In 2022, three founders with roots in Egypt launched Justyol in Morocco, identifying a clear gap in the e-commerce market. Moroccan consumers wanted access to Turkish fashion, but high shipping costs and the absence of cash-on-delivery options created significant barriers.

Justyol emerged to connect Turkish suppliers with North African shoppers, building a platform tailored to local needs. Now serving over 250,000 active customers and processing 30,000 monthly orders, Justyol is expanding into electronics and household items, leveraging Morocco’s growing role as a hub for cross-border commerce.

Before launching Justyol, Ahmed Rashed was working in investment management in Istanbul when Anas Ahmed, a logistics specialist based in Morocco, invited him to explore North African opportunities in 2021. Rashed, with nearly a decade in Turkey’s tech scene, saw Morocco’s market potential.

Joined by Ahmed Badran, an e-commerce expert with experience in Egypt and Turkey, the trio, all originally from Egypt, shared a deep connection to the continent “I see Africa as the most dynamic continent in the world right now, especially with its young population,” Rashed told Technext.

Rashed’s travels through Kenya and Djibouti reinforced his belief in Africa’s market potential, while his time in Istanbul provided insight into Turkey’s affordable, trendy fashion industry. Moroccan demand for these products was evident, particularly given Morocco’s position as a top buyer of Turkish fabric exports, behind Italy, Belarus, and Spain, and the leading buyer of Turkish goods, with exports reaching $3.09 billion in 2022.

In late 2022, the founders bootstrapped Justyol with early support from Earn Rocket Holding, where Rashed later became a managing partner. Their goal was to deliver Turkish fashion to Moroccan consumers while navigating the region’s unique e-commerce challenges, setting the stage for broader regional ambitions.

Overcoming Logistics and Payment Hurdles

Morocco’s e-commerce landscape presented immediate challenges: shipping costs often outstripped product prices, and consumers preferred cash-on-delivery over online payments. Global platforms like Amazon and AliExpress, lacking local entities, didn’t offer this option.

“Most big players don’t have legal entities in Morocco and don’t offer cash on delivery, which is crucial here,” Rashed explained.

Justyol enabled cash-on-delivery for Turkish products, but early dropshipping led to losses when customers cancelled orders. “Customers would change their minds after ten days, resulting in a financial loss for us since we didn’t own the products,” he noted.

To address this, Justyol built a warehouse in Morocco, shifting to a stock-selling model to manage inventory and returns, boosting delivery success rates from 75% to 95%. High logistics costs were tackled through partnerships with Aramex, Cathides, and Colis Privé, fostering competition for faster, cost-effective deliveries.

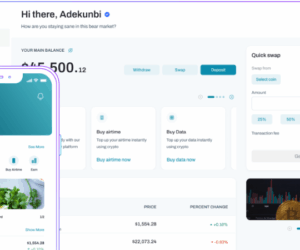

Payment integrations with CMI and Payzone are aligned with local preferences. To support its early growth, Justyol raised a $350,000 pre-seed round from Earn Rocket Holding in 2022.

This month, the company raised another $1 million funding package, split between $400,000 in equity from an angel investor and $600,000 in inventory financing from Turkey’s Danis Group, facilitated by Nomadic Minds.

This funding is driving deeper market penetration in Morocco and exploration of new markets like Algeria, Libya, Kenya, and Ghana.

Competing smart and expanding horizons

Justyol’s rapid growth, which saw them exceeding 1,000 monthly orders in under six months, confirmed its potential. “Our initial goal was to grow from 50 orders per month to 1,000 orders per month within six months,” Rashed recalled.

Now with 30,000 monthly orders and 300% year-over-year growth, Justyol competes with giants like Jumia, Temu, and AliExpress by leveraging its local presence.

“The market is so big that no one can take all the market share alone,” Rashed said, noting Jumia’s logistical challenges. Unlike global competitors, Justyol operates with legal entities, bank accounts, offices, and a warehouse. “People know our offices and warehouse, so if they have a problem, they can reach us,” he added.

Justyol’s focus on Turkish fashion, now expanding to electronics and household items, has attracted partnerships, such as Trendyol’s entry into Morocco through their platform and discussions with an Alibaba-related company for sourcing Chinese products.

The company supports Moroccan suppliers selling locally and testing exports to markets like Saudi Arabia.

Using AI to analyse consumer data, Justyol has launched its own branded textiles and kitchenware, with plans to extend this approach to new categories. “The good thing about our model is that we don’t always need equity partners because the main thing we are putting money into is the inventory,” Rashed explained.

As Justyol prepares for a $2–3 million Series A round, it aims to scale regionally and develop a “revolutionary” AI feature for African e-commerce.

Operating in Morocco’s developing startup ecosystem, where venture capital and incubators are scarce, Justyol’s 25-person local customer service team and focus on unique products, competitive pricing, and cultural alignment are strengthening Morocco’s role as a hub for cross-border commerce.