need to gradually ease rates to attract FDI while maintaining a credible anti-inflation stance.”

Read also: Cardoso signals possible rate cuts as inflation cools, capital flows strengthen

Striking this balance is essential, he added, noting that “Nigeria must move from stabilising with FPIs to transforming with FDI.”

The MPC, which is responsible for setting monetary policy to ensure price and financial system stability, will review recent economic and financial developments both within and outside the country. Key decisions on interest rates, inflation control, and overall economic direction are expected to emerge from the session.

United Capital Research expects the MPC to implement a modest rate cut of between 0.25 percent and 0.50 percent at its September 2025 meeting, while keeping other policy parameters unchanged. Such a move will signal confidence in the ongoing disinflation trend and stronger external buffers, without undermining policy credibility, it said.