Managing crypto transactions in Africa has historically meant navigating slow confirmations, volatile prices, and clunky platforms built for advanced markets. For traders moving large volumes, these inefficiencies are inconvenient and expensive. A bitcoin transaction that takes ten minutes to confirm can cost thousands in lost profits when prices fluctuate.

Most African crypto platforms cater to retail users, leaving professional traders underserved. Despite Sub-Saharan Africa recording over $200 billion in on-chain transactions between July 2024 and June 2025. These transactions are under $10,000.

Traders handling larger volumes still face limited infrastructure, caught between retail-focused local platforms and global exchanges unfamiliar with regional payment systems.

In 2017, adoption was the problem. Crypto barely existed beyond WhatsApp and Telegram groups. Most people had never heard of Bitcoin; those who had were sceptical, given the lack of regulations, trusted products, or an easy way to convert assets to naira.

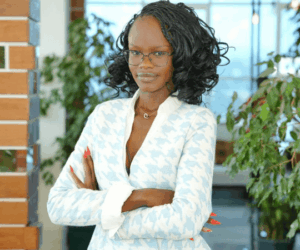

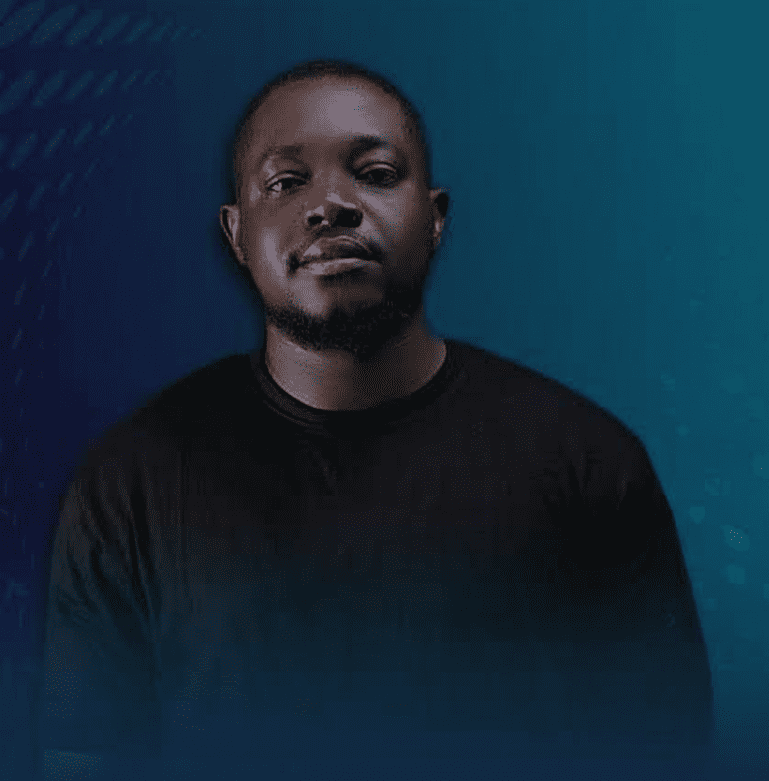

Ikechukwu Jerome Okeke, a crypto evangelist who’d quit other ventures to immerse himself in the technology, saw the adoption gap clearly. He’d spent time educating people about crypto, but education alone wasn’t enough. People need to use crypto; instant naira settlements for merchants could drive adoption.

In that same year, Jerome began building Paylot, a gateway for Nigerian merchants to accept crypto and receive naira. He partnered with Onyedikachukwu Emmanuel Igili, CEO of Afrivelle, to bring the vision to life. But tragedy struck before launch, Onyedika died in a devastating car accident.

“It was really tough,” Jerome said quietly. “But we tried to see how we could keep things moving forward.”

Chidozie Ogbo, Onyedika’s co-founder, stepped in, and the team pressed on.

When Paylot finally launched in 2018, the product worked technically, but adoption was slow because crypto as a payment method was still years ahead of the market’s readiness. Fintech payments were emerging, and merchants were wary of digital assets.

Then the Paylot team noticed something odd: one customer kept using Paylot in a way it wasn’t designed for. He wasn’t a merchant and didn’t have a store, but he was creating invoices and paying himself, just to easily convert crypto to fiat.

“He created an account and paid himself just to get fiat into his account,” Jerome recalls. “So he was actually off-ramping but going the whole route.” That pattern made it clear that the market needed more than to accept crypto. It needed a simple, dependable way to convert it back to fiat. The team built a single-page tool called OTC.paylot.co specifically for off-ramping. “It picked up; people were just using it,” Jerome says. “People liked it because it was fast and it was efficient.”

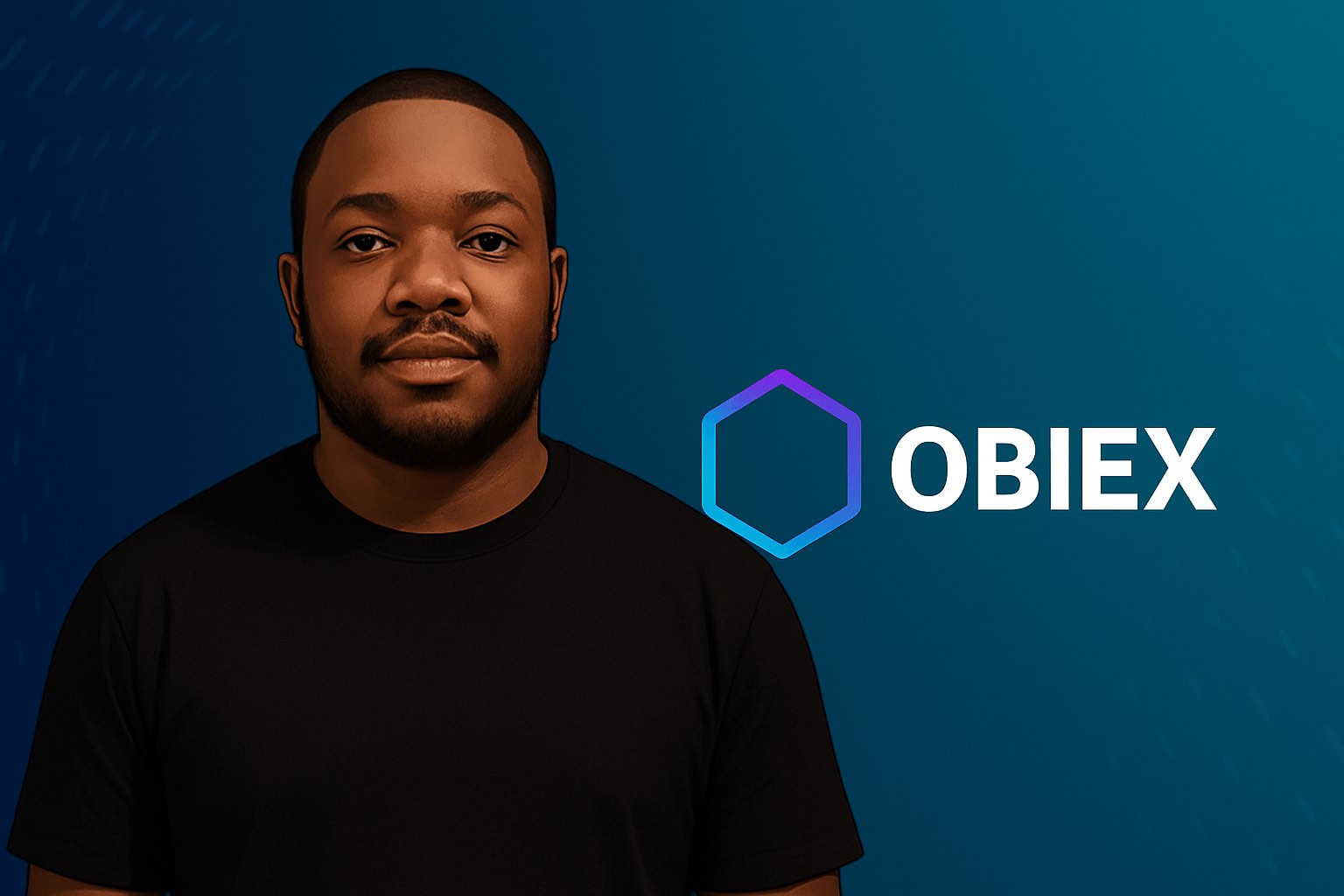

The one-page experiment gained more traction than Paylot’s core product. By July 2021, it had evolved into Obiex, a crypto exchange designed for speed and efficiency. The name combines “Obi”, an Igbo word meaning king, with “X”, for exchange, translating to their tagline: the king of exchanges.

Obiex focused on speed

Users get dedicated wallet addresses; send crypto there, and naira hits their bank accounts automatically. “Once you create an account, we give you a wallet address. As the money hits that address, your Naira hits your bank account,” Jerome explains.

Growth came organically. “At the beginning, it was mostly just word of mouth,” Jerome says. “People loved it. So people just kept referring to it.”

Then, the Central Bank of Nigeria’s (CBN) 2021 directive barring financial institutions from facilitating crypto transactions hit. For Obiex, this was existential. “CBN hit regulated financial institutions with the memo. Banks and PSPs pulled the plug. We couldn’t really process automated payments anymore,” Jerome recalls. “If you can’t process automated payments, the product is as good as dead.”

Many Nigerian crypto companies shut down permanently. Obiex tried manual processing, but it undermined what made the platform special. “The speed, ease of use, and the unique value proposition were gone,” Jerome says. They decided to shut it down and redesign the platform.

The team began to ask themselves what other problems they could solve without relying on banks.

Done more, more to do

The revamped platform attracted high-net-worth and OTC traders, focusing on eliminating volatility losses and making trading effortless. “We wanted trading to be brain-dead easy,” Jerome says.

In just four years and without a single dollar of external funding, the startup has processed nearly $20 billion in trade volume. “I once spoke with a co-founder of one of Africa’s most funded crypto apps,” Jerome recalls. “They’d raised $60 million, yet our trade volume matched theirs, all without external backing.”

Today, Obiex powers the backend infrastructure for other businesses that need crypto rails. The team has also grown to about 40 people, built around two core values.

Jerome identifies with efficiency and perseverance. “The number one thing is efficiency,” Jerome says. His co-founder, Dozie, even earned an unofficial title: “My co-founder is our chief efficiency officer, also. He’s always the one responsible for making sure that our flows are more efficient.”