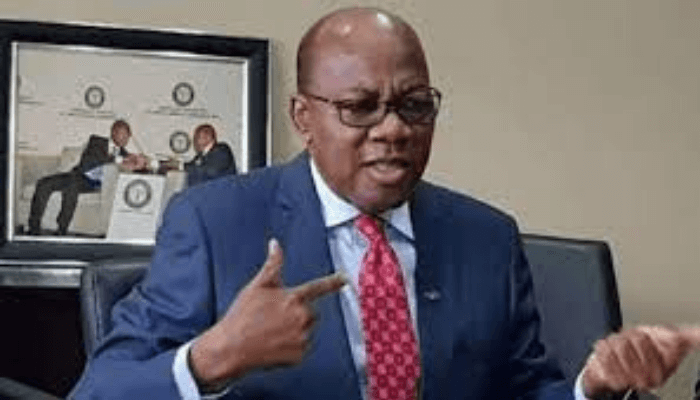

Nigeria needs to double down on its efforts on land titling reforms, expand its credit systems, and mechanise its agricultural sector to strengthen the naira and expand the economy in a way that ensures sustainable prosperity, according to Olisa Agbakoba, former president of the Nigeria Bar Association.

Agbakoba, on Monday, in an open letter to Wale Edun, the minister of finance and the coordinating minister of the economy, said implementing land and real estate titling reforms, a move that would allow properties to become tradeable assets, could unlock N1.5 quadrillion into the economy, thereby providing sustainable backing for the naira that faced intense volatility last year but has now seen some stability.

“Unlocking trapped property assets that are presently dead capital will encourage investors who currently prefer to buy properties abroad to buy in Nigeria,” Agbakoba said. “This will deepen naira-denominated asset markets, reduce dependency on dollar-denominated assets for wealth storage, and strengthen demand for the naira by creating viable local investment alternatives.”

Read also: National land registration key to unlocking Nigeria’s $300bn dead capital—Dangiwa

Nigeria has as much as $900 billion in dead capital, according to estimates by PwC and the World Bank. The reform, if implemented, meant land and real estate would become legally recognised assets, creating a credit market that could engender economic development.

Agbakoba further noted that Africa’s most populous nation must move from a ‘cash economy’ to a ‘well-developed credit system’ in order for its over 200 million people to get access to credit facilities up to N300,000. That would generate N60 trillion into the economy and improve the value of the naira.

For the Senior Advocate of Nigeria, when citizens can access credit in naira to own homes, start businesses, and build wealth, the currency gains intrinsic value and stability

“Naira-denominated credit will boost domestic consumption of locally produced goods and services, reduce import demand and foreign exchange pressure,” he said. “A thriving naira credit market will deepen domestic financial markets and make the naira more attractive as an asset, and reduce the speculative attacks that drive exchange rate volatility.”

Read also: FG seeks to unlock over $150bn in dead capital via land reforms

In his comparison, Agbakoba argues that Nigeria’s agricultural sector employs nearly 15 times more workers proportionally than the United States but produces a fraction of the output — a reflection of the country’s deep productivity crisis.

While about 30 percent to 38 percent of Nigeria’s workforce is engaged in agriculture, the sector generates just $47 billion to $49 billion annually, compared with America’s $1.5 trillion output from only 2 percent of its workforce. The numbers expose a systemic failure that keeps the country’s food production largely subsistence-driven and inefficient.

The gulf in productivity, according to Agbakoba, stems from Nigeria’s overreliance on manual farming methods and the absence of a supporting value chain. Unlike the U.S., where agriculture is powered by mechanisation, cold storage, processing plants, and logistics networks, Nigerian farmers are still using hoes and cutlasses.

Read also: Experts canvass land reforms, PMBs’ recap to expand access to finance

The sector’s inability to attract large-scale investment, he noted, is worsened by defective land titles that prevent farmers from using land as collateral for credit. Without reforming the legal and policy environment, “capital will not flow into the economy,” he said.

Agbakoba argues that transitioning to mechanised agriculture could do more than just boost productivity, it could also become a stabilising force for the naira. Higher output and export capacity would raise foreign-exchange earnings, while reduced food imports could save billions of dollars and ease pressure on the currency.

“When a nation feeds itself and exports the surplus, its currency strengthens naturally,” he said.

Linking agricultural reform with broader initiatives in oil, gas, maritime, and manufacturing, he added, could help the naira find a more stable, fundamentally supported value over time.