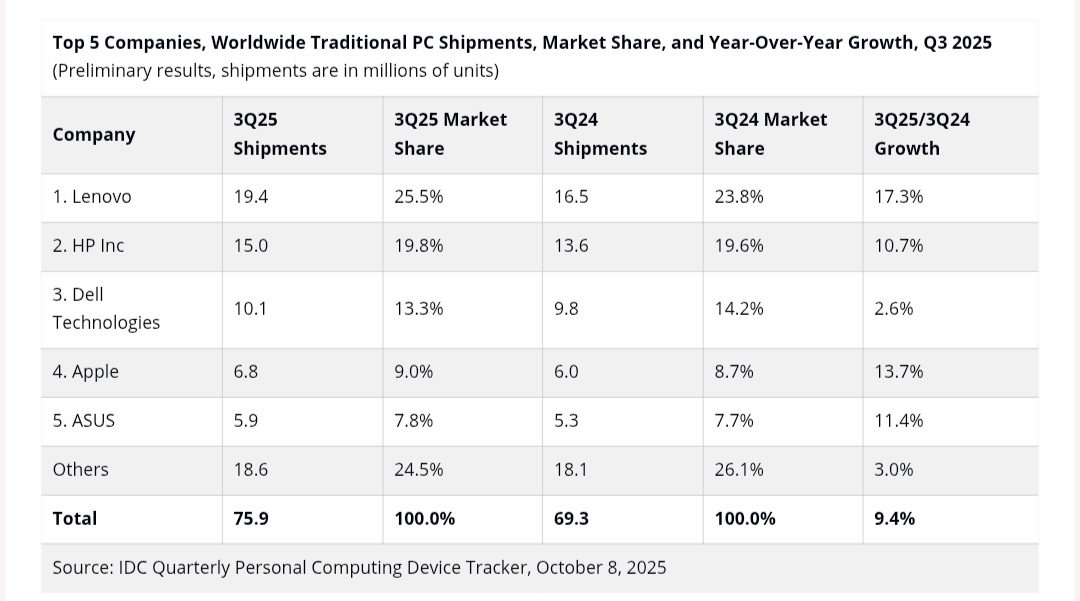

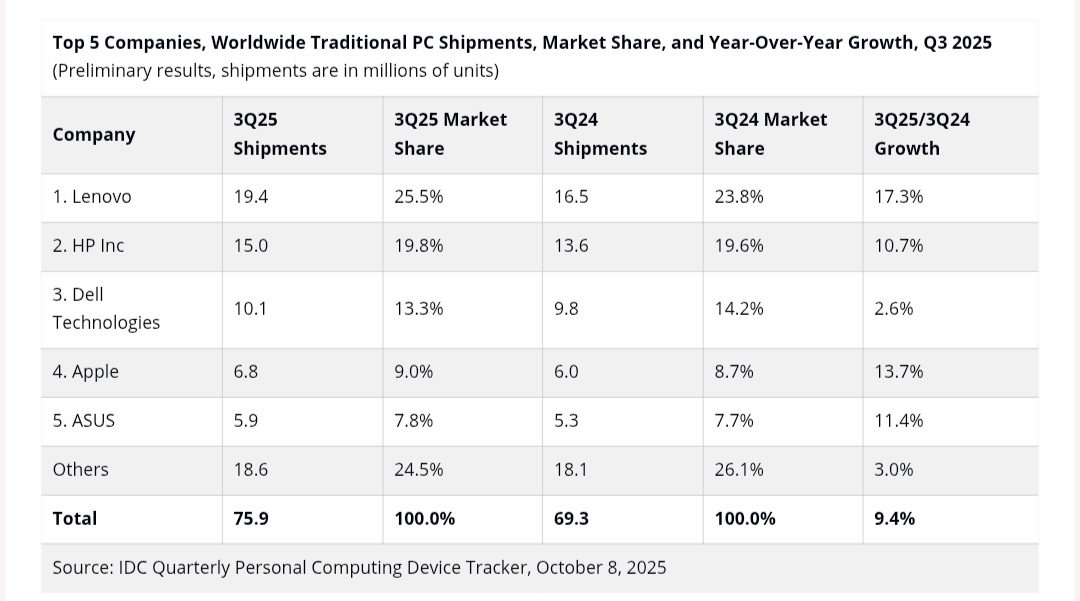

According to IDC’s latest release, global PC shipments rose 9.4 per cent year-on-year in the third quarter of 2025, reaching 75.8 million units.

The Q3 result outclassed the 64.9 million units shipped in Q2, affirming that the PC market, long written off as mature and declining, still has pulses of vitality. But beneath the headline strength lies a story of regional contrasts, uneven demand, and structural tensions that tech watchers and startup ecosystems in emerging markets must parse carefully.

At first glance, the rebound is welcome. After several quarters of flat or modest growth, the double-digit gain signals a renewed wave of refresh activity.

It suggests that ageing device bases around the world are finally being replaced, especially as support cycles shift and software deadlines loom. IDC’s own forecasting for the Personal Computing Devices segment had already anticipated this momentum, projecting a 5 per cent annual growth for the full year.

Yet the more interesting story is where that growth is concentrated and why.

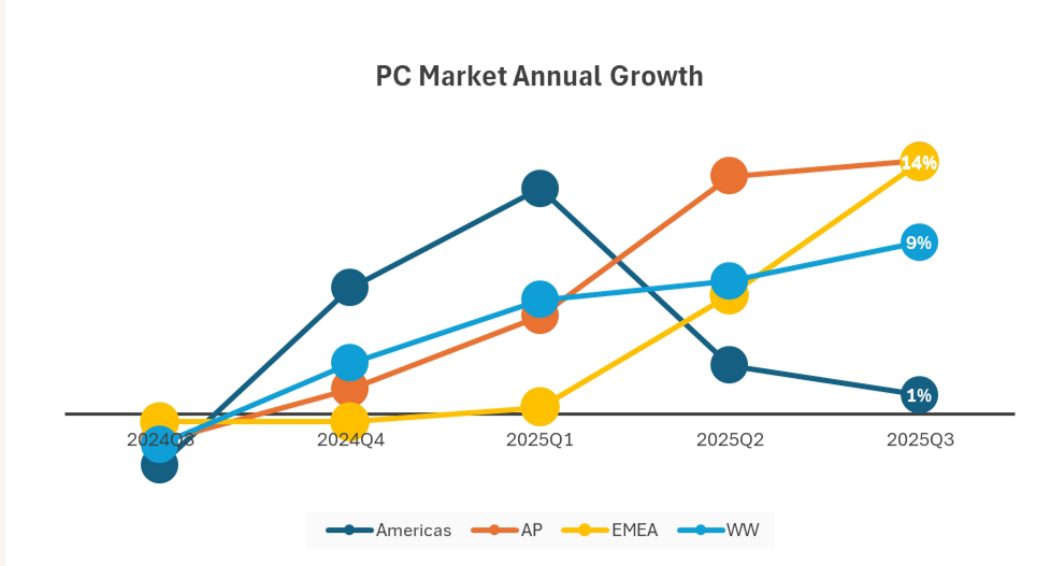

How the respective regions fared

Asia-Pacific is clearly carrying much of the global momentum. Countries such as Japan and China drove double-digit growth in Q3, powered in part by large-scale public procurement efforts, particularly in education.

In Japan, refresh cycles under the GIGA School programme and local government stimulus pushed massive volume into the market. In China, still a central production hub and major domestic demand centre, OEMs appear to have captured spillover demand as well.

In contrast, North America showed muted growth, hampered by import tariffs, earlier inventory frontloading, and cautious end-user demand. Some of the shipment increases in prior quarters were driven by vendors pushing inventory ahead of tariff changes, a dynamic that has now started to settle.

“While the entire market is continuing on a very strong year, fuelled by the Windows 11 transition and the need to replace an ageing installed base, the results by regions are telling different stories,” said Jean Philippe Bouchard, research vice-president with IDC’s Worldwide Mobile Device Trackers.

“In particular, the North American market continues to be impacted by the US import tariff shock and by macroeconomic uncertainties. While existent, the demand for newer PCs ready for Windows 11 is likely to push well into 2026.”

The result is a regional deceleration in net new demand. Europe, the Middle East & Africa (EMEA) chalked up moderate gains in Q3, buoyed by enterprise refreshes and seasonal procurement cycles, although with high sensitivity to pricing and currency fluctuations.

This patchwork of regional performance matters for emerging markets. In many African, Latin American, and Southeast Asian countries, the strength in Asia-Pacific and public procurement cycles elsewhere creates both competitive pressure and opportunity.

OEMs chasing scale may divert resources away from smaller markets. Yet conditional financing, bundled leasing deals, or public sector programmes may open windows for local integrators and startup ecosystems to piggyback on refresh waves.

What’s driving the global PC shipment boost?

One clear trigger for the Q3 bump is the approaching end-of-support for Windows 10, scheduled for October 2025. Many organisations and consumers find themselves forced to decide: upgrade to Windows 11, replace hardware entirely, or pay for extended security (ESU) options.

This deadline has created urgency in procurement cycles. In markets where legacy fleets run deep, common in many emerging economies, this deadline can act as a hard scheduling anchor for refresh plans.

But that driver is not uniform. Enterprises with complex software stacks or peripheral dependencies are cautious. Some are delaying aggressive upgrades, choosing instead to stretch life cycles or buy ESU.

In contrast, education agencies or public institutions, which often procure en masse, see sharper bursts of demand when their time fleet refreshes around budget cycles or stimulus allocations.

Another factor is the marketing and hype around “AI PCs” and next-gen computers.

Since this year, device vendors have leaned hard on AI-branded spec bumps, on-device accelerator features, and “Copilot+” branding to differentiate premium models. But at the volume level, buyers, especially in developing markets, still prioritise reliability, management, cost, and compatibility over high-end AI gimmicks.

As several analysts have cautioned, the average refresh in 2025 is still driven by replacement logic rather than a sweeping upgrade tide.

The supply chain also plays a role. Vendors that managed to retool manufacturing footprints away from tariff-sensitive geographies, or that preposition inventory ahead of trade shocks, gained flexibility and could respond faster. But that tactic has diminishing returns: excess channel inventory remains a real risk, and clearing backlogs may pressure margins or prompt discounts.

Lenovo leads again

Vendor leadership remains concentrated, but with interesting shifts. Lenovo led the pack in Q3 2025, shipping about 19.4 million units, a year-on-year growth rate of about 17.3 per cent.

HP maintained its strong position, while Dell, Apple, and ASUS all posted gains in their niche portfolios.

What this means for tech ecosystems in emerging markets

For tech startups, system integrators, and local OEMs in emerging economies, the Q3 explosion offers both signal and caution.

On the signal side: device refresh cycles are real and may generate windows for complementary services (fleet management, software upgrades, migration tools, device leasing, and repair). Startups focused on endpoint security, migration automation, or device analytics could ride flush procurement budgets into scalable contracts.

On the caution side: just because global shipments are rising doesn’t mean every market reaps the benefit. Currency volatility, import duties, logistics friction, and low-per-capita purchasing power still constrain many markets. Local demand may lag global waves, and not all regions see the deadlines and stimulus that fuel volume elsewhere.

Importantly, in markets where public procurement plays a major role, there may be procurement windows aligned with fiscal calendars. Startups and local vendors that glue themselves into those cycles, offering value-added services, bundling local content, or enabling financing, will have outsize opportunities.

For market watchers, the Q3 data underlines a structural truth: the PC is far from dead. But its growth edge is now tethered to software life cycles, public budgets, and trade policies, not pure consumer demand. The next few quarters will test whether this upswing has real staying power.