The International Monetary Fund (IMF) says Nigeria’s

debt-to-gross domestic product (GDP) ratio is expected to decrease to 36.4

percent in 2025 and further to 35 percent in 2026.

In its latest Fiscal Monitor report, launched at the ongoing

2025 IMF/World Bank annual meetings on Wednesday in Washington DC, the fund

forecasted that the country’s debt-to-GDP ratio will rise to 35.3 percent in

2027.

Nigeria’s public debt-to-GDP ratio was reported at 39.4

percent in the first quarter (Q1) of 2025, following the successful rebasing of

the country’s gross domestic product by the National Bureau of Statistics.

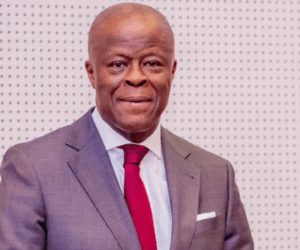

David Furceri, division chief of the fiscal affairs

department at the IMF, speaking during the launch of the report, advised

Nigeria to ramp up its revenue and strengthen its tax system.

He said the IMF is projecting “a neutral fiscal stance” for

Nigeria.

Fiscal neutrality refers to a principle or goal of public

finance that fiscal decisions (taxing, spending, or borrowing) of a government

can or should avoid distorting economic decisions by businesses, workers, and

consumers.

“We think that a neutral stance is also consistent in

economic policies aimed at reducing inflation. But let me tell you more about

the structural characteristics in terms of our recommendation for countries

such as Nigeria.”

“Our policies advice has been both on the revenue side as

well on the spending side because the revenue side of this scope is to improve

from revenue, to reform, to tax administration, to increase revenue.”

Furceri noted that Nigeria has made significant progress in

recent years with its tax reform efforts.

“Many of the laws that have been passed are trying to

streamline the tax code, tax expenditures have also been reduced. The burden

for business and low income also has declined in terms of taxation. These are

policies that go in the right direction,” he said.

“On the spending side, there is a scope to, on the one hand,

improve the efficiency of the spending.”

In addition, Furceri said it is important to increase social

spending, particularly to support vulnerable households and ensure inclusive

growth.

Click to signup for FREE news updates, latest information and hottest gists everyday

Advertise on NigerianEye.com to reach thousands of our daily users