The credit economy system shapes society deeply while changes to this system produce extensive social effects. The Nigerian government achieved better economic reform success through its improved Fitch Ratings credit rating which now stands at B. The improved credit rating will drive investor trust which will decrease borrowing expenses and drive investments into infrastructure development and manufacturing and financial services and oil and gas sectors.

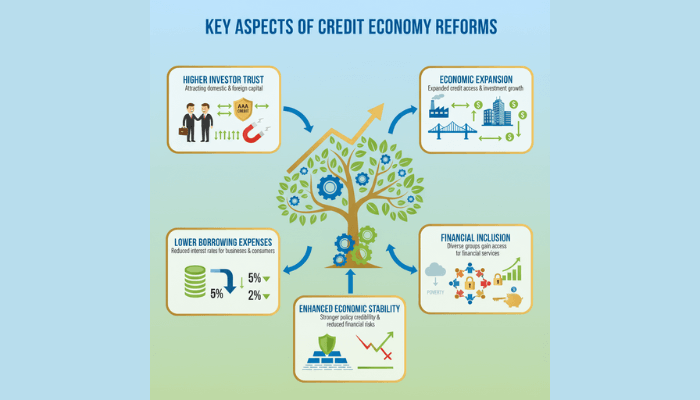

Key Aspects of Credit Economy Reforms:

The implementation of credit economy reforms leads to multiple advantages which include higher investor trust because better credit ratings attract both domestic and foreign investors and lower borrowing expenses through reduced interest rates and enhanced economic stability through reduced macroeconomic risks and stronger policy credibility. The reforms drive economic expansion through expanded credit access and investment promotion and stability maintenance and foreign capital attraction and domestic investment growth and economic development enhancement and financial inclusion expansion that reduces poverty levels.

Challenges and Opportunities:

The successful implementation of credit economy reforms depends on their ability to deliver sustained results throughout multiple years. The success of well-designed reforms depends on maintaining consistent implementation and dedicated commitment. The implementation of reforms creates inherent dangers which include dangerous levels of debt buildup and potential financial system instability. The management of these risks requires fiscal discipline and strong regulatory oversight and transparent governance systems.

The success of reforms depends on their ability to stabilize the economy while generating new growth opportunities. The main objective should focus on inclusive growth because credit reforms need to benefit all segments of society. Credit economy reforms which prioritize equity during their design and implementation process will build societal resilience and trust while delivering better life quality for every citizen.

The implementation of credit economy reforms leads to economic growth and increased investment and better financial inclusion for society. The long-term economic stability and prosperity of a nation depends on maintaining these reforms while handling their associated risks.

Credit functions as a fundamental economic growth tool because it provides funding opportunities to people and organizations and public institutions for investments and consumption and development initiatives. Credit usage in moderation leads to economic growth through job creation and standard of living enhancement. The overuse of credit leads to debt problems and economic instability which results in market declines.

Positive Effects of Credit on Economic Growth

1. The availability of credit allows businesses to launch new projects and expand their operations and implement innovative technologies which results in economic expansion and employment opportunities.

2. The ability to use credit for purchasing goods and services drives up consumer spending which in turn increases economic activity throughout the market.

3. Governments use credit to fund infrastructure development projects which include building roads and bridges and public transportation systems to drive economic expansion and enhance community living standards.

Risks and Challenges

1. The need to repay debts becomes a burden for governments and their citizens.

2. The formation of credit bubbles occurs when people borrow too much money which creates financial instability that could trigger economic breakdowns.

3. The practice of borrowing too much money creates debt problems which prevents people and businesses from getting credit while credit access worsens economic inequality because those with better credit scores obtain more borrowing opportunities.

Sustainable Credit Practices

To fully harness the benefits of credit whilst minimizing its potential risks, the adoption of sustainable credit practices is essential, beginning with responsible lending in which financial institutions carefully assess the creditworthiness ofborrowers and ensure that repayment obligations are within their capacity, supported by the promotion of financial literacy so that borrowers clearly understand the terms and conditions of credit agreements and are empowered to manage their debts responsibly, and reinforced by strong regulatory oversight where regulators consistently monitor credit markets and intervene decisively when necessary to curb excessive borrowing, safeguard financial stability, and maintain the long-term health of the economy.

Conclusion

Credit can be a powerful tool for driving economic growth, but it requires careful management to avoid the risks associated with excessiveborrowing and debt accumulation. By promoting sustainable credit practices and responsible lending, we can harness the benefits of credit whilst minimizing its risks and promoting economic stability and growth. Effective credit management is crucial for ensuring that credit-induced economic growth is sustainable and equitable, benefiting individuals, businesses, and the broader economy.

About The Author

Prof. Prisca Ndu who holds four doctorate degrees in Credit Management, Banking and Finance, Leadership and Management and Artificial Intelligence, is a social impact advocate and multi-sector entrepreneur. An alumnus of the University of Ibadan, Lagos Business School, Harvard Business School, London Graduate School, Institute of Management Development, INSEAD and Robert Kennedy College, Switzerland, amongst others. She sits on the Board of several companies including INDECO, KREENO Consortium, BHLA Awards, and many more. She was listed in 2017 among the most influential people of African descent by the United Nations and is passionate about Nation Building.