In a significant step towards strengthening Nigeria’s environmental sustainability agenda and deepening its sustainable finance market, FMDQ Group PLC, in collaboration with the FC4S Lagos, FSD Africa, and Chapel Hill Denham, has officially formed a strategic partnership with Kaltani International Ventures Limited, formalised at a signing ceremony held on Monday, November 24, 2025, in Lagos, Nigeria.

The ceremony was attended by senior representatives from all participating institutions. Convened under the Nigerian Green Bond Market Development Programme, the partnership brings together leading organisations committed to accelerating the development of market-based mechanisms that support the circular economy, enhance sustainable industrial growth, and mobilise private capital for environmental projects at scale. The collaboration aims to create a viable framework capable of transforming Nigeria’s approach to climate and waste-management financing.

Central to this initiative is an innovative financing product developed by FC4S Lagos with support of FSD Africa and FMDQ Group, aimed at expanding access to sustainable financing for KALTANI, a leading plastic recycling and waste-management company in Nigeria. This development is particularly timely given Nigeria’s ranking among the world’s top 10 plastic waste producers and the urgent need to address the country’s escalating plastic pollution challenge. The initiative also builds on global momentum, noting that while the first Plastic Waste Reduction-Linked Bond was issued by the World Bank in 2024 to finance circular projects in Ghana and Indonesia, this will be the first corporate plastic- and carbon-linked debt instrument in Africa.

Commenting on the significance of this initiative, Joy V. Kendi, associate, Financial Markets (FSD Africa), said, “FSD Africa is proud to partner with Kaltani International Ventures Limited, alongside FMDQ and Chapel Hill Denham, on this pioneering initiative that brings together circular-economy innovation and sustainable capital markets. Nigeria is paving the way for what could become Africa’s first corporate plastic- and carbon-linked instrument. This collaboration shows the power of domestic capital to finance climate-smart socio-economic growth. We have already begun Phase I preparation, including rigorous carbon and biochar credit assessments and registration. This is a bold step toward unlocking Africa’s next generation of climate-finance solutions, and we are just getting started.”

Read also: CBN’s curious move on FMDQ

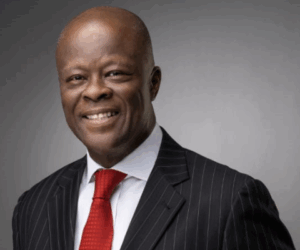

Obi Charles Nnanna, CEO, KALTANI, commented on the partnership, stating, “By working with world-class institutions like FMDQ Group, Chapel Hill Denham, FC4S, and FSD Africa, we are unlocking a new model for circular economy finance in Africa—one that turns waste into wealth, jobs, and measurable climate impact. This is profit with purpose. This partnership demonstrates that climate finance can be local, credible, and transformational, and that Africa can lead the world in innovation and integrity within the carbon and plastic recovery economy.”

This initiative represents a shared vision: leveraging financial markets not only as engines of economic advancement but also as catalysts for environmental regeneration. The partnership signals a collective commitment to demonstrating the power of market-based instruments to mobilise capital for climate-aligned projects in Nigeria, while fostering innovation in sustainable finance and highlighting the country’s readiness to attract global climate investment opportunities.

Speaking at the ceremony, Tumi Sekoni, group chief operating officer, FMDQ Group, emphasised the importance of the collaboration in strengthening Nigeria’s market readiness for innovative sustainability-linked instruments. She noted that the initiative aligns closely with the aspirations of FMDQ’s Green Exchange, a dedicated platform for visibility and credibility for sustainability-focused instruments, and reinforces FMDQ’s capacity to facilitate structured finance solutions that address environmental challenges while fostering a resilient and competitive economy.

This historic collaboration marks a major milestone in Nigeria’s journey toward a more sophisticated sustainable-finance ecosystem and further underscores the country’s commitment to aligning with global best practices, strengthening circular-economy value chains, and positioning Nigeria as a leading destination for climate-finance innovation on the continent. For FMDQ Group, this partnership further demonstrates its unwavering dedication to advancing sustainable finance in Nigeria by championing market-led solutions that mobilise capital for green and climate-aligned projects and fostering instruments and platforms that promote transparency, resilience, and long-term environmental impact.