The Bank of Ghana (BoG) has released a draft policy paper setting out how the country plans to regulate virtual assets and virtual asset service providers (VASPs), marking a pivotal step in bringing digital currencies and blockchain-based finance under formal oversight.

The document, titled “Ghana’s Policy Position on Virtual Assets and Service Providers,” proposes a risk-based, principle-driven regulatory framework that seeks to balance innovation with monetary stability, consumer protection, and the fight against illicit financial flows.

Ghana joins a growing list of African countries, including South Africa, Kenya, Nigeria, and Mauritius, that have moved to legalise and regulate virtual assets as part of broader efforts to mitigate risks to monetary systems and prevent crypto markets from becoming conduits for money laundering and terrorist financing.

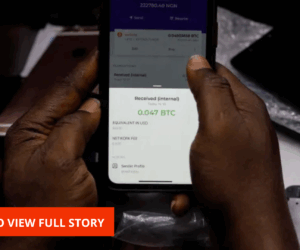

“Virtual assets can no longer remain outside Ghana’s financial regulatory purview,” the BoG stated in the policy paper. “Since the release of the Bitcoin white paper more than 15 years ago, Ghana’s virtual assets ecosystem has expanded substantially, now encompassing more than 3 million users.”

A regional shift in monetary prudence

Across Africa, regulators are racing to keep pace with the surge in virtual asset activity, which has ballooned as millions turn to cryptocurrencies for investment, remittance, and hedging against currency volatility.

Ghana’s ecosystem now counts more than 3 million users, according to the BoG, with over 100 VASPs registered in July during the central bank’s mandatory registration exercise.

The exercise gave Ghana its first comprehensive picture of virtual asset activity and laid the groundwork for the more formal licencing and supervision system now envisioned. According to Johnson Asiama, BoG’s governor, the country plans to have a full virtual assets law in place by December.

Guiding principles

Ghana’s policy framework rests on six governing principles. Chief among them is that VASPs must be appropriately regulated and operate within an activities-based and risk-sensitive framework. The BoG stressed a neutral stance—neither “hostile” nor “friendly”—but one designed to enable responsible innovation while ensuring a level playing field between traditional financial players and new entrants.

Rather than applying the same rules to everyone, the BoG said firms offering higher-risk virtual asset services would face stricter licencing and registration requirements, while those posing lower risks would go through a simpler process.

Collaboration is another core theme. The BoG proposes a joint regulatory architecture involving the Securities and Exchange Commission (SEC), Financial Intelligence Centre (FIC), Cybersecurity Authority, and the Data Protection Commission (DPC) to ensure coordinated oversight.

Crucially, the policy underscores the importance of consumer literacy through what the regulator calls the National Virtual Asset Literacy Initiative (NaVALI). The paper says the NaVALI will bring together government, industry, and civil groups to help Ghanaians better understand virtual assets and protect themselves from scams and fraud.

Eight recommendations defining Ghana’s regulatory future

The BoG outlined eight policy recommendations that will form the backbone of its virtual asset regulatory framework:

- Licencing and registration: All entities offering virtual asset services must be registered or licensed, depending on their activities, with either the BoG or SEC.

- Legal foundation: The framework will build upon Ghana’s Anti-Money Laundering Act, 2020 (Act 1044), and align with international standards set by the Financial Action Task Force (FATF) and others.

- The FATF “Travel Rule”: VASPs will be required to collect and share accurate sender and receiver data for all virtual asset transactions to ensure traceability.

- Regulatory clarity: The BoG will oversee payments, custody, and monetary stability–related activities; the SEC will regulate trading and investment; and the FIC will enforce AML/CFT compliance. Several violations will attract criminal sanctions.

- Continuous monitoring: Ghana will maintain ongoing supervision of its virtual assets ecosystem to detect and deter illicit activity.

- Legal tender stance: Virtual assets will not be recognised as legal tender in Ghana.

- Virtual Assets Regulatory Office (VARO): A new dedicated body will coordinate policy, supervision, and inter-agency collaboration.

- Public awareness drive: Through NaVALI, regulators will promote financial literacy, especially among youth who form the largest segment of Ghana’s virtual asset users.

Ghana’s balancing act

Ghana’s choice of a risk-based framework, rather than prohibition or laissez-faire oversight, reflects a pragmatic middle ground. An outright ban, the BoG argued, would only push activity underground and erode the possibility of supervision, a stance consistent with FATF guidance.

Ghana envisions its regulatory future of virtual assets as principle-based, relying on high-level legal provisions complemented by adaptable secondary instruments such as guidelines and directives. This, the BoG says, will allow regulation to evolve in step with technological innovation and global best practices.