Spiro electric bikes were never meant to be sleek showroom toys. They were designed as workhorses for riders who burn through 150 kilometres a day and cannot afford breakdowns. That blunt reality has shaped the company’s engineering choices more than any global EV trend. That’s the crux of my conversation with Rahul Gaur, Director for the West African region at Spiro: the firm’s edge is not in radical invention but in ruthless localisation.

Its current range includes the Ekon series, the Alpha+ and the Davido Collectible for the elites. They target commercial riders first. Okada operators. Delivery fleets. The people who throttle every mile into income.

Gaur insists the real story is the groundwork before launch. Spiro did not parachute into a global e-bike design. It spent months running test units across Nigeria, mapping the rough roads, rider habits and maintenance gaps that kill most imported electric bikes.

“The design of the product is very country-fit,” he says. “We make small changes depending on the terrain.”

This unglamorous fieldwork shaped decisions that matter to riders. A 4.5kW motor with peak output reaching 6kW. Enough to rival 125cc petrol bikes in real conditions. The placement of the battery and engine aims for stability rather than showroom symmetry. The frame is built heavier than Asian equivalents, simply because it has to be.

Spiro’s pricing is equally pragmatic. At 1.75 million naira for the bike, battery and charger, it sits obviously above the price of an average petrol bike but far below what EVs cost in the market. Moreover, daily operating costs sweeten the deal. A rider spends about 125 naira to travel 100 kilometres on electric, versus over 3,400 naira on petrol. Maintenance remains the clincher. With fewer moving parts, Gaur estimates running costs drop by up to 45 per cent.

The hidden story: Data as infrastructure

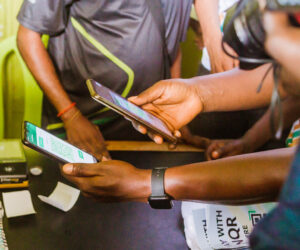

Much of the current excitement around Spiro centres on its IoT stack. Each bike and battery is fitted with embedded GPS, a cellular connection and a telemetry layer that streams data to Spiro’s cloud. In practice, this system gives fleet owners real-time eyes on their assets.

“You can immobilise or activate a bike with a click,” Gaur says. Geofencing and even time-fencing add another layer of control. A fleet operator can literally put a bike to sleep at 10 p.m. and wake it up at 6 a.m.

This is no marketing gimmick but a practical theft prevention measure in a market where missing assets often sink small fleet operators. The analytics matter too. The system logs braking behaviour, average speed, route choices and stop patterns.

The broader insight is that Spiro is not just selling electric bikes but building a mobility data network, a competitive moat that rivals cannot copy with hardware alone.

Spiro’s bet on battery

Spiro’s battery swap network has attracted the most attention, yet the company’s real innovation is operational rather than technical. Automated swap stations sit on solar-supported sites, backed by second-life batteries that act as energy buffers during grid outages. Stations identify a rider’s incoming battery through linked IDs. Health checks run continuously in the background, allowing the company to pull degraded packs out of circulation.

A swap takes under two minutes. The process is dull by design. In a market with unreliable power, boring reliability is a feature, not a bug.

Also read: Nigeria’s EV drive gains momentum as Spiro showcases 3 flagship bikes in Lagos

What stands out is how Spiro uses granular state-of-charge data for billing. Riders pay only for the energy consumed. If a rider arrives with 20 per cent left, the system charges for the remaining 80 per cent. This level of precision, Gaur argues, keeps energy pricing fair and helps Spiro optimise battery life across its network.

Still, the firm knows swapping cannot carry the entire ecosystem. Public fast chargers are rolling out across major cities, each able to serve six to eight riders at once. A full charge takes about an hour, though most commercial riders top up 30 to 40 per cent between trips. Home charging remains the quiet pillar for private users, who can charge overnight at no added cost.

Local assembly as a strategy, not optics

Governments in Nigeria and Kenya have pushed for local assembly. Many companies treat this as a political requirement. Spiro treats it as infrastructure. Its Nigerian tech centre already supports operations across Africa. Almost the entire plant workforce is local.

Localisation has not yet cut major costs, as the company still imports some components as CKDs. But the groundwork is set for deeper value addition by 2026. The strategic goal is clear: control the supply chain close to the market and remove the currency volatility that haunts hardware businesses in the region.

Spiro’s model challenges the assumption that African EV growth depends on imported scooters and donor-driven pilots. Instead, the company has built a layered ecosystem: durable hardware, a live data network, a multi-channel charging model and increasingly localised production.

The bigger shift is cultural. Riders who once feared range anxiety now work with a mental map of swap stations and fast chargers. Governments are beginning to see telemetry as a tool for planning rather than surveillance. Investors are watching the affordability curve bend as localisation and scale take effect.

Also read: Spiro hits $350 million valuation after new $100m funding round

The unanswered question is whether Spiro’s capital-intensive network gives it a defensible lead or ties it to heavy infrastructure in volatile markets. What is clear is that the business is not chasing a Western EV narrative. It is building for the streets where its bikes actually run.

In West Africa, crowded with glossy EV promises, Spiro’s approach feels refreshingly unsentimental. Reliability over hype. Local constraints over global templates. It may not sound radical, but in the emerging electric mobility market like West Africa, that pragmatism might be the boldest move of all.