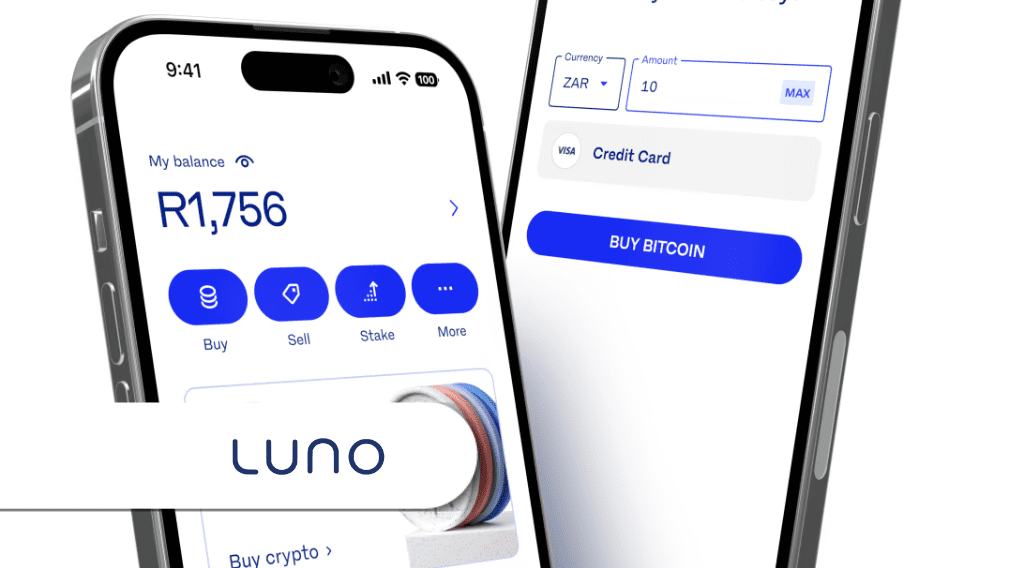

South African Luno users can now use cryptocurrency for purchases at major retailers like Shoprite, Checkers, Makro, and Vodacom. With the expansion of Luno Pay, nearly 700,000 retail outlets nationwide are now connected through Scan to Pay, allowing shoppers to make purchases with Bitcoin or Tether by simply scanning a QR code.

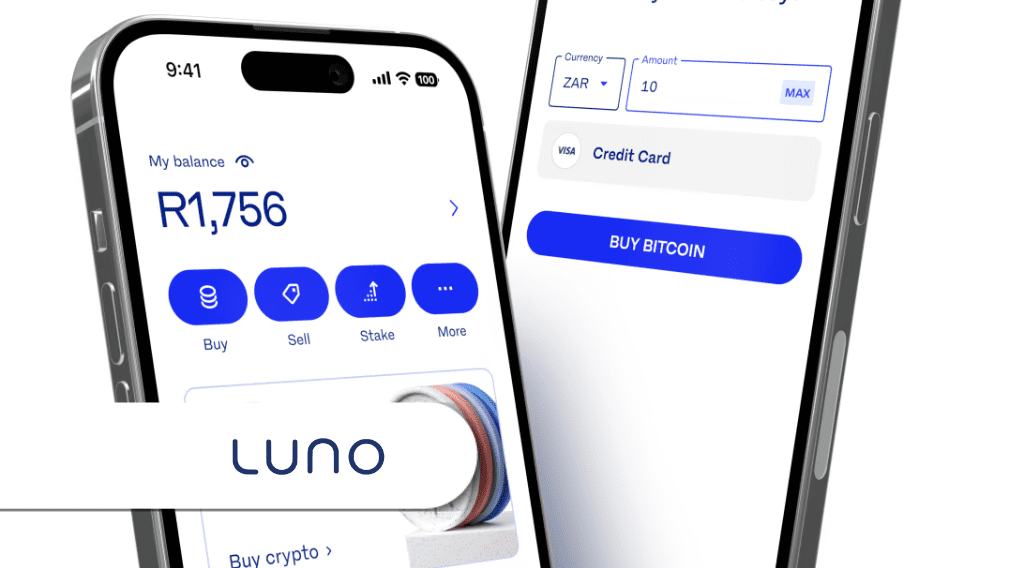

Luno’s partnership with MoneyBadger enables cryptocurrency payments for merchants without requiring system changes. Consumers simply scan a QR code with the Luno app, select their cryptocurrency, and authorise the payment.

Since its November 2024 launch, Luno Pay has facilitated over 48,000 transactions totalling more than R28 million across 1,600 merchants. A 70% user return rate suggests a shift in South Africa from holding Bitcoin as an investment to using it for everyday transactions.

Getting crypto into day-to-day shopping

Integrating Luno Pay’s 30,000 outlets with Scan to Pay’s 650,000 outlets significantly expands cryptocurrency payment acceptance across South Africa, now including major retailers for nationwide cryptocurrency transactions.

By offering customers who choose to pay with USDT a generous reward of up to 10% back in USDT, we are actively encouraging the broader adoption of cryptocurrency payments. This attractive cashback program provides immediate and tangible incentives for customers to utilise USDT for their transactions, fostering a greater acceptance and understanding of digital currencies.

At the same time, vendors can significantly benefit from this smooth and efficient integration with their existing payment systems. The seamless nature of this system minimises disruptions to current business processes while unlocking the advantages of accepting USDT.

This allows vendors to cater to a growing market of crypto-savvy consumers and streamline their payment processing capabilities. The real-time rewards further enhance the appeal, creating a mutually beneficial ecosystem for both customers and vendors.

MoneyBadger CEO Carel van Wyk expects this change to incentivise daily Bitcoin spending, shifting its perception from investment to currency. Luno’s Christo de Wit believes this is a step toward mainstream adoption, enabling customers to spend cryptocurrency and earn instant rewards at any retailer, thereby integrating digital currencies into everyday transactions.

Luno Pay’s integration positions it as a leading cryptocurrency payment network in South Africa. This network connects hundreds of thousands of retailers and facilitates the widespread use of digital currencies. Consumers can make payments effortlessly using cryptocurrency, while merchants can accept these payments without needing to modify their systems..

Read also: Luno launches tokenized global stock service in Nigeria

The platform’s growth highlights cryptocurrency’s growing utility, allowing users to transact and access services with digital currency. Increased vendor acceptance will further integrate cryptocurrency into everyday use.

Easing shopping and payments for consumers and merchants

At the point of sale, consumers scan a QR code, choose either Bitcoin or Tether, and confirm their payment, similar to well-known mobile payment systems. Merchants receive payments instantly and can convert them into local currency, streamlining their operations.

Luno Pay’s expansion promotes financial inclusion by enabling cryptocurrency payments for goods and services, particularly benefiting those without traditional bank accounts. Wider merchant integration increases digital currency adoption and facilitates everyday purchases.

This increased processing speed is a direct benefit of the rising adoption and spending of cryptocurrency. The higher transaction speed and volume play a crucial role in enhancing the entire cryptocurrency network, making it more resilient and efficient.

The platform promotes the daily use of virtual currency in real-world scenarios by rewarding spending. This reflects the evolution of cryptocurrency from a mere investment to a practical economic tool, encouraging continued adoption through user benefits.

Merchants can retain their existing point-of-sale systems, minimising disruption and easing cryptocurrency payment acceptance. This seamless integration is crucial for wider adoption, highlighting cryptocurrency’s practicality and potential as a viable alternative to traditional payments.

For digital currency to gain widespread acceptance as a mainstream financial tool in South Africa, it is essential to increase its visibility among the population and make it easy to use. Raising awareness and understanding of the benefits and features of digital currency will be crucial in encouraging consumers to explore and adopt this innovative payment method.