1

The Executive Chairman of the Federal Inland Revenue Service (FIRS), Dr. Zacch Adedeji, has called on Nigeria’s judiciary to continue strengthening its understanding of the country’s evolving tax laws, stressing that a knowledgeable and responsive judicial system is crucial to sustaining fair, efficient, and predictable tax administration.

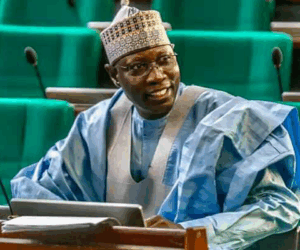

He made the call in Abuja during his goodwill message at the opening of a capacity-building workshop for Justices of the Supreme Court, the Court of Appeal, and Judges of the Federal High Court, organised by the National Judicial Institute (NJI) in collaboration with the FIRS.

Adedeji described the workshop as both “timely and essential,” noting that recent legislative reforms—such as the Finance Acts, the Petroleum Industry Act (PIA), and other subsidiary tax regulations—have transformed the country’s fiscal landscape, creating new obligations and challenges that demand deeper judicial insight.

“The introduction of new tax laws, including amendments to the Finance Acts, the Petroleum Industry Act, and various subsidiary legislations, has significantly reshaped our tax ecosystem,” he said.

“These developments have introduced new compliance obligations, dispute resolution mechanisms, and enforcement provisions that require robust judicial interpretation for effective implementation.”

The FIRS Chairman commended the judiciary for its consistency and fairness in tax-related rulings, describing the courts as the “ultimate arbiter” in maintaining a balance between the legitimate powers of tax authorities and the rights of taxpayers.

“My Lords, permit me to commend the judiciary for its consistent and sound pronouncements in the area of tax jurisprudence,” he said. “The decisions of our superior courts have clarified ambiguities, provided predictability, and upheld fairness in tax administration. Through its interpretative powers, the judiciary ensures that the tax system remains transparent, just, and credible.”

Adedeji stressed that timely and consistent judicial pronouncements play a vital role in promoting voluntary compliance and boosting investor confidence, as they provide clarity and stability for both taxpayers and the tax authority.

“The efficiency of our tax system is closely linked to the timeliness and consistency of judicial decisions. Prompt and principled tax rulings enhance compliance, strengthen revenue mobilisation, and build trust in public institutions,” he stated.

The FIRS boss noted that as the global economy becomes increasingly digitalised and interconnected, new business models and cross-border transactions are creating complex tax issues that require both administrative and judicial agility.

“The dynamic nature of the global economy—driven by digitalisation, cross-border transactions, and evolving business models—continues to present complex tax challenges,” he said. “Understanding these complexities is crucial to ensuring that judicial interpretation aligns with both domestic legislation and international best practices.”

He reaffirmed FIRS’s commitment to supporting the judiciary through capacity building, technical assistance, and knowledge-sharing initiatives, saying the Service recognises the judiciary as a strategic partner in advancing Nigeria’s fiscal reforms and revenue efficiency.

“On our part, the Federal Inland Revenue Service remains committed to supporting the judiciary through knowledge sharing, provision of technical resources, and continuous engagement,” he assured. “We recognize that a strong and knowledgeable judiciary is indispensable to the success of any modern tax administration.”

Adedeji also called for stronger collaboration among all arms of government to ensure the effective implementation of tax policies and the early resolution of tax disputes.

According to him, strengthening dialogue between tax authorities and the judiciary will reduce litigation bottlenecks, improve compliance, and foster a more transparent fiscal environment.

“As key stakeholders in the Nigerian tax system, we must continue to strengthen collaboration, foster dialogue, and develop mechanisms that promote the early and effective resolution of tax disputes,” he said.

While commending the NJI for its continuous efforts in advancing judicial education, Adedeji expressed optimism that the insights gained from the workshop would further enhance the quality of judicial pronouncements and contribute to a more equitable and efficient tax system.

“I am confident that the insights gained from this workshop will further enhance the quality of judicial pronouncements and contribute to a more efficient and equitable tax system in Nigeria,” he concluded.

The training workshop, which brought together eminent jurists from Nigeria’s apex and appellate courts, focused on emerging issues in tax jurisprudence, dispute resolution, and interpretation of new fiscal laws shaping the country’s evolving tax regime.