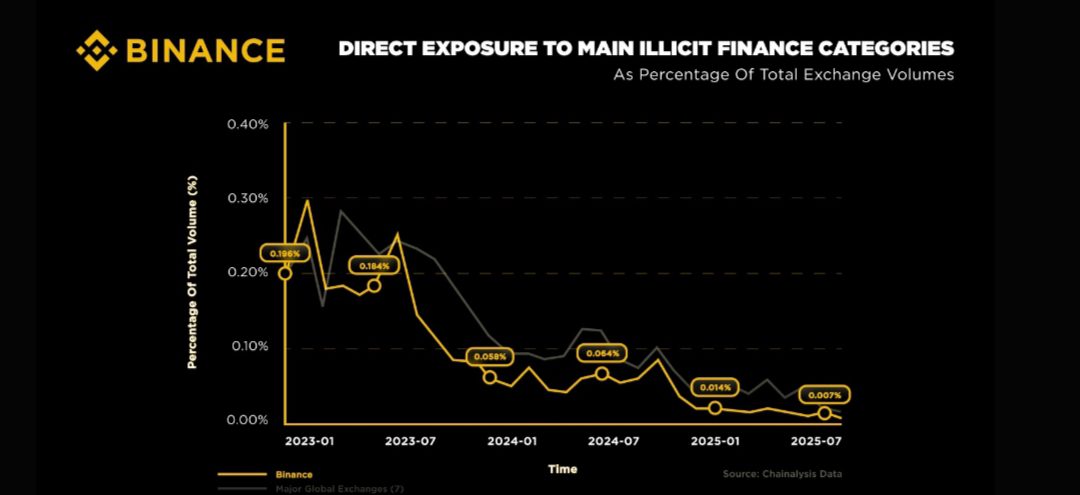

Illicit crypto activity across centralised exchanges has plunged to record lows in 2025, marking a pivotal moment for an industry long shadowed by concerns over misuse. Independent data from Chainalysis and TRM Labs points to a sharp drop in exposure to wallets linked to scams, hacks and sanctioned entities.

As of June 2025, the seven largest exchanges recorded just 0.018 to 0.023 per cent of total trading activity linked to illicit addresses. This represents a steep decline from levels recorded two years ago. Analysts describe it as evidence of stronger compliance standards and more intelligent transaction monitoring across the crypto ecosystem.

Among the top platforms, Binance stood out. Chainalysis found only 0.007 per cent of Binance’s June 2025 volume came from wallets tied to illicit activity, more than 2.5 times less than the industry average. TRM Labs’ independent analysis corroborates this, placing Binance’s “direct exposure” at 0.016 per cent, versus roughly 0.023 per cent for its peers.

As Binance processes daily volumes comparable to all its six largest competitors combined, maintaining these low ratios is especially significant.

“Direct exposure” here refers to the share of an exchange’s volume that interacts with wallets verified to be involved in scams, hacks, sanctions-evading operations or other illicit activities. A lower figure suggests that suspicious transactions are being caught, blocked or reported before they can circulate broadly.

What the sharp decline in illicit crypto activities means for the ecosystem

Industry-wide, this decline reflects more than just Binance’s progress. It points to broader changes, better compliance protocols, improved tracking technology, and greater coordination between exchanges, analytics firms and law enforcement.

Between January 2023 and June 2025, Binance reportedly cut its illicit exposure by 96–98 per cent. Even as its daily trading volume soared (with 217 million trades daily and over $90 billion processed), it kept illicit flows at near-negligible levels.

According to the reports, achievements like this are underpinned by structured compliance programmes. Binance alone now employs over 1,280 staff in compliance, risk and investigations; that’s about 22 per cent of its workforce. The exchange also leverages AI-powered monitoring systems, responds to hundreds of thousands of law-enforcement requests, conducts investigator trainings, and participates in multi-exchange anti-money laundering networks such as the Beacon Network and the T3+ programme.

Also read: Stablecoins shed $6 billion in November, its largest monthly drop since 2022

Crucially, the data provides context against claims that crypto is a primary vehicle for financial crime. Research referenced by NASDAQ, the United Nations and the IMF suggests trillions are laundered annually through traditional banking systems in the form of anonymous fiat transfers, offshore accounts and shell companies. Compared to this, while traces of illicit activity still exist, the sheer scale of global crypto trading means illicit volume is now a tiny fraction of overall activity.

The near-universal drop in illicit exposure across major exchanges suggests the narrative around crypto as a haven for criminal finance is becoming outdated. Instead, exchanges are evolving into highly monitored, regulated hubs, and users benefit from safer, more transparent markets.

As the industry continues to grow, maintaining these gains is critical. That means continued investment in compliance tools, cooperation with regulators and law-enforcement agencies, and transparent reporting. The 2025 data shows that with diligence and technology, crypto can scale without sacrificing integrity.