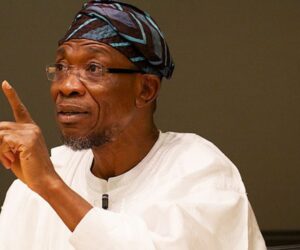

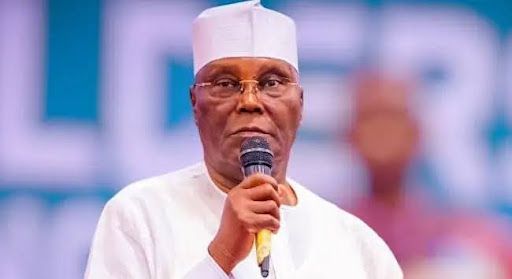

The Federal Inland Revenue Service (FIRS) has dismissed comments made by former Vice President Atiku Abubakar regarding the role of Xpress Payments in Nigeria’s tax collection system, warning politicians against misrepresenting routine administrative processes.

In a statement by Aderonke Atoyebi, Technical Assistant on Broadcast Media to the FIRS Executive Chairman, said Atiku’s remarks were “incorrect, misleading, and capable of politicising a purely technical procedure.”

Atoyebi clarified that the FIRS does not run a single-gateway collection model and has never granted any private company exclusive rights over national revenue channels.

According to her, the service currently operates a multi-channel, multi-Payment Solution Service Provider (PSSP) framework that includes several long-established platforms such as:

-

Quickteller

-

Remita

-

Etranzact

-

Flutterwave

-

XpressPay

“These platforms form part of a competitive and transparent ecosystem designed to make tax payment easier and more efficient,” she noted.

Atoyebi stressed that PSSPs are not collection agents, do not earn a percentage of tax revenues, and cannot access or control government funds.

“All revenues go directly into the Federation Account without diversion or private custody,” she said.

FIRS explains features of its collection system

The statement outlined key elements of the agency’s revenue-payment framework:

-

Multiple PSSPs for flexibility: The system has been expanded to eliminate the dominance of any single provider.

-

Improved efficiency: Streamlined monitoring and reporting have boosted accountability and performance.

-

Support for innovation and jobs: Opening the system to more providers strengthens Nigeria’s fintech ecosystem.

-

Transparent onboarding: All PSSPs are approved through a fair and verifiable process.

Tax reforms should not be politicised — FIRS

Atoyebi also linked the clarification to ongoing national tax reforms led by the Presidential Committee on Fiscal Policy and Tax Reforms, describing them as central to Nigeria’s economic modernisation.

“These reforms are built on transparency, efficiency, and broad stakeholder engagement. They should not be dragged into partisan controversy,” she said.

The FIRS urged Atiku and other political actors to avoid spreading inaccuracies that could create public confusion.

“Nigeria’s tax administration is too important to be subjected to misinformation or unnecessary alarm,” Atoyebi added, reaffirming the agency’s commitment to professionalism and transparency.