When people talk about Africa’s business expansion opportunities, they often point to population growth, rising internet penetration, and the speed at which mobile money has replaced traditional banking. These forces are real. But the less visible side of the story is how businesses actually move money in and out of these markets. The choice of a payment gateway can accelerate growth or stall it entirely.

Unlike in Europe or North America, there is no single dominant rails provider. In Kenya, M-Pesa underpins most digital commerce, while in Nigeria, you’ll find a fragmented mix of wallets like Opay and PalmPay alongside bank transfers. In the DRC, transactions are split across Vodacom, Orange, and Airtel’s mobile money systems, with many customers still handling cash.

A business hoping to expand across these borders faces not just multiple currencies, but multiple infrastructures.

What to Look For in a Payment Gateway in Africa

So what does “the right gateway” look like in this context? First, it must do more than process card payments. Card penetration is still below 10% in many African markets. The best payment gateways in Africa are those that prioritize mobile money payment processing, while still giving merchants the ability to accept cards, QR codes, and POS transactions where relevant.

Second, local depth matters as much as regional breadth. A gateway that integrates across 15 countries but lacks strong partnerships with local banks and telecoms in each market won’t solve much. Businesses need assurance that settlement flows will comply with regulations, and that customer payments won’t get stuck because an integration hasn’t been properly maintained.

Third, a modern gateway should come with communication capabilities built in. Payments rarely happen in isolation; they need confirmations, alerts, and customer engagement. A customer making a deposit in Uganda or a purchase in Zambia expects an instant confirmation. Bulk SMS remains one of the most reliable ways to provide that reassurance, particularly where internet penetration is patchy.

Why Integrated Platforms Are Gaining Ground

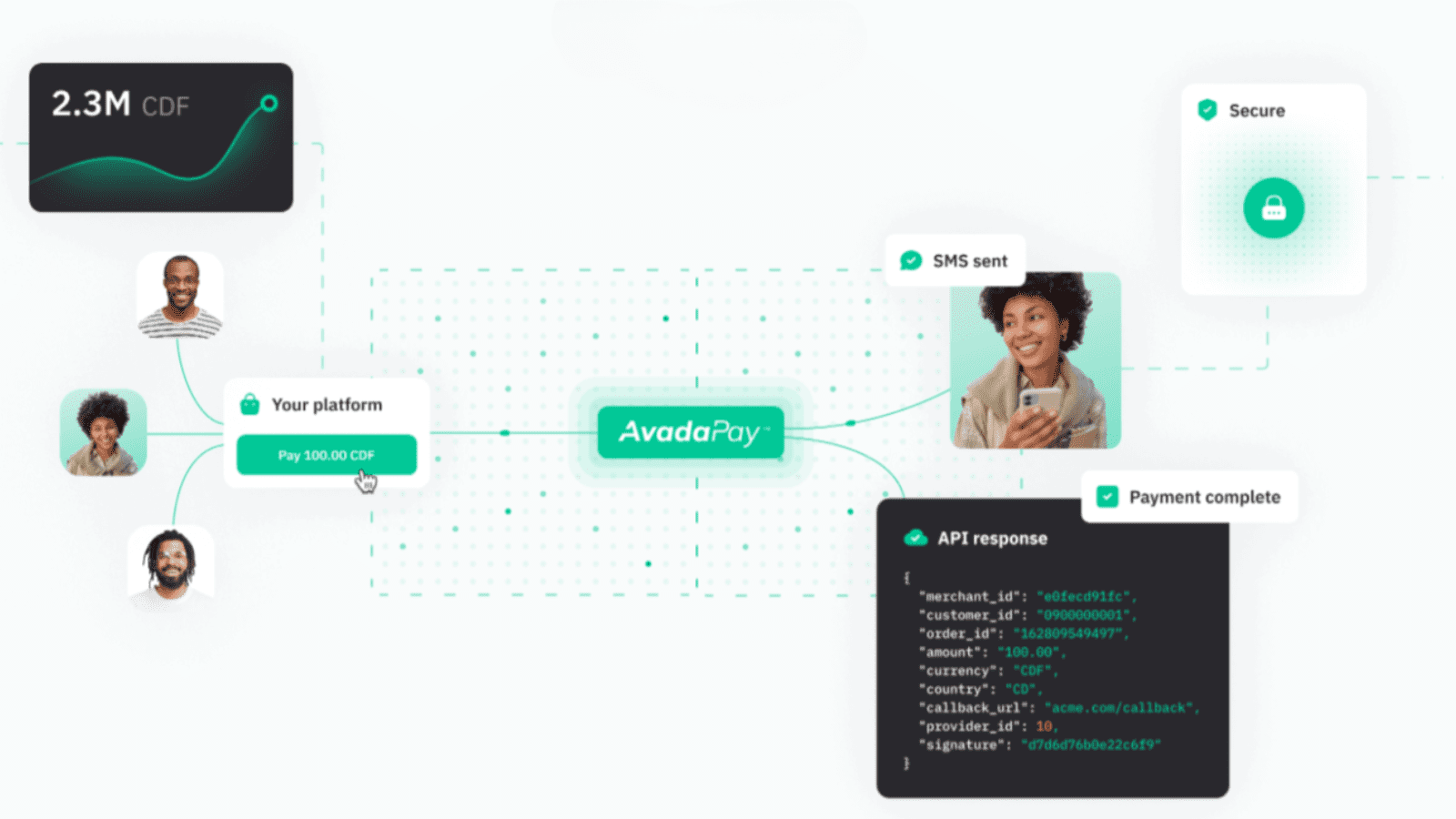

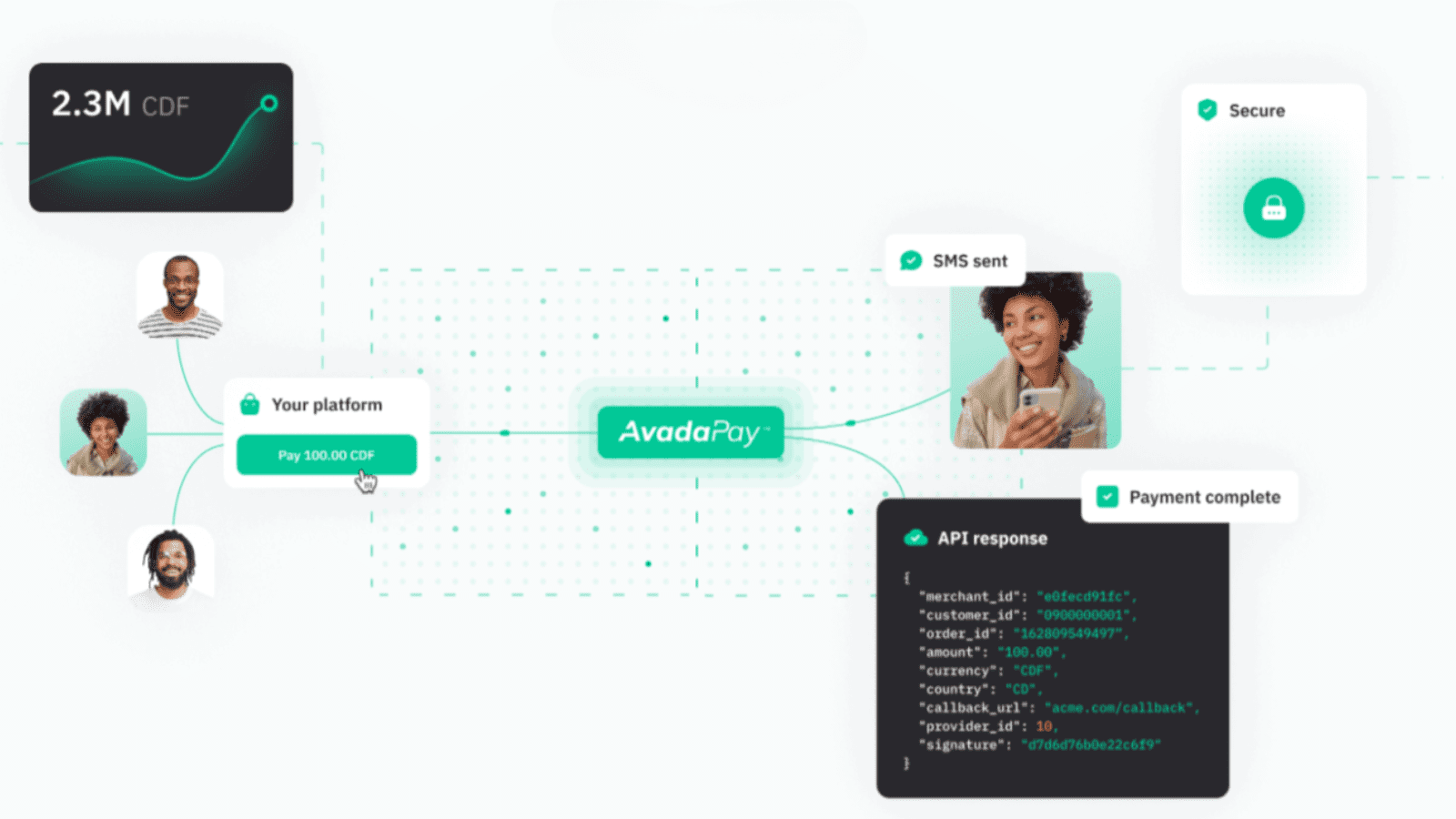

This is why we are seeing a shift toward integrated platforms that combine payments and communication in a single interface. AvadaPay is one example. The platform processes mobile money, cards, and POS transactions across more than 20 African markets, with expansion plans underway. For a retailer in Nairobi that wants to reach customers in Kinshasa or Lagos, this means they don’t need to onboard a new gateway in each country.

The iGaming sector illustrates this well. Operators cannot afford delays; players expect deposits and withdrawals to be instantaneous, whether through Airtel Money in the DRC or bank transfers in Nigeria. By using an integrated gateway, operators have been able to scale across multiple countries while keeping user experience consistent. The same logic applies to logistics and FMCG companies where thousands of low-margin transactions must be processed quickly and reliably every day.

The Strategic Decision Behind Expansion

In my conversations with fintech partners and business owners, the biggest misconception I encounter is that choosing a payment gateway is a technical decision left to the IT team. In practice, it is a strategic decision that determines how quickly a company can scale.

The right partner will simplify settlement across currencies, reduce regulatory headaches, and improve customer trust. The wrong partner leaves businesses reconciling transactions manually and apologizing for failed payments.

In his role as Chief Visionary Officer at Velex Group, Artur Mildov highlights that payment gateways are now much more than just back-end infrastructure; they’re essential for enabling growth. In Africa, with its diverse market systems, the right gateway can be the difference between a business constantly chasing transactions and one that is successfully expanding into new regions.

AvadaPay, a Velex Group portfolio company, reflects this vision by treating payment infrastructure as a strategic lever for business expansion through its unified platform that brings mobile money, card, QR, and POS transactions into a single system. This allows businesses to operate seamlessly across borders and scale without the friction of managing multiple providers.

Africa’s payments landscape is complex, and it will remain so for the foreseeable future. However, with the right gateway, businesses can grow beyond single-market dependence and position themselves for regional scale.

Final Thoughts

For companies serious about expansion in Africa, the choice of payment gateway is too important to be left as an afterthought. It is not just about processing payments; it is about building trust with customers and ensuring operational continuity across diverse markets. Platforms that combine payment processing with reliable communication are showing what that looks like in practice.

If you are ready to expand your business with a payment gateway designed for Africa, partner with AvadaPay and start scaling with confidence.

Contributing Authors,

Maurice Bisungo, Key Accounts Manager, AvadaPay

See also: How payment switches power cashless transactions in Nigeria